Earlier this week, Reuters reported that Taiwan Semiconductor Manufacturing Co. (TSM) reached out to Nvidia (NVDA), Advanced Micro Devices (AMD), Qualcomm (QCOM), and Broadcom (AVGO) to pitch a joint venture that would run Intel’s (INTC) foundries. New Intel CEO, Lip-Bu Tan, has a big decision to make regarding the future of Intel’s foundry business, perhaps sooner than anyone may have anticipated.

After the Reuters report, the stocks mentioned jumped. Although a joint venture of this caliber is not to be taken lightly, its impact on the prices of the stocks for these companies should be scrutinized. Even though the market is becoming more efficient, hype and momentum have not left the building. We’re a long way from a perfectly efficient market – thank goodness, or there would be no reason for any of us to be in the market.

I realize that is a small consolation for what has been a rough year for many investors. We cannot turn back the clock and fix your portfolio, but we can help you protect your portfolio going forward. Our research has always focused on serving you, the investor, first and foremost by giving you research based on real diligence that you can trust. Following the whims and noise of the market might be fun in the short term, but, in the long term, it is dangerous.

We prefer to avoid danger, and this week we make it easy for you to avoid danger in the stock market by giving you a free stock pick from our Most Dangerous Stocks Model Portfolio. This Model Portfolio finds the worst of the worst stocks in any kind of market. The stocks in this Model Portfolio have both terrible fundamentals and expensive valuations. In other words, the risk/reward for these stocks is very dangerous.

This free stock feature provides a concise summary of how we pick stocks for this Model Portfolio. It is not a full Danger Zone report, but it gives you insight into the rigor of our research and approach to picking stocks. Whether you’re a subscriber or not, we think it is important that you’re able to see our research on stocks on a regular basis.

We’re proud to share our work. Please feel free to share it with your friends and family.

Keep an eye out for the free pick from our Most Attractive Stocks Model Portfolio, which will be published this week as well! The work that goes into that report is just as valuable.

We update this Model Portfolio monthly. The latest Most Attractive and Most Dangerous stocks Model Portfolios were updated and published for clients on March 5, 2025.

Free Most Dangerous Stock Pick: Krispy Kreme Inc. (DNUT)

Krispy Kreme Inc. (DNUT: $6/share) is the featured stock from March’s Most Dangerous Stocks Model Portfolio.

Krispy Kreme’s net operating profit after tax (NOPAT) margin fell from 9% in 2019 to 1% in 2024, while the company’s invested capital turns rose from 0.3 to 0.5 over the same time. Falling NOPAT margins offset the improved capital turns and drive Krispy Kreme’s return on invested capital (ROIC) from an already low 3.1% in 2019 to 0.7% in 2024.

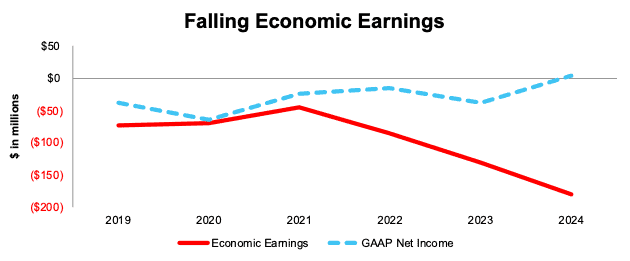

Krispy Kreme’s economic earnings, the true cash flows of the business, fell from -$73 million in 2019 to -$181 million in 2024. Meanwhile, the company’s GAAP net income rose from -$37 million to $3 million over the same time. Whenever GAAP earnings rise while economic earnings decline, investors should beware.

Figure 1: Krispy Kreme’ Economic vs GAAP Earnings Since 2019

Sources: New Constructs, LLC and company filings

DNUT Provides Poor Risk/Reward

Despite its poor and declining fundamentals, Krispy Kreme’s stock is priced for significant profit growth, and we believe the stock is overvalued.

To justify its current price of $6/share, Krispy Kreme must improve its NOPAT margin to 3% (compared to 1% in 2024) and grow revenue by 16% (compared to 12% compounded annually over the last five years) compounded annually over the next ten years. In this scenario, Krispy Kreme’s NOPAT would grow 25% compounded annually to $220 million in 2034. We think these expectations are overly optimistic, especially considering the company’s NOPAT fell 23% compounded annually over the last five years.

Even if Krispy Kreme improves its NOPAT margin to 3% and grows revenue 12% compounded annually through 2034, the stock would be worth no more than $2/share today – a 70% downside to the current stock price. The huge amount of debt piled onto the company by the private equity firm that IPO’d Krispy Kreme makes it hard for equity investors to get much value, if any.

Each of these scenarios also assumes Krispy Kreme can grow revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best case scenarios that demonstrate the high expectations embedded in the current valuation.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we made based on Robo-Analyst findings in Krispy Kreme’s 10-K:

Income Statement: we made around $200 million in adjustments, with a net effect of removing just under $50 million in non-operating expenses. Professional members can see all adjustments made to Krispy Kreme’s income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made over $600 million in adjustments to calculate invested capital with a net increase of around $600 million. One of the most notable adjustments was for operating leases. Professional members can see all adjustments made to Krispy Kreme’s balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made over $1.8 billion in adjustments, all of which decreased shareholder value. The most notable adjustment to shareholder value was for total debt. Professional members can see all adjustments to Krispy Kreme’s valuation on the GAAP Reconciliation tab on the Ratings page on our website.

This article was originally published on March 13, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.