We closed this Long Idea on September 19, 2024. A copy of the associated Position Close report is here.

Despite missing top-line estimates in 3Q21 and giving back some of the pandemic-induced sales of 2020, this company is more profitable than it was pre-pandemic and is expanding its reach in the fast-growing health and wellness and natural/organic grocery markets. Sprouts Farmer’s Market (SFM: $24/share) remains a Long Idea.

We leverage more reliable fundamental data, as proven in The Journal of Financial Economics[1] and shown to provide a new source of alpha, with qualitative research to pick this Long Idea.

Sprouts Farmers Market Has Very Attractive Risk/Reward

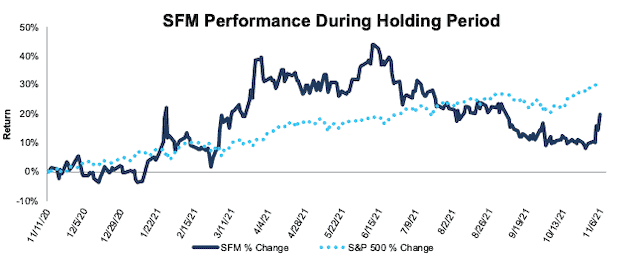

We made Sprouts a Long Idea in November 2020, and the stock has underperformed the market by 10% since then. However, given the company’s strong market position and cheap valuation, we continue to see upside in the stock.

Figure 1: Long Idea Performance: From Date of Publication Through 11/9/21

Sources: New Constructs, LLC and company filings

What’s Working:

Sales Remain Up from 2019 and Shoppers Are Spending More. Sprouts Farmer’s Market beat bottom-line expectations, despite missing top-line estimates, as sales slowed from record levels seen in the prior year period when grocery sales soared amidst lockdown orders and rising COVID-19 cases. Despite falling from 2020 highs though, 3Q21 revenue is still up 5% over 3Q19.

Compared to 2019, Sprouts notes that customers are buying more products per purchase and paying higher average prices via “a combination of mix, fewer promotions, and inflation.”

Going forward, management expects sales to grow “in the low- to mid-single digits” year-over-year (YoY) in 2022.

Margins Remain 2nd Only to Amazon. Other grocers with more commoditized offerings may struggle to maintain margins as inflation rises. However, Sprouts notes that outside of certain protein products, it has been “able to pass on what’s been passed on to us”, which is why net operating profit after-tax (NOPAT) margins of 5.5% over the trailing twelve months (TTM) remain higher than any year of our model.

Additionally, Sprouts’ focus on local sourcing means the company has a powerful negotiating position over much smaller suppliers to which Sprouts is a “big customer.” Per Figure 2, Sprouts’ NOPAT margin ranks above all competition except for Amazon (AMZN), whose margin undoubtedly gets a boost from its software/cloud business.

Figure 2: Sprouts' NOPAT Margin Vs. Competition

Sources: New Constructs, LLC and company filings

New Store Format Helps Maintain Margin Improvement. Any further increase to the cost of its products can also be mitigated with the roll out of Sprouts' updated store format. The new stores aim to tap into the “farmer’s market” experience Sprouts is known for and expand frozen and refrigerated offerings.

The new stores cost on average 20% less to build largely due to 50% lower cost in deli fixtures and 50% lower cost in protein fixtures. Additionally, Sprouts estimates the smaller stores cost on average 20% less to operate due to lower rent and reduced labor costs from the addition of self-checkout.

Most importantly, despite being smaller in size, the more efficient layout means Sprouts is not reducing the number of products sold, and management expects “sales to be at least equal to the larger boxes we built in the past.”

Store Growth Increases Market Reach. Sprouts Farmers Market has improved profitability while continually expanding its store count. From 2013 through the end of 3Q21, Sprouts has grown its store count 10% compounded annually. The firm plans to open nine new stores in 4Q21 and another 25-30 stores in 2022. Increasing its return on invested capital (ROIC) (from 7% in 2013 to 12% TTM) while also growing its store count at a high rate is no small feat. Very few companies are able to achieve growth and improve ROIC at the same time.

Private Label Also Aids Profitability. Sprouts’ private label business helps differentiate it from the larger box retailers, while boosting profitability. The company notes its private label products also provide customers with “lower prices while still delivering generally higher margin as compared to branded products.” Sprouts’ private label products as a percent of revenue have grown from 10% in 2016 to 16% in 2020.

Ecommerce Gains Have Persisted. In 3Q21, ecommerce sales made up 10% of revenue, which is up slightly from 9.5% in 2020 and just 3.7% in 1Q20 (the earliest available data). Ecommerce sales correlate to higher spending per consumer, as Sprouts noted in its 2Q21 earnings call that “the e-commerce basket remained significantly higher than an in-store basket.”

Going forward, Sprouts’ ecommerce sales provide growth opportunities. The company notes that between Instacart and its own site, it is “collecting customer data on ~2/3rds of those who shop online”, which can then be leveraged to support additional online and brick-and-mortar sales.

Positioned in Fast-Growing Markets. The demand for health and wellness products, along with natural and organic products, is growing at a rapid pace that provides Sprouts a long-term runway for growth.

- The global organic food and beverages market is expected to grow 16.4% compounded annually from 2020-2028

- The global health and wellness products market is projected to grow 6.3% compounded annually from 2021-2025

What’s Not Working:

After record-breaking sales in 2020, Sprouts’ comparable store sales growth is negative YoY through the first nine months of 2021. However, TTM sales remain higher than any annual period prior to 2020, and sales through the first nine months of 2021 are up 8% over the same period in 2019. In other words, while the company has given back some of the revenue gains of 2020, sales still remain higher than pre-pandemic levels.

Sprouts’ previous marketing, by admission of its management team, failed to effectively communicate its competitive and/or lower prices to consumers. The value proposition wasn’t clear until consumers reached the store, which helped drive Sprouts’ market share, as measured as revenue as a percent of U.S. grocery store sales down from 0.84% in 2020 to 0.79% over the TTM. However, even with this decline, its average market share over the past three years remains at 0.81%, which is up from 0.77% in 2019 and 0.41% in 2014.

To address its ineffective marketing, Sprouts updated its materials to highlight pricing and differentiated products such as local varieties of organic produce. Store traffic improved in each month of 3Q21, and management believes the updated marketing materials are an important factor in that improvement.

While Sprouts has been able to pass on most cost increases, ongoing labor shortages across the country still impact the company. In 3Q21, Sprouts experienced lower job applications, and should available labor tighten, margins could be at risk.

SFM Is Still Priced for Permanent Profit Decline of 60%

Despite a growing market, a more profitable business operation, and expectations for a return to YoY growth in 2022, SFM still trades below its three-year average economic book value (EBV)[2]. With price-to-three-year-average economic book value ratio of 0.4, the market is expecting significant profit decline, despite management guidance and consensus estimates for the opposite.

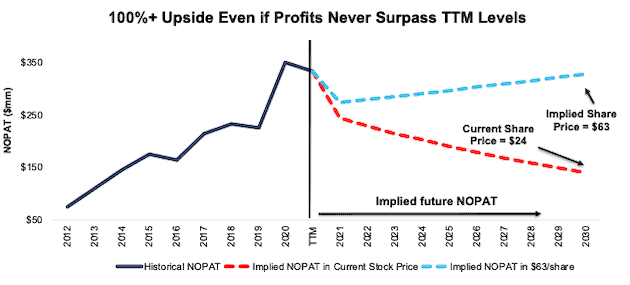

Below, we use our reverse DCF model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for Sprouts.

In the first scenario, we assume Sprouts’:

- NOPAT margin falls to 4% (company low in 2016, compared to 5.5% TTM and 5-yr avg of 4.5%) from 2021 through 2030, and

- revenue falls 6% compounded annually through 2030

In this scenario, Sprouts NOPAT falls by 9% compounded annually over the next decade and the stock is worth $25/share today – nearly equal to the current price. See the math behind this reverse DCF scenario. For reference, Sprouts grew NOPAT by 9% compounded annually from 2014-2019.

Shares Could Reach $63 or Higher: If we assume Sprouts’:

- NOPAT margin falls to 4.5% (5-year avg) and

- revenue falls 6% (equal to consensus estimates) in 2021, and

- revenue grows 2% a year each year thereafter through 2030 (below consensus estimate for 6% in 2022 and 8% in 2023), then

the stock is worth $63/share today – 163% above the current price. See the math behind this reverse DCF scenario.

Should Sprouts maintain current margins, or grow revenue even faster than assumed above, the stock has even more upside.

Figure 3: Sprouts’ Historical and Implied NOPAT: DCF Valuation Scenarios[3]

Sources: New Constructs, LLC and company filings

This article originally published on November 10, 2021

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

[2] We calculated Sprouts’ economic book value using a 5-year average WACC of 3.5% to normalize the impact of significantly lower WACC in 2020 and the TTM period.

[3] We use the override capabilities in our DCF model to replace Sprouts’ TTM WACC (2.5%) with its 5-year average WACC (3.5%) in both scenarios.