We’re always working to give clients the best fundamental research and models in the business. We’re excited to announce enhancements to the Override capability in our Company Valuation Models:

- Simplified overrides for net operating profit after-tax (NOPAT), invested capital, weighted average cost of capital (WACC) and DCF valuation adjustments.

- Added overrides for the trailing-twelve-month period.

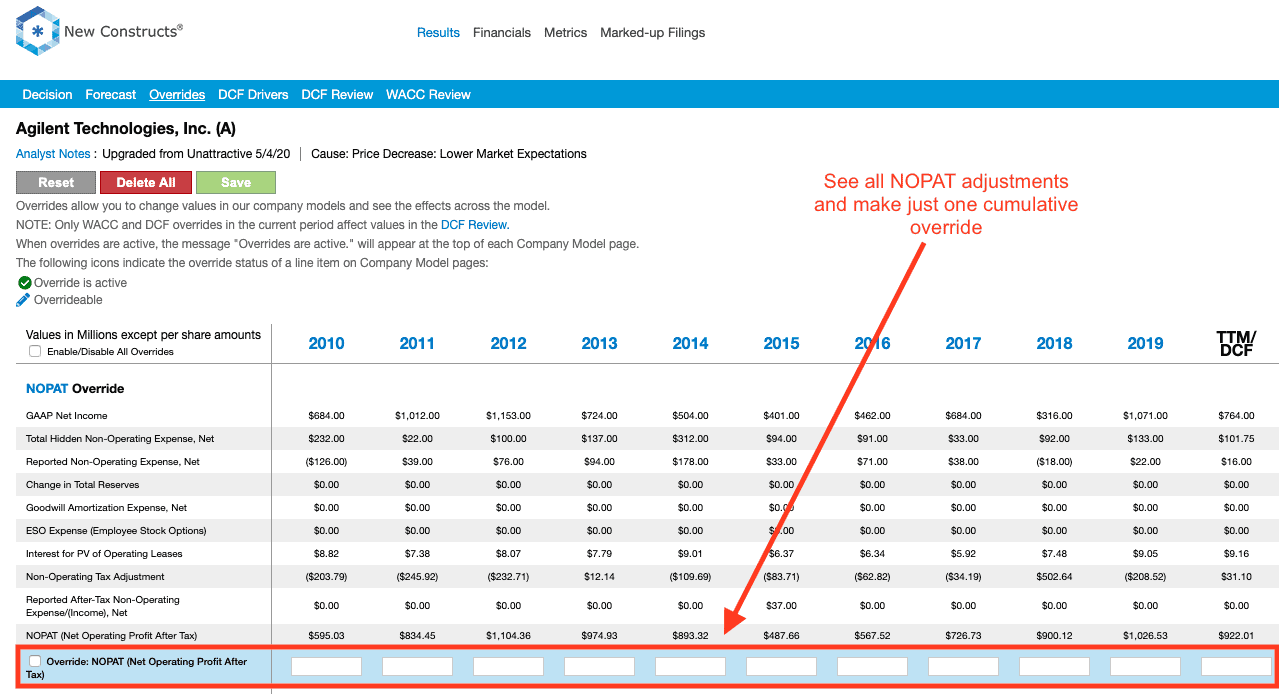

The primary simplification is that clients only need to make one override for each metric, rather than override each adjustment. Per Figure 1, which shows the updated NOPAT override, clients can see all adjustments we make to NOPAT, and, should they choose, enter their own override value for NOPAT. Your override value for NOPAT will replace NOPAT throughout our model.

Figure 1: Updated Override Page – NOPAT Override

Sources: New Constructs, LLC and company filings.

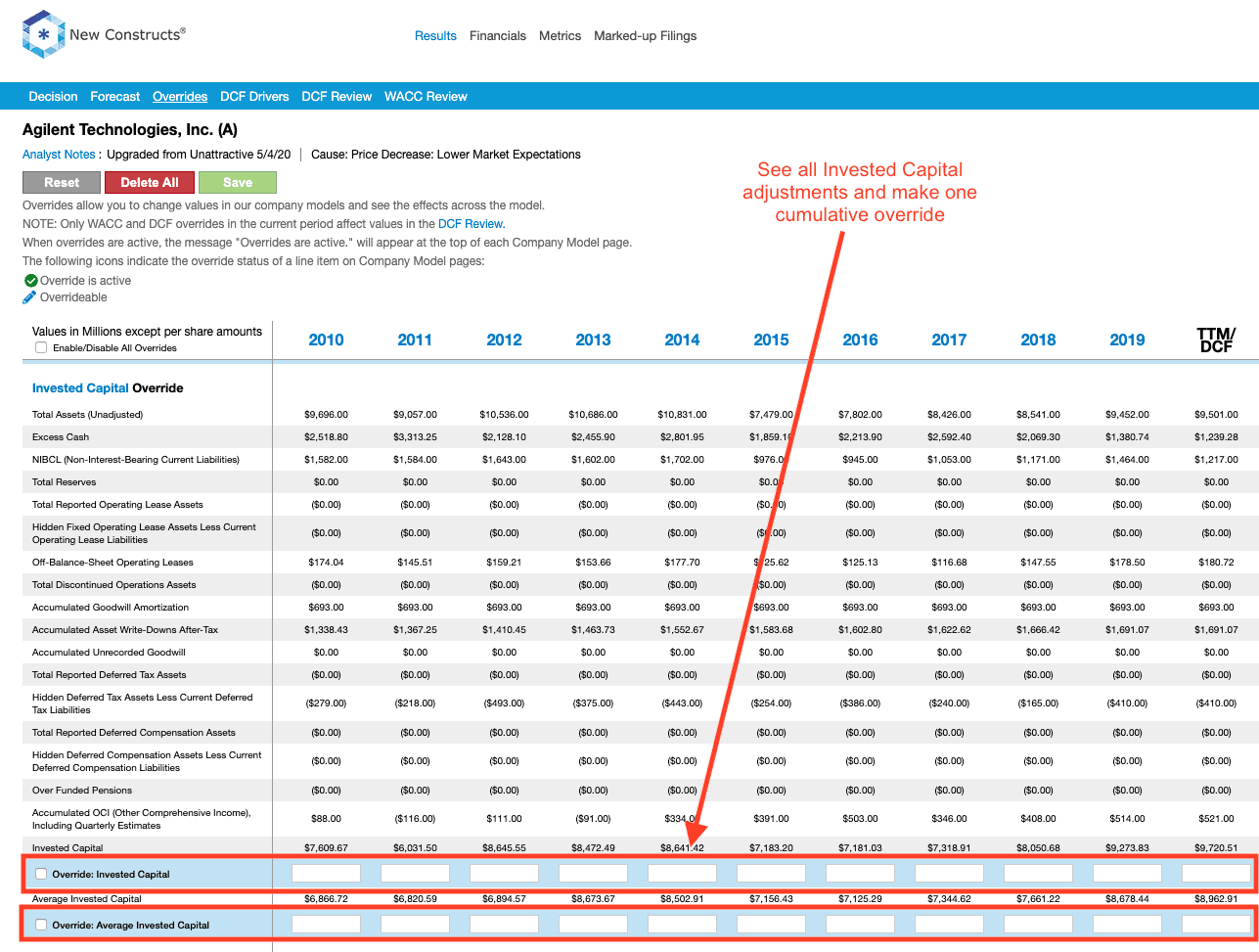

Figure 2 shows the updated invested capital override. You can override Invested Capital and Average Invested Capital, the denominator in our return on invested capital (ROIC) calculation.

Figure 2: Updated Override Page – Invested Capital Override

Sources: New Constructs, LLC and company filings.

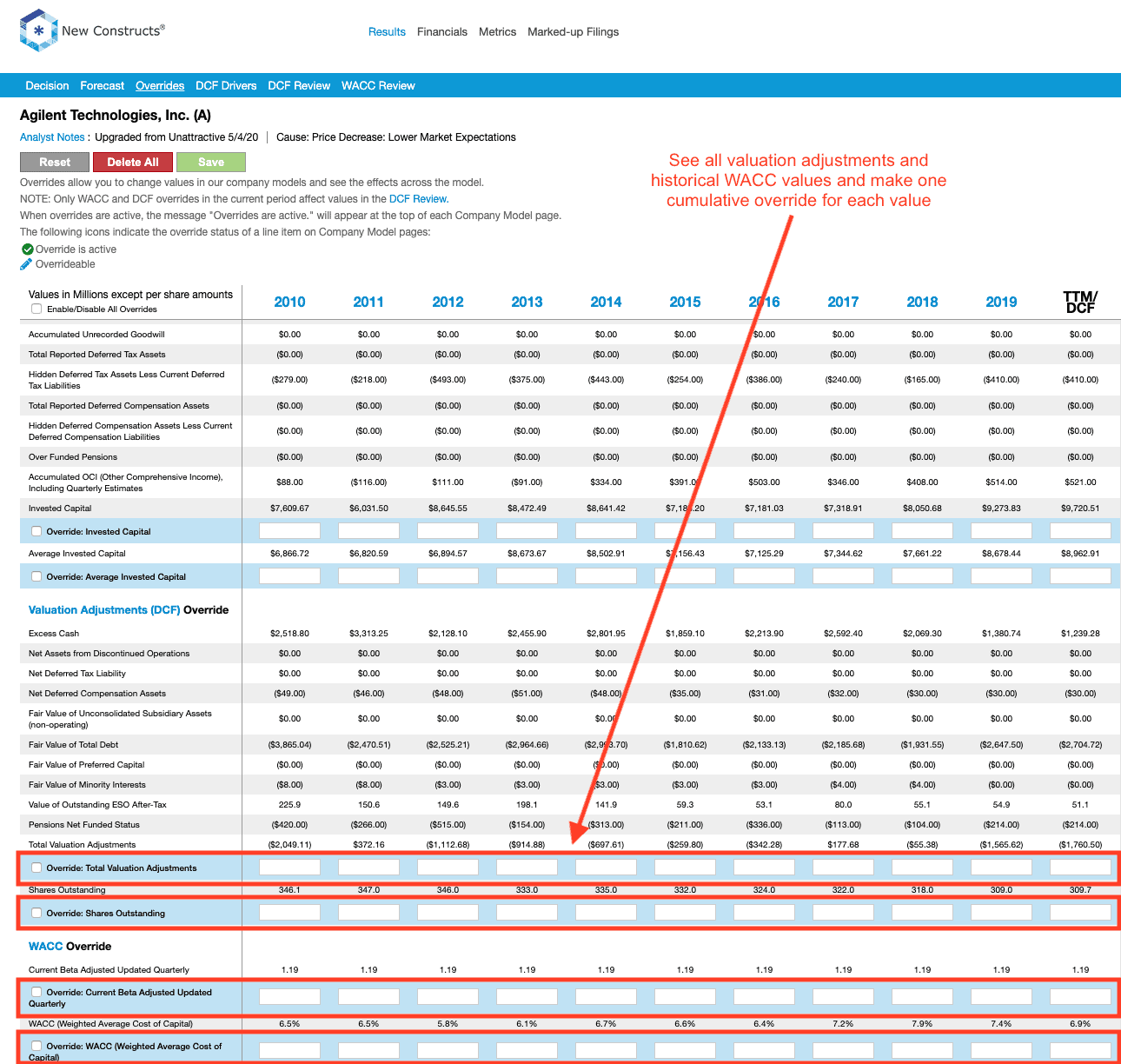

Figure 3 shows the updated valuation adjustments and WACC overrides. Use the valuation adjustments override to change the value of economic book value (EBV), enterprise value (EV), or shareholder value in the discounted cash flow (DCF) model.

Figure 3: Updated Override Page – Valuation and WACC Override

Sources: New Constructs, LLC and company filings.

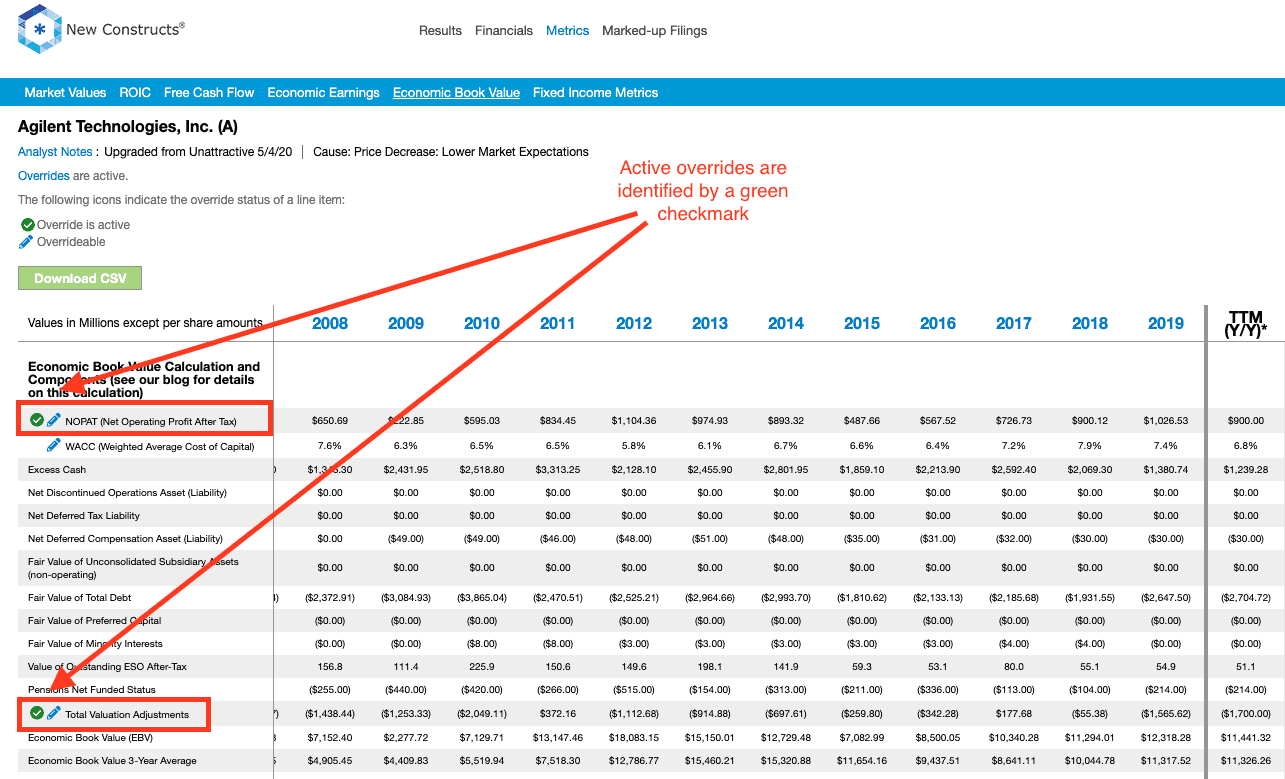

These overrides are automatically applied throughout our model, including on Financials and Metrics pages such as NOPAT, Invested Capital, Free Cash Flow and Economic Book Value, as well as the DCF page. Active overrides are identified by a green checkmark and can be edited by clicking the blue pencil icon.

Figure 4: Active Overrides in a Model

Sources: New Constructs, LLC and company filings.

Please contact us at support@newconstructs.com if you have any questions.

This article originally published on May 5, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.