To demonstrate the difference our proprietary Adjusted Fundamental data makes, we continue our series of reports that show how our Credit Ratings are more reliable than legacy firms’ ratings. This report explains how our “Adjusted” Interest Coverage ratio is better than the “Traditional” ratio because the Traditional ratio is based on unscrubbed financial data. Interest Coverage is one of the 5 ratios that drives our Credit Ratings. Get explanations and comparisons for the other four metrics here.

No Bias, More Coverage, and Better Analytics: A New Paradigm for Credit Ratings

Though legacy providers, e.g. Moody’s, S&P, and Fitch, have dominated the credit ratings industry for some time, our Credit Ratings offer these advantages:

- more coverage: ~2,700 companies vs. ~1,500 for S&P

- more frequent updates: we update all ~2,700 of our credit ratings quarterly while S&P updates ratings for ~400 companies per year

- free of conflicts of interest that continue to taint legacy ratings.

Most importantly, superior fundamental data drives material differences in our Credit Ratings and research compared to legacy firms’ research and ratings. This report will show how Interest Coverage ratings for 6% of S&P 500 companies are misleading because they rely on unscrubbed data.

We also detail the differences that better data makes at the aggregate[1], i.e. S&P 500[2], level and the individual company level (see Appendix) so readers can easily quantify the benefits of our superior data.

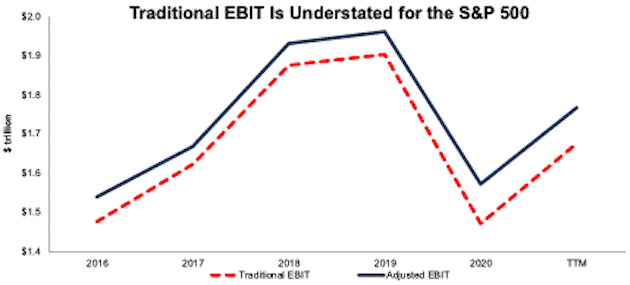

Unscrubbed EBIT Is Understated by 5% for the S&P 500

We use EBIT as the numerator for the Interest Coverage ratio. Figure 1 shows the difference between Traditional EBIT and our Adjusted EBIT since 2016. Over the trailing twelve months (TTM), Traditional EBIT understates our Adjusted EBIT by $88 billion, or 5% of Traditional EBIT.

Figure 1: Traditional Vs. Adjusted EBIT for S&P 500

Sources: New Constructs, LLC and company filings.

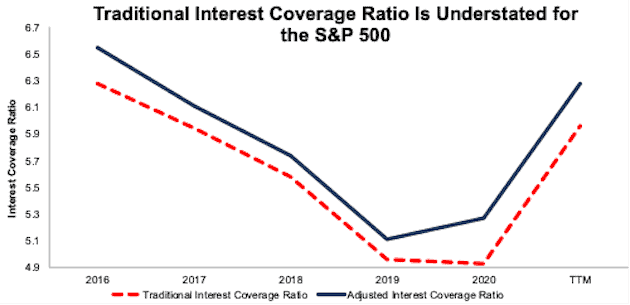

Traditional Interest Coverage Ratio Is Understated by 5% at the Aggregate Level

We use the same Interest Expense value as the denominator for both our Traditional and Adjusted Interest Coverage ratio, which means, the difference between Traditional and Adjusted EBIT drives the difference between the Traditional and Adjusted Interest Coverage ratios. Figure 2 shows that the Traditional Interest Coverage ratio has been understated since 2016. Over the TTM, the Traditional Interest Coverage ratio of 6.0 is lower than the Adjusted Interest Coverage ratio of 6.3 and is understated by 5%.

Figure 2: Traditional Vs. Adjusted Interest Coverage ratio for S&P 500

Sources: New Constructs, LLC and company filings.

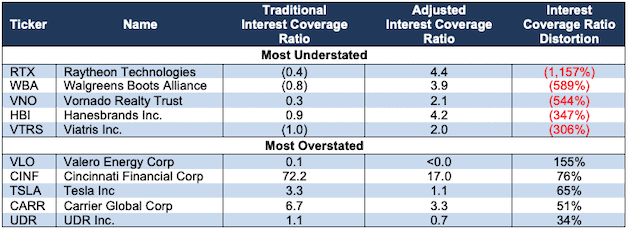

Even Bigger Differences Emerge at the Individual Company Level

When analyzing individual companies, we see very large differences in Traditional and Adjusted EBIT and Traditional and Adjusted Interest Coverage ratios. For example, even though there is a 5% difference between Traditional and Adjusted EBIT at the aggregate level, at the company level, we find Traditional EBIT understated by as much as 1,157% and overstated by as much as 155%. 19% percent of the firms in the S&P 500 have Traditional EBIT that is over/understated by 10% or more.

Figure 3 shows the number of S&P 500 companies with understated and overstated Interest Coverage ratios. Understated ratios have negative Interest Coverage ratio distortion[3], and overstated ratios have positive distortion.

About 59% of S&P 500 firms’ Traditional Interest Coverage ratios are understated, and 25% are overstated.

Figure 3: Number of S&P Companies with Under/Overstated Interest Coverage ratios: TTM

Sources: New Constructs, LLC and company filings.

Figure 4 lists ten S&P 500 companies with the most understated and overstated Interest Coverage ratios over the TTM.

Note: we detail the data and disclosures that drive the differences in Traditional versus Adjusted Interest Coverage for Raytheon Technologies (RTX) and Tesla Inc (TSLA) in the Appendix to this report.

Figure 4: Companies with Under/Overstated Interest Coverage ratios: TTM

Sources: New Constructs, LLC and company filings.

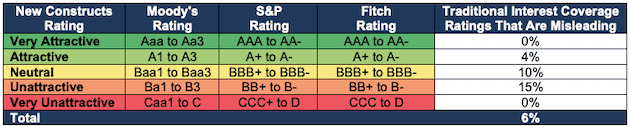

Ratings Based on Traditional Ratios Are Misleading

Not surprisingly, differences between Traditional and Adjusted ratios drive differences in the Credit Ratings we derive for Interest Coverage.

Figure 5 shows how our Credit Ratings align with legacy firms’ ratings systems and the percentage of Traditional Interest Coverage ratings that are different from ratings based on Adjusted ratios for companies in the S&P 500. Overall, 6% of the Traditional Interest Coverage ratings are different from our Adjusted Interest Coverage ratings because they rely on unscrubbed data.

As we explain in our Credit Ratings methodology, we set the Interest Coverage ratio thresholds so that the distribution of our ratings is comparable to the distribution of ratings for legacy firms. We use the Traditional version of the Interest Coverage ratio to set thresholds so that the difference in our ratings comes from the difference in our data.

Figure 5: S&P 500: Percent of Traditional Interest Coverage Ratings That Are Misleading

Sources: New Constructs, LLC and company filings.

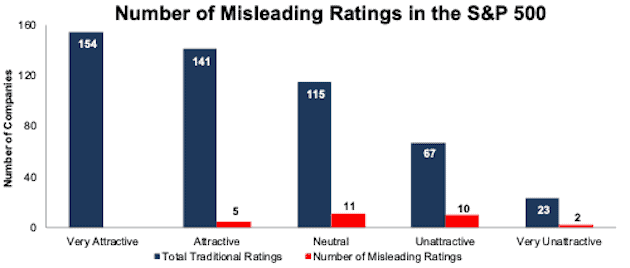

Figure 6 provides more details on the number of companies whose Traditional Interest Coverage ratings are different from the rating based on Adjusted Interest Coverage ratios.

For example, 10 out of 67 (15%) companies that earn an Unattractive Interest Coverage rating based on the Traditional ratio earn a different rating based on the Adjusted ratio.

Figure 6: S&P 500: Number of Misleading Traditional Interest Coverage Ratings

Sources: New Constructs, LLC and company filings.

We dedicate the Appendix of this report to showing readers exactly how our Adjusted values for EBIT and Interest Coverage ratios are different and better than the unscrubbed versions.

This article originally published on July 13, 2021.

Disclosure: David Trainer, Kyle Guske II, Alex Sword, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Appendix: Auditing the Differences in Traditional Vs. Adjusted Values

This Appendix will show exactly how our Adjusted values for EBIT and Interest Coverage ratios differ from the Traditional versions for Raytheon Technologies and Tesla.

Raytheon Technologies: The Difference in Traditional Vs. Adjusted Values

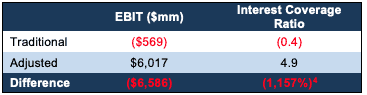

Figure 7 shows the differences between Traditional and Adjusted EBIT for Raytheon Technologies. The difference between Raytheon Technologies’ Traditional EBIT and Adjusted EBIT is -$6.6 billion, or -1,157% of the absolute value of Traditional EBIT.

Figure 7: Raytheon Technologies: Traditional Vs. Adjusted Interest Coverage Components

Sources: New Constructs, LLC and company filings.

Reconciling Raytheon Technologies’ Traditional and Adjusted EBIT

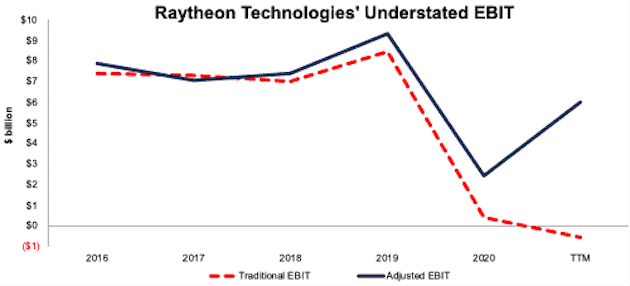

Raytheon Technologies’ understated EBIT drives its understated Interest Coverage ratio. Figure 8 shows the firm’s Traditional and Adjusted EBIT since 2016. Notice the large divergence between Traditional and Adjusted EBIT since 2020.

Figure 8: Raytheon Technologies: Traditional Vs. Adjusted Debt: 2016-TTM

Sources: New Constructs, LLC and company filings.

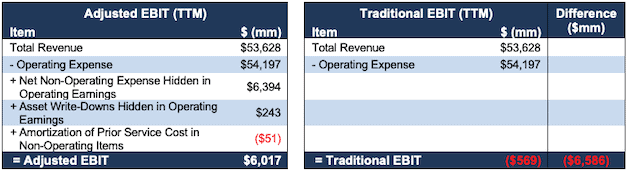

The -$6.6 billion difference between Raytheon Technologies’ Traditional and Adjusted EBIT is driven by:

- $6.4 billion in hidden non-operating expense which includes

- $5.7 billion in acquisitions and divestitures – Page 39 1Q21 10-Q

- $397 million in restructuring charges recorded in cost of sales – Page 116 2020 10-K

- $100 million in restructuring charges recorded within selling, general & administrative costs – Page 116 2020 10-K

- $142 million in integration costs – Page 89 2020 10-K

- $23 million in aggregate transaction costs recorded in selling, general and administrative costs – Page 91 2020 10-K

- $23 million in restructuring charges recorded in selling, general and administrative costs – Page 23 1Q21 10-Q

- $20 million in restructuring charges recorded in cost of sales – Page 12 1Q21 10-Q

- $17 million in merger-related costs – Page 23 1Q21 10-Q

- $243 million in hidden asset write-downs – Page 76 2020 10-K

- -$51 million amortization of prior service cost – Page 107 2020 10-K

Figure 9 reconciles Raytheon Technologies’ Traditional and Adjusted EBIT and details each of the adjustments listed above.

Figure 9: Raytheon Technologies: Adjusted Vs. Traditional EBIT Detailed Comparison

Sources: New Constructs, LLC and company filings.

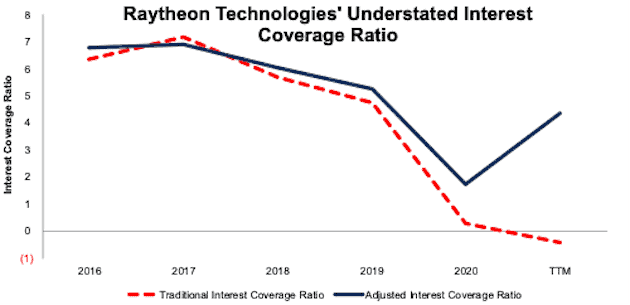

Raytheon Technologies’ Interest Coverage Ratio Is Understated

With large understated Traditional EBIT, Raytheon Technologies’ Interest Coverage ratio is one of the most understated of all companies in the S&P 500. Per Figure 10, Raytheon Technologies’ Interest Coverage ratio has grown increasingly understated since 2019.

Figure 10: Raytheon Technologies: Traditional Vs. Adjusted Interest Coverage Ratio: 2016-TTM

Sources: New Constructs, LLC and company filings.

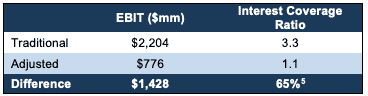

Tesla: The Difference in Traditional Vs. Adjusted Values

Figure 11 shows the differences between Traditional and Adjusted EBIT for Tesla. The difference between Tesla’s Traditional and Adjusted EBIT is $1.4 billion, or 65% of Traditional EBIT.

Figure 11: Tesla: Traditional Vs. Adjusted Interest Coverage Components

Sources: New Constructs, LLC and company filings.

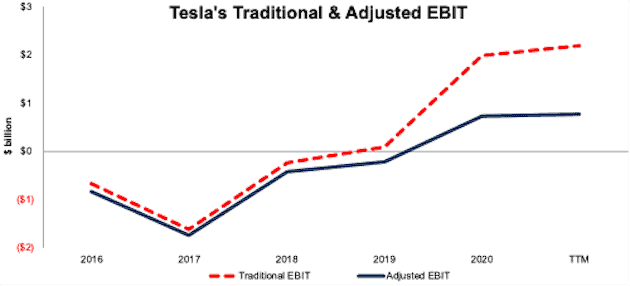

Reconciling Tesla’s Traditional and Adjusted EBIT

Tesla’s overstated EBIT drives its overstated Interest Coverage ratio. Figure 12 shows the firm’s Traditional EBIT has grown increasingly overstated since 2017.

Figure 12: Tesla: Traditional Vs. Adjusted EBIT: 2016-TTM

Sources: New Constructs, LLC and company filings.

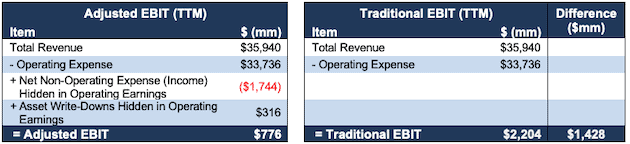

The $1.4 billion difference between Tesla’s Traditional and Adjusted EBIT is driven by:

- $1.7 billion in hidden non-operating income which includes

- $1.2 billion in sale of automotive regulatory credits – Page 41 2020 10-K

- $518 million in automotive regulatory credits – Page 10 1Q21 10-Q

- $316 million in hidden asset write-downs which includes

- $157 million in inventory and purchase commitments write-downs – Page 58 2020 10-K

- $110 million in loss on disposals of fixed assets – Page 58 2020 10-K

- $49 million in inventory and purchase commitments write-downs – Page 8 1Q21 10-Q

Figure 13 reconciles Tesla’s Traditional and Adjusted EBIT and details each of the adjustments listed above.

Figure 13: Tesla: Adjusted Vs. Traditional EBIT Detailed Comparison

Sources: New Constructs, LLC and company filings.

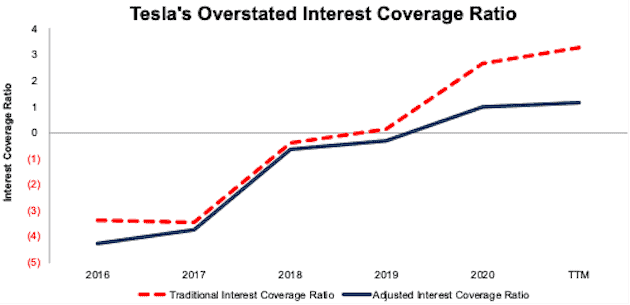

Tesla’s Interest Coverage Ratio Is Overstated

With overstated Traditional EBIT, Tesla’s Interest Coverage is one of the most overstated of all companies in the S&P 500. Per Figure 14, Tesla’s Interest Coverage has become increasingly overstated since 2018.

Figure 14: Tesla: Traditional Vs. Adjusted Interest Coverage ratio: 2016-TTM

Sources: New Constructs, LLC and company filings.

[1] We calculate the S&P 500 Traditional and Adjusted EBIT by aggregating the results for all current members of the S&P 500.

[2] In this analysis, we use the 494 companies for which we have data back to 2016 and are currently in the S&P 500.

[3]Interest Coverage ratio Distortion equals (Traditional Interest Coverage ratio - Adjusted Interest Coverage ratio) / absolute value of Traditional Interest Coverage ratio.

[4] This number is the Interest Coverage ratio Distortion, which equals (Traditional Interest Coverage ratio - Adjusted Interest Coverage ratio) / absolute value of Traditional Interest Coverage ratio.

[5] This number is the Interest Coverage ratio Distortion, which equals (Traditional Interest Coverage ratio - Adjusted Interest Coverage ratio) / absolute value of Traditional Interest Coverage ratio.