See David Trainer’s interview on CNBC’s Closing Bell regarding Netflix’s overvaluation here.

Quarter after quarter Netflix bulls tout how impressive the company’s subscriber growth numbers are. Despite underlying issues, which these investors care little about, as long as subscriber growth remains on the uptick, the stock follows suit. So what happens when that subscriber growth disappoints? NFLX shares face a stark reality in which the business operations aren’t justifying the current share price, far from it actually. We’ll detail some of the issues facing Netflix below.

Accounting Tricks Hide Netflix’s Cash Burn

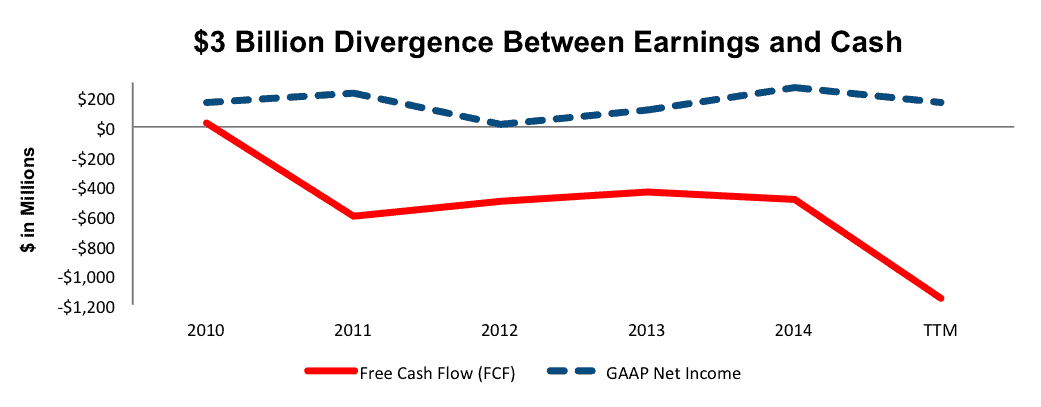

As our regular readers already know, reported earnings do not tell the whole story of a company’s operations. Per Figure 1, from fiscal 2011-2014 Netflix hemorrhaged a cumulative $2 billion in free cash flow (FCF) while reporting $783 million in cumulative net income. The cash burn trend is getting worse as our model shows another -$1.1 billion in free cash flow over the last twelve months.

The last year Netflix generated positive FCF was 2010, which coincides with the year Netflix began ramping up its content library. We first warned investors of Netflix’s soaring content obligations in April 2014. The way Netflix accounts for its streaming content allows the company to understate the true cash costs of content on its income statement. From 2011-2014, the difference between reported content costs and actual cash payments for new content was nearly $1 billion. In 2014 alone, Netflix paid $500 million more to add to its library than it recognized in expenses.

Figure 1: Cash Flows Tell The True Story

Sources: New Constructs, LLC and company filings

We expect the cash flow burn to continue as the company has stated it is focused on creating more of the costly original content and growing international subscribers, where even reported profit margins are highly negative.

Raising Capital Gets Wall Street Analysts To Gush

According to Factset, the 35 analysts who cover Netflix have an average overweight rating and price target of $121/share. How can so many analysts be bullish on a company that has burned through nearly $3 billion in cash since 2011? The answer is simple. They want the banking business.

Since 2013, Netflix has raised $2.4 billion through three separate debt issuances, which culminated in raising $1.5 billion in February 2015. The issuance of debt has brought Netflix’s debt total to $2.6 billion on a TTM basis, up from only $303 million in 2010.

As Netflix continues to burn billions in cash, investment banks stand ready to help facilitate another debt issuance or even a secondary share offering. These issuances mean big profits for an investment bank. Since Netflix announced in its shareholder letter that it would need to raise further capital in 2016 to fund its ventures, don’t expect analyst ratings to jeopardize a firm’s chances at cashing in on Netflix’s need for more cash. Analyst buy ratings can and do have ulterior motives.

Subscriber Growth Miss Should Not Be A Surprise

It seems many investors in NFLX care only about subscriber growth and when it disappoints, NFLX crashes. We mentioned Netflix’s slowing subscriber growth in October 2014, and again in February 2015. The 3Q15 subscriber “miss” is just the continuation of that trend. Netflix added only 880,000 subscribers to its U.S. streaming segment in 3Q15, down from 980,000 in 3Q14. Similar to prior quarters, Netflix continued to expand internationally by adding 2.7 million members over 2 million the year before. However, the international segment’s contribution margin dropped to -13% from -9% year-over-year. Expanding internationally still remains unprofitable for Netflix and the U.S. market appears to be reaching a saturation point.

Competition Is Only Increasing and Getting Stronger

At its core, Netflix is merely a content delivery platform — and one of many. Netflix may blame poor subscriber additions on the transition of credit/debit cards to new chip cards, which made it harder to collect membership fees, but we believe the poor additions were probably from the litany of competition Netflix faces. Some competitors include:

- Amazon Video – $8.25/month

- Hulu Plus – $7.99/month

- CBS All Access – $6/month

- HBO Now – $14.99/month

- Showtime –$ 11/month

- Dish Network’s Sling TV – $20/month

- Verizon’s Go90 – Free

There is no shortage of competition in this space, and none of them stand out as offering anything that is really unique. Netflix’s attempts to differentiate through original content are extremely costly and the company is not the only player in that game. Amazon creates excellent original content, Hulu has its own original series, and there are numerous reports of Apple taking steps to create its own original programming, further adding to the competition pool.

Valuation Implies Half The World Uses Netflix

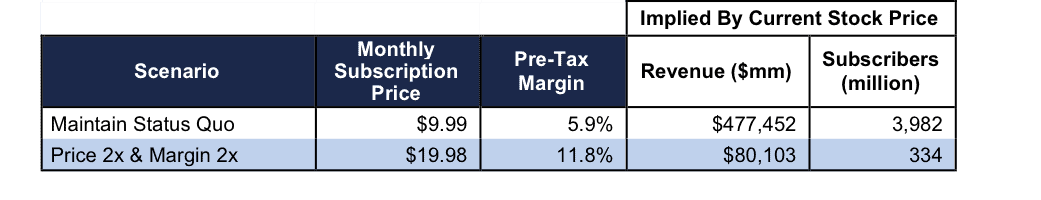

Netflix may be one of the most overvalued stocks in the market today. To justify the current price of $100/share, Netflix must grow revenue by 25% compounded annually for the next 20 years. Netflix currently maintains a TTM pre-tax margin around 5.9% and has 69 million subscribers, 43 million of which are in the U.S. United States penetration is around 13% of the 320 million people in the U.S. and global penetration is much lower. We think most investors have failed to realize that the valuation of the stock price already implies staggering levels of global penetration. Figure 2 has the details.

Figure 2: Implied Stock Price Scenarios

Sources: New Constructs, LLC and company filings

Scenario 1 above assumes Netflix prices and margins remain the same. Netflix recently upped the price of the 2-screen account to $9.99 so we use that new price. Pre-tax margins are currently 5.9% on a TTM basis. The DCF model shows that at the current profit margin, the company must grow revenues by 25% compounded annually for the next 20 years to justify the current price. That performance means the company would reach over $477 billion in revenue in 20 years. At $9.99 per month, Netflix would need over 3.9 billion subscribers to generate $477 billion in revenue. The world population is about seven billion. Any questions?

Scenario 2 assumes Netflix can double its price and profit margins. We realize that doubling price and doubling margins at the same time is a stretch. Nevertheless the DCF model shows after doubling prices and margins, the company would have to reach over 334 million subscribers, or nearly five times their current subscriber base of 69 million. We wouldn’t bet on that happening.

Don’t Get Caught Up In The Hype Again

We’ve seen this movie before: After a huge run up in 2013, Netflix stock dropped over 28% in early 2014. Then again, after a large run, the stock dropped 24% in October 2014. This year has been no different, as Netflix fell 20% in August. NFLX remains up over 106% YTD despite the drop in August. Don’t get caught as this earnings miss leads to the next as margins continue deteriorating and subscriber growth continues its descent.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any particular stock, sector, or theme.

Click here to download a PDF of this report.

Photo Credit: Televisione Streaming (Flickr)

1 Response to "Netflix Earnings Miss: One Of Many To Come"

Excellent report, especially in your citations of the negative free cash flow and what I’d term fake “earnings” which usually result in nonsense headlines: “NFLX beats the Street”. Here are some additional factors to note:

1) One must distinguish the service (good) from the stock (a massively over-hyped literally pump and dump scheme, in which management has mastered the art of constant press releases which breathlessly announce far in the future developments while at the same time obfuscating critical facts, especially about costs. This happens virtually every time the stock price begins to roll over. Price pops quickly result, followed by significant insider selling, now in the millions of shares over the past 3 years. If prospects are so wonderful as the cheerleaing “analysts proclaim,why are there never any open market officer purchases,ever?

2) “Facts” are frequently misrepresented, eg. “NFLX “garners” 16 Emmy nominations”. Actually,in most instances the developers of projects earned the nominations. NFLX merely has a contract right over a limited period to stream, and has no control over other means of distribution. But they intentionally mislead about this.

3) They encourage binge viewing of new series, i.e,. rapid depletion of an asset,but that requires timely expensing. Under their aggressive accounting, they refuse to do this, but rather amortize over extensive time periods. You always have “earnings” if you have no expenses.

3) They claim “fabulous” success of their series, but refuse to provide any metrics demonstrating such claims.

4) If I understand correctly, they have about $2B in cash and cash equivalents, the same amount in current liabilities, and %4B of the $10B+ in off balance sheet liabilities coming due next year. This is a serious situation, and only one other analyst, Michael Pacter,has ever cited this in passing.

Good work.

J.S.

Whitney Advisors