Five years after the Financial Accounting Standards Board (FASB) first issued new revenue recognition rules, we finally get to see its impact on reported financials. The new standard was originally scheduled to go into effect in 2016, but the FASB delayed implementation until 2018 due to concerns over the difficulty of implementation. As a result, the first 10-K’s utilizing the new standard came out earlier this year for most companies.

While the new standard, ASU 2014-09 (also referred to as ASC 606), primarily deals with revenue, it will also have significant impacts on how companies report expenses, as well as assets and liabilities on the balance sheet.

Most companies have seen relatively little impact from the new revenue recognition rules, but for a handful of industries it significantly distorted revenue and earnings over the past year. This report digs into how the new rule works, what’s changed, and how investors should respond.

How the New Rule Works

The FASB announced the new revenue recognition rule in 2014 as part of an effort to standardize accounting treatments and continue to converge U.S. Generally Accepted Accounting Principles (GAAP) with International Financial Reporting Standards (IFRS). As the FASB wrote in the announcement of the new rule:

“Previous revenue recognition guidance in U.S. GAAP comprised broad revenue recognition concepts together with numerous revenue requirements for particular industries or transactions, which sometimes resulted in different accounting for economically similar transactions.”

The new revenue recognition standard replaced the more than 100 different industry and transaction-specific guidelines with a basic, five-step framework. Under the new rule, companies must carry out the following steps:

Step 1: Identify the contract(s) with a customer.

Step 2: Identify the performance obligations in the contract.

Step 3: Determine the transaction price.

Step 4: Allocate the transaction price to the performance obligations in the contract.

Step 5: Recognize revenue when (or as) the entity satisfies a performance obligation.

In principle, these steps sound straightforward, but executing them is not always simple. The full standard runs 700 pages long with all the amendments included. These amendments give guidance on specific issues related to revenue recognition and outline the increased disclosure that will be required from companies under the new rules.

In addition to changing the way companies recognize revenue, the new rule impacts some of the expenses related to how companies obtain and satisfy contracts with customers. For example, companies now have more discretion to capitalize sales commissions for long-term contracts. Rather than being expensed immediately, these commissions are now recognized as contract assets on the balance sheet and amortized over the life of the contract.

All in all, the new standard was so complex that the FASB pushed back the implementation date to give companies more time to adjust. Fiscal year 2018 was the first year for which companies delivered fully audited financial statements under ASU 2014-09.

While every company that files under GAAP is subject to the new rule, the impact can vary widely. Some companies, like US Steel (X), saw no change to their financial statements. Others experienced significant boosts to revenue or earnings based on the new accounting rules. Below, we’ll walk through examples from three different industries that have been especially impacted.

Software: Verint Systems (VRNT)

We previously highlighted how ASU 2014-09 impacted Verint Systems’ (VRNT) 2018 earnings in our article, “This Tech Laggard Is Back in the Danger Zone.” The software industry has been particularly impacted by the new rule due to the long-term nature of many cloud software recurring revenue contracts.

Under previous guidelines, revenue from software licensing agreements where payment for the license is paid in installments over more than 12 months could only be recognized when the customer was billed for each payment. Under the new standards, contracted revenue can be recognized upon transfer of control of the software license.

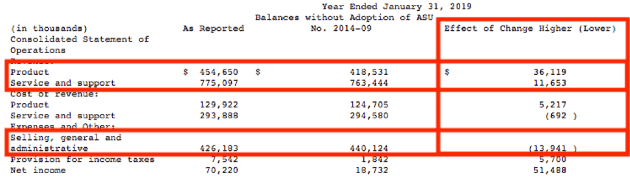

This change accelerated the recognition of contracted revenue for software companies in 2018 and led to a significant increase in revenue for some companies. In fiscal year 2018, VRNT, for example, recognized additional revenues of $48 million (4% of total revenue and 50% of revenue growth) due to the adoption of the new standard, as shown in Figure 1.

Figure 1: VRNT Income Statement with and Without the New Revenue Recognition Rule

Sources: New Constructs, LLC and company filings

Figure 1 also shows that VRNT’s selling, general, and administrative expense declined by $14 million, primarily due to the capitalization of commissions paid to agents and sales personnel. As a result, VRNT received a $51.5 million boost to net income last year, which significantly impacted NOPAT as well. See Figure 2.

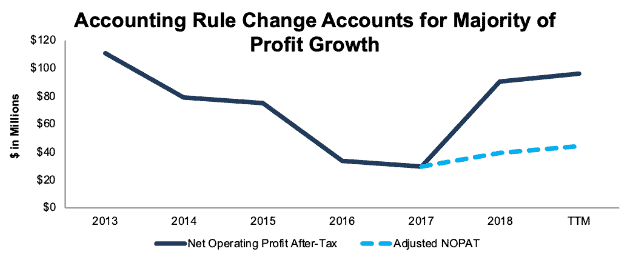

Figure 2: VRNT NOPAT With and Without Accounting Rule Change: 2013-TTM

Sources: New Constructs, LLC and company filings.

Normally, our Robo-Analyst[1] technology would collect this information and make an adjustment to account for the impact of a new accounting rule change. However, ASU 2014-09 represents a complete overhaul of the revenue recognition process, and the disclosure around its impact is too inconsistent for us to fully disaggregate and adjust for its impact across all companies over all of their histories. Limited disclosures force us to accept this new standard as the default going forward and study disclosures on a case by case basis with the hope that we can find profit distortions.

Clearly, investors need to be on the lookout for companies – like Verint – with unusual changes to their income statement in 2018 based on this new rule. Because disclosures on how the companies apply the rule vary so much, we do not yet have comprehensive data on the rule’s impact. But, the rule has a material impact on every software company we’ve analyzed so far.

The good news for investors is that the distortionary effect of this rule should dissipate after a year. The revenue that was pulled forward into 2018 should be a one-time boost. The commissions that were capitalized appear on the income statement as amortization. VRNT, and other companies like it, should see their revenue growth and after-tax operating profit (NOPAT) revert to historical levels going forward.

Telecom: AT&T (T)

Telecom companies face significant challenges regarding the timing and allocation of their revenue due to their tendency to bundle a variety of products and services together. These bundles make it difficult to determine what portion of a transaction price is attributable to each performance obligation (Step 4 of the new standard) and when each performance obligation is completed (Step 5 of the new standard).

As an example, a telecom company such as AT&T may sell a cell phone and cell service together with the price of both bundled into a single monthly payment. This arrangement raises two important questions:

- Are the cell phone and cell service two distinct performance obligations, or are they a single performance obligation?

- If they are separate performance obligations, should the revenue from the sale of the cell phone be recognized immediately, or over the lifetime of the contract?

Under previous revenue guidance, the cell phone and the service were considered to be a single performance obligation, and revenue from both could only be recognized as payments were received.

Under ASU 2014-09, however, these two items can be treated as distinct performance obligations. The revenue from the cell service would be recognized monthly, but the entirety of the expected revenue from the sale of the phone would be immediately recognized upon its transfer to the customer. The revenue that has been recognized but not yet billed is recorded on the balance sheet as a contract asset.

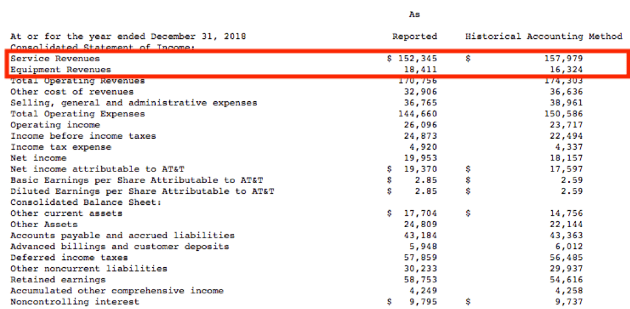

In addition, the new revenue recognition standard advises companies to allocate transaction prices based on a stand-alone selling price basis, i.e. the amount that a good or service would sell for on its own without a bundle. Since AT&T often sells phones at highly discounted prices as part of its bundles, this new guidance causes the company to report higher equipment revenue and lower service revenues than in the past, as shown in Figure 3.

Figure 3: T Income Statement with and Without the New Revenue Recognition Rule

Sources: New Constructs, LLC and company filings

Defense Industry: Lockheed Martin (LMT)

Roughly 70% of LMT’s revenue comes from contracts with the U.S. government, and many of these contracts cover large-scale projects that may take years to complete and consist of a large number of deliverables. In addition, the company often receives payment – or part of its payment – for these contracts prior to fulfilling the performance obligations.

Under the prior revenue recognition guidance, LMT recognized revenue in two different ways based on the nature of products or services delivered. It either recorded revenue under:

- Percentage of Completion Cost-to-Cost: Recognize revenue as the costs to fulfill the contract are incurred.

- Percentage of Completion Units-of-Delivery: Recognize revenue as the various units of the contract are delivered to the customer.

Under ASU 2014-09, this disparity has been resolved, and all contracts are now accounted for using the Cost-to-Cost method. Since costs are typically incurred prior to the delivery of a unit, this new standard accelerates the recognition of revenue for contracts that had previously been accounted for under the Units-of-Delivery method.

Unlike VRNT and T, LMT does not disclose how the new accounting rule impacted its financial statements for 2018. However, the company does show the impact of the retrospective adoption of the rule on its 2017 financial statements.

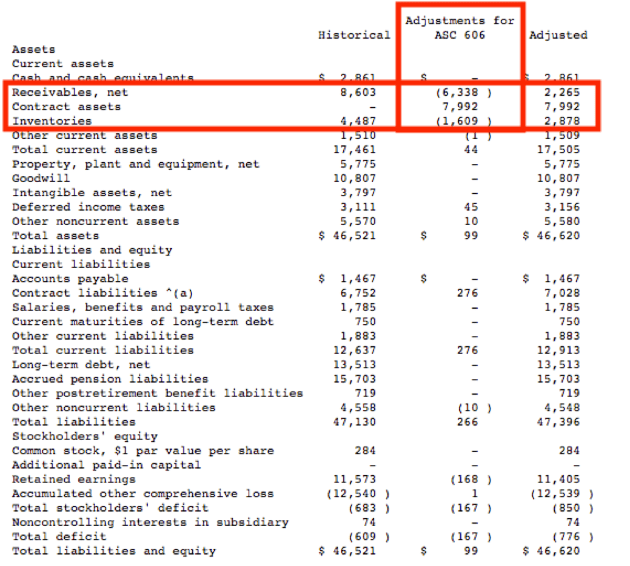

It appears that about half of companies disclose the rule’s impact on current financials and half only disclose its impact on past financials. So far, very few companies have disclosed the impact of the rule (past or present) on their balance sheet as Lockheed Martin does. See Figure 4.

Figure 4: LMT 2017 Balance Sheet With and Without the New Revenue Recognition Rule

Sources: New Constructs, LLC and company filings

The two largest changes under the rule are:

- The reclassification of a significant portion of accounts receivables as contract assets instead.

- A $1.6 billion reduction in inventories to reflect the accelerated recognition of revenue under the Cost-to-Cost method.

While the components of the balance sheet shift around, the ultimate impact on total assets and liabilities is negligible. In other words, the actual cash flows and assets of the company are not changing despite the new revenue recognition standard.

How To Protect Yourself

Given the distortionary impact of the new rule, how should investors avoid being misled by changing accounting rules?

The first step is to analyze free cash flow. While the new rule may artificially increase NOPAT for some companies, those changes will also flow through the balance sheet and increase invested capital.

Take the example of VRNT above. The new rule may have increased the company’s NOPAT from $30 million to $90 million, but it also contributed to a $145 million increase in invested capital due to the increase in contract assets and decrease in current liabilities on the balance sheet.

As a result, even though VRNT’s NOPAT increased in 2018, its free cash flow declined from -$27 million to -$54 million. When the trend in a company’s NOPAT and its free cash flow diverges in this manner, investors need to focus on free cash flow.

In addition, investors should be on the lookout for companies that try to game the new revenue recognition rules to maximize their reported revenue. On page 82 of its fiscal 2019 10-K, VRNT wrote:

“While the table below indicates that calculated revenue for the year ended January 31, 2019 without the adoption of ASU No. 2014-09 would have been lower than the revenue we are reporting under the new accounting guidance, this lower calculated revenue results not only from the impact of the new accounting guidance, but also from changes we made to our business practices in anticipation and as a result of the new accounting guidance.”

In other words, the company states it modified its business practices solely in an effort to hit accounting numbers, even though those accounting numbers don’t actually have an impact on the real cash flows of the business.

This gaming of the numbers should be a stark reminder to investors that financial statements do not tell the full story of a business. Over the long-term, it is the economic cash flows, not the accounting earnings, of a business that drive stock prices.

This article originally published on September 18, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features our Robo-Analyst research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.