The Impacts of Operating Leases Moving to the Balance Sheet

The Financial Accounting Standards Board (FASB) introduced a new accounting standard (ASU 2016-02) that requires companies to recognize operating lease assets and liabilities on the balance sheet. Our forensic accounting technology has applied this convention since inception, so all of our models and research already reflect and will continue to reflect this change. In other words, we have you covered. For details on subsequent accounting rule changes regarding operating leases, see this report.

Note: The impact of this change is almost entirely around lessee accounting (companies that pay leases) and is the focus of this article.

Background on This Change

A company can lease assets in one of two ways: capital leases or operating leases.

Capital leases effectively act as debt to own the underlying asset leased. A simple analogy is taking out a loan to purchase a car or home; payments are made periodically and, at the end of the term, the asset is owned outright with the loan repaid.

Operating leases do not transfer ownership of the underlying asset, and payments are made for usage of the asset. A simple analogy here is leasing a car from a dealer; the lessee makes payments for the right to use the car, but does not gain equity in the car itself and will not own the car at the end of the lease.

Prior to this new accounting standard, GAAP required the assets and liabilities associated with capital leases to be on a company’s balance sheet. Typically, these leases are in relation to property, plant and equipment (PP&E), so the capital lease assets were recorded in PP&E while the lease liabilities were recorded in debt or other liabilities.

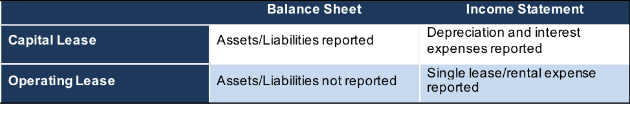

On the other hand, operating leases, both the assets and liabilities, were not reported on the balance sheet, despite the fact that entities were using the assets and contractually obligated to pay the lease. Also prior to this change, capital leases required separate depreciation and interest expenses, whereas operating leases required a lump-sum lease payment or rental expense. A summary of historical accounting is shown in Figure 1, below.

Figure 1: Historical Accounting for Capital vs Operating Leases

Source: FASB Accounting Standards Update 2016-02 (see Appendix)

The single largest change in FASB’s ASU 2016-02 is the requirement of operating leases to have the associated asset and liability recorded on the balance sheet at the present value of future lease payments. These large assets and liabilities, once hidden in the notes, will now be placed directly on the balance sheet, and we applaud FASB for requiring more transparency for investors in public equities.

The new standard still requires just one lease/rental expense reported. However, because assets are now recognized, impairments will also be recognized on the income statement, outside of this single lease cost.

Historical Treatment in Our Models

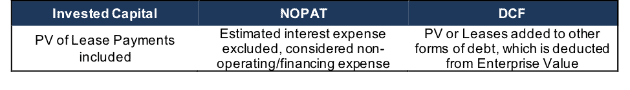

Despite being off-balance sheet assets and liabilities, we have always included the effects of operating leases in its models. On the balance sheet side, we added the present value of the future minimum lease payments, discounted by a consistent cost of debt, to our measures of Invested Capital and Operating Debt. This methodology is virtually identical to the new treatment required by FASB.

On the income statement, we subtracted an estimated interest cost component from operating expenses in our calculation of NOPAT. Because operating lease expenses are recorded as a lump-sum, we need to remove the financing component as a non-operating expense, as we do with other financing costs.

Finally, along with other forms of debt, the operating lease liability is subtracted from Enterprise Value to arrive at Shareholder Value.

More details are in the white papers on our treatment of off-balance sheet debt.

Figure 2: Methodology/Impact of Operating Leases on Models/Metrics

Source: New Constructs, LLC

Future Treatment in Our Models

After this accounting rule change goes into effect, we will continue to calculate operating lease liabilities and expenses as we always have. Given the likely variances in how companies will calculate their operating lease debt, we will remove what they report the on-balance sheet and replace it with our calculated value. Our values will provide far greater comparability for all companies with operating leases as well as for the year-over-year results of individual companies.

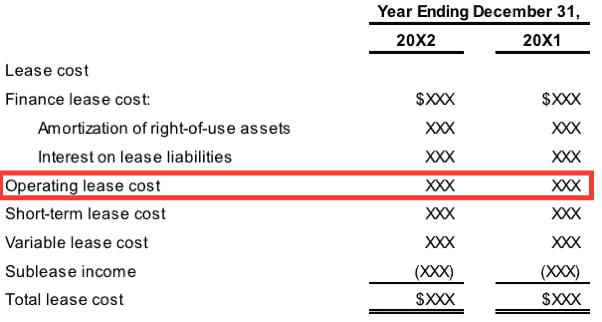

Figure 3: Example of Cost Disclosure Under New Standard

Source: FASB Accounting Standards Update 2016-02 (see Appendix)

When operating lease costs are reported as a lump-sum item, as shown in Figure 3, above, New Constructs will continue to remove an estimated interest expense for operating leases from operating expenses. In the event companies disclose the interest expense portion of the operating lease expense, we will consider that value as a replacement for our estimated values.