Trade wars, on-again off-again tariffs and threats, and rising geopolitical tensions are roiling markets.

With uncertainty and volatility through the roof, it’s a great time to remember Warren Buffet’s famous saying, “be fearful when others are greedy, and be greedy when others are fearful.”

For a long time, the market has been “greedy”, riding the coattails of momentum and meme trading. Those were the easy trading days. Almost every stock went up no matter how good or bad the underlying business was. It is nice when markets are easy. Unfortunately, easy markets cannot last forever.

So far in 2025, we’re seeing a shift to a more discerning market. Investors have been more cautious. Some overvalued stocks are correcting, and the market seems more efficient about how it allocates value. A more efficient market is a very good thing for those of us who prefer to be investors over traders. And, the Most Attractive Stocks Model Portfolio is very good, maybe the best, portfolio for an efficient market. We scour the entire market to find the hidden gem stocks for this model portfolio. We leverage our proven-superior research to deliver you those companies with truly strong fundamentals and undervalued stock prices.

This week’s free stock pick is featured from our Most Attractive Stocks Model Portfolio.

You can find the free pick below along with a concise summary of why we like the stock. It is not a full Long Idea report, but it gives you insight into the rigor of our research and approach to picking stocks. Whether you’re a subscriber or not, we think it is important, especially in today’s tough market environment, that you’re able to see our research on stocks. We’re proud to share our work, and we want to help investors when they need it most.

Keep an eye out for the free pick from our Most Dangerous Stocks Model Portfolio, which will be published this week as well! The work that goes into that report is just as valuable.

We hope you enjoy this research. Feel free to share with friends and colleagues!

If you’re looking for more picks like this one, then check out our latest free training on the Golden Metric for picking stocks.

We update this Model Portfolio monthly. The latest Most Attractive and Most Dangerous stocks Model Portfolios were updated and published for clients on March 5, 2025.

Free Most Attractive Stocks Pick: Markel Group (MKL)

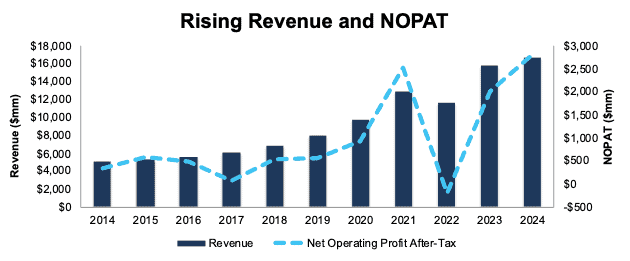

Markel Group (MKL: $1,827/share) has grown revenue and net operating profit after tax (NOPAT) by 12% and 24% compounded annually since 2014, respectively. Markel Group’s NOPAT margin increased from 7% in 2014 to 17% in 2024 while its invested capital turns rose from 0.8 to 1.0 over the same time. Rising NOPAT margins and invested capital turns drive Markel Group’s return on invested capital (ROIC) from 5% in 2014 to 18% in 2024.

Markel’s ability to rebound from plummeting bond prices in 2022, and immediately regain profitability in 2023, should give investors more confidence in the company’s ability to navigate the current volatile market.

Figure 1: Markel Group’s Revenue and NOPAT Since 2014

Sources: New Constructs, LLC and company filings

MKL Is Undervalued

At its current price of $1,827/share, MKL has a price-to-economic book value (PEBV) ratio of 0.6. This ratio means the market expects Markel Group’ NOPAT to permanently decline by 40% from 2024 levels. This expectation seems overly pessimistic for a company that has grown NOPAT by 24% compounded annually over the last decade and 15% compounded annually over the last two decades.

Even if Markel Group’s NOPAT margin falls to 10% (below 2024 NOPAT margin of 17% and five-year average margin of 11%) and the company’s grows revenue by 4% (below ten-year compound annual growth rate of 12%) compounded annually through 2034, the stock would be worth $2,274/share today – a 24% upside. In this scenario, Markel Group’ NOPAT would fall 1% compounded annually through 2034. Should Markel Group grow profits more in line with historical levels, the stock has even more upside.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we made based on Robo-Analyst findings in Markel Group’s 10-K:

Income Statement: we made over $350 million in adjustments, with a net effect of removing over $200 million in non-operating expense. Professional members can see all adjustments made to Markel Group’ income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made just under $1.6 billion in adjustments to calculate invested capital with a net increase of just under $300 million. One of the most notable adjustments was for other comprehensive income. Professional members can see all adjustments made to Markel Group’ balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made just under $3.5 billion in adjustments to shareholder value, with a net decrease of over $3.3 billion. The most notable adjustment was for deferred tax liability. Professional members can see all adjustments to Markel Group’ valuation on the GAAP Reconciliation tab on the Ratings page on our website.

This article was originally published on March 13, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.