We closed the EQIX position on November 16, 2020. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

The earnings recovery remains an accounting mirage. We highlighted the divergence between accounting earnings and economic earnings – the real cash flows of the business – at the beginning of the year. Through the first three quarters of 2018, that divergence has only grown more pronounced.

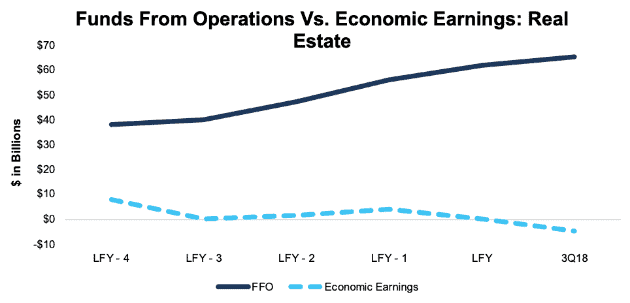

Our full report (available to subscribers) shows that six out of 11 sectors have negative economic earnings over the trailing twelve months. Most notably, the Real Estate sector’s economic earnings continued to decline and turned negative through the first three quarters of 2018. Meanwhile, funds from operations (FFO) continue their misleading upward and positive trend. This disconnect makes the Real Estate sector our worst-rated sector for ETFs and mutual funds. The Real Estate sector as a whole, and Equinix (EQIX: $390/share) in particular, is this week’s Danger Zone pick.

GAAP Earnings Mislead Investors

The Real Estate sector, and especially REITs, have looked strong so far in 2018 based on funds from operations. Trailing twelve months (TTM) funds from operations are up 5% vs. 2017, and up 72% over the past five years.

However, Figure 1 shows that this accounting earnings growth is an illusion. Economic earnings have fallen from $300 million in 2017 to -$4.7 billion over the TTM period.

Figure 1: Economic Earnings Vs. FFO: Real Estate

Sources: New Constructs, LLC and company filings

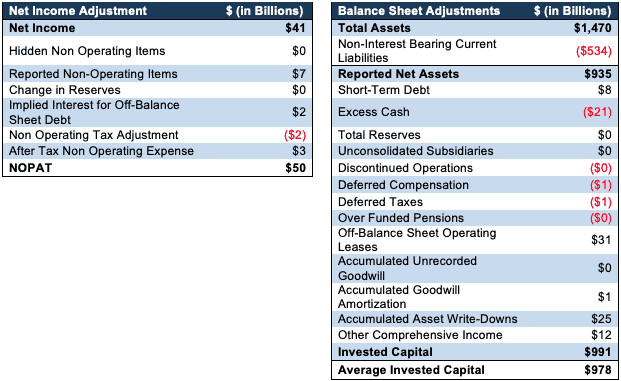

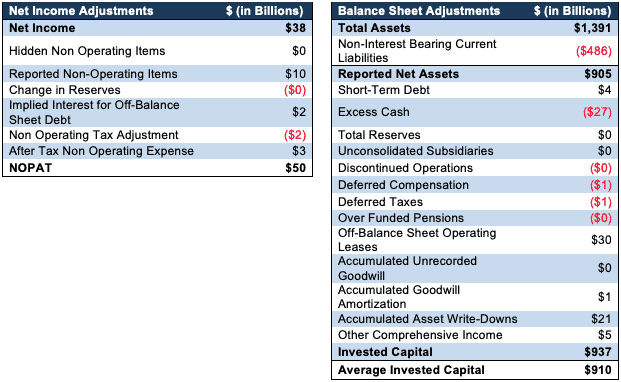

Figures 2 and 3 show all the adjustments[1] we make to calculate economic earnings for the Real Estate sector for this current analysis and our original analysis in January of 2018. They show that after-tax operating profit (NOPAT) has stayed flat while invested capital is up 7%.

Figure 2: Adjustments for Economic Earnings: End of 3Q18

Sources: New Constructs, LLC and company filings

Figure 3: Adjustments for Economic Earnings: January 2018

Sources: New Constructs, LLC and company filings

The combination of flat operating profit and rising invested capital (combined with increased cost of capital due to rising interest rates) decreased economic earnings.

One REIT to Avoid

Equinix (EQIX), a data center REIT, is one our least-favorite stocks in the Real estate sector and earns our Very Unattractive rating. EQIX is a classic “roll-up” that manufactures earnings growth by acquiring smaller competitors, all the while destroying shareholder value.

Since 2016 alone, EQIX has made acquisitions worth a combined $10.5 billion (50% of invested capital). These acquisitions helped the company grow FFO per share from $9.12 in 2015 to $19.22 TTM.

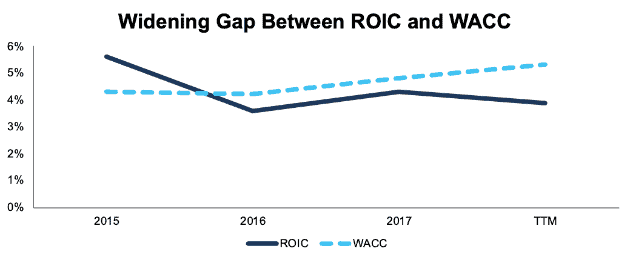

On the other hand, economic earnings per share have declined from $1.80 in 2015 to -$3.35 TTM. Figure 4 shows the decline of EQIX’s return on invested capital since 2015.

Figure 4: ROIC Vs. WACC Since 2015

Sources: New Constructs, LLC and company filings

Many investors are bullish on EQIX’s growth opportunities due to the rise of cloud computing and increased demand for data storage. However, growth does not create shareholder value if a company earns an ROIC below its WACC.

To justify its current price of ~$390/share, EQIX must grow NOPAT by 22% compounded annually for seven years. In this scenario, EQIX would have an ROIC of 9% in year seven. For comparison, the highest ROIC EQIX has ever earned going back to 2000 was 6% in 2013. In essence, the market expects EQIX to continue its rapid acquisition-driven growth, but be able to do so at a much more profitable level than it has ever achieved in the past. See the math behind this dynamic DCF scenario.

If EQIX grows NOPAT by 9% compounded annually for 10 years and achieves an ROIC of 7%, the stock is worth just $158/share today, a 59% downside from the current stock price. See the math behind this dynamic DCF scenario.

EQIX’s valuation is based on the idea that it can continue its acquisition-driven growth for many years to come, but as we’ve seen in the past (like with Valeant), this kind of growth can’t last forever. Both EQIX and the entire Real Estate sector could be in for a rough time when this misleading growth comes to an end. Only through the use of unconflicted and comprehensive research can investors learn the true economics of the sector and avoid high-risk stocks.

This article originally published on December 3, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] A forthcoming paper from Harvard Business School and MIT Sloan proves that these adjustments are necessary “to construct a complete picture of a firm’s earnings.”