Editor’s Note: Accounting Standards Update 2016-02, which requires companies to record operating lease assets and liabilities on the balance sheet, went into effect for calendar year 2019. The adjustments/treatment of operating leases described below pertain to periods prior to 2019. For periods after 2019, we account for operating leases as explained here.

This report is one of a series on the adjustments we make to convert GAAP data to economic earnings.

Reported earnings don’t tell the whole story of a company’s profits. They are based on accounting rules designed for debt investors, not equity investors, and are manipulated by companies to manage earnings. Only economic earnings provide a complete and unadulterated measure of profitability.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivaled due diligence on 5,500 10-Ks every year for the past decade.

Operating leases are a form of off-balance sheet debt. Two companies with identical operations would have very different financial statements if one funds asset purchases with debt while the other utilized operating leases.

The company that borrowed money to purchase assets would show the value of the debt and the asset on its balance sheet. On its income statement, there would be interest expense and depreciation related to the purchased asset. In contrast, operating leases accounting requires no record of debt or the value of the leased asset on a company’s balance sheet. The only accounting impact is the rental expense on net income.

Rental expenses do not receive their own line item on the income statement. Without careful research in the footnotes, investors would never know the income statement included rental expenses from operating leases.

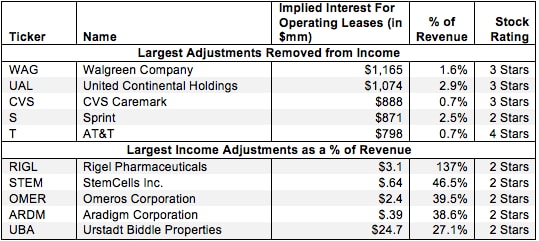

Our models reverse the distorting effect of operating lease accounting and makes the financials of the two companies comparable. First, we deduct the implied interest expense related to operating leases from net operating profit after tax (NOPAT). This adjustment ensures the NOPAT of the two companies is comparable. NOPAT is an unlevered measure of profit and excludes financing costs. The second adjustment is to put the operating lease debt back on the balance sheet so the two companies balance sheets are comparable. The balance sheet portion of this adjustment will be covered in a separate report.

These adjustments essentially convert all operating leases into on-balance sheet debt to make the financials of companies with differing accounting methods comparable. This conversion gives us a more accurate view of the core operating profitability of businesses.

7 replies to "Implied Interest For Operating Leases – NOPAT Adjustment"

What about hypothetical depreciation and amortization of the asset once we convert operating leases into assets and debt?

You don’t necessarily need the hypothetical depreciation and amortization of the asset b/c there is no large, upfront cash expenditure.

We get updates on the asset/debt values naturally thru the quarterly/annual updates of the future minimum payments.

Why do you subtract the implied interest? NOPAT is before ineterest.

Subtracting implied interest is important for comparability between companies that finance investment through leases vs. debt. Subtracting the implied interest cost from total expenses ensures that you’re not counting a financing cost as an operating expense.

So with regards to your answer to Juan, you’re saying that even though it’s an interest expense it’s still operational, and this is why you’re subtracting it from the NOPAT? You didn’t mention it in the piece but don’t you also need to add back the rental expense?

Also what rate are you using to compute the implied interest expense?

Thanks

Sorry for the confusion. What we’re saying is that on the income statement all rental expense is treating as an operating expense, but in reality a portion of that rental expense is an implied interest expense that should be treated as financing. So what we’re doing is subtracting the implied interest from operating expenses, effectively adding it back to NOPAT.

In terms of the rate used to compute implied interest expense, we use an estimate of cost of debt. For most companies it ends up being ~5%