Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

It appears that the Netflix (NFLX) micro-bubble might finally be bursting. We’ve been bearish on Netflix for a long time, but our conviction now is higher than ever. The noise-trader momentum driving the stock is evaporating, the company’s mounting (and increasingly expensive) debt poses a significant near term liquidity risk, and the bull case remains full of holes.

Even after a large drop over the past few months, the expectations embedded in the stock price, i.e. its valuation, remain sky-high. As a result, Netflix (NFLX: $290/share) is back in the Danger Zone.

Momentum Has Run Out

Noise traders drove NFLX up over 100% through the first half of 2018. Too many investors bought the story (pushed by Wall Street) that Netflix would become a dominant media company, and the stock would keep rising.

Over the past three months, however, the fundamentals are taking back the reins, and the stock is down over 30% from its high in mid-July. What’s more, the stock pop from the recent earnings beat lasted only a couple of days. More investors see past the beats on earnings and subscribers to the highly negative free cash flow that threatens the long-term viability of the company.

The risk in the past with betting against Netflix was that noise traders would push the stock up on no real news. Now, we see the opposite as negative sentiment pushes the stock down after a positive earnings surprise.

Debt Keeps Piling Up

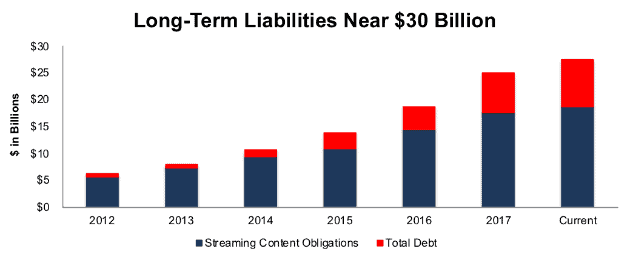

The most notable number from Netflix’s latest earnings report is the company’s trailing twelve months (TTM) free cash flow of -$3 billion. This negative cash flow shows no signs of letting up. The company forecasts similar cash flow numbers for 2019, and they just announced another $2 billion bond offering, their sixth debt raise of over $1 billion in the past three and a half years. After this debt deal, Netflix will have over $10 billion in debt, along with nearly $19 billion in streaming content obligations for a total of nearly $30 billion, per Figure 1.

Figure 1: Netflix’s Debt and Content Obligations Since 2012

Sources: New Constructs, LLC and company filings

Netflix’s debt is getting more expensive as both interest rates and the company’s leverage rise. Its latest offering received a junk rating and a higher interest rate of 6.375% vs. 5.875% for its previous debt raise.

Netflix is spending over $12 billion on content this year alone. Add in ~$5 billion in other operating costs, capex, and interest payments, and the company cannot fund its spending out of its projected $16 billion in revenue this year.

To meet investors’ expectations for subscriber growth, Netflix must continue big-time spending on content. Low interest rates have made this strategy viable, but, as interest rates rise, investors are tightening the leash on the rather large cash burn rate.

Bull Case Is Full of Holes

The bull case for Netflix relies on the idea that, in addition to rapidly growing its subscriber base, the company has the leverage to significantly increase prices. As evidence, bullish articles – such as this one from Ensemble Capital – point to a variety of price increases over the past few years that haven’t stopped growth.

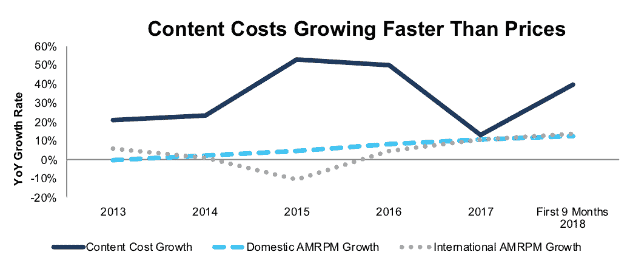

The flaw in this logic is that price increases have not brought any improvements in profitability. The firm’s content costs have grown more than five times[1] as fast as Average Monthly Revenue per Paying Member. Netflix can only raise prices without alienating subscribers as long as it continues to give them content at prices increasingly below cost.

Through the first nine months of this year, revenue per member is up 12% domestically and 14% internationally year over year, but content spending is up a whopping 40%. Figure 2 has details.

Figure 2: Netflix’s Price Increase and Content Spending Since 2013

Sources: New Constructs, LLC and company filings

Netflix doesn’t have a competitive advantage in content creation, it’s just willing to spend more without getting commensurate gains in revenue than anyone else. The amount of price increase required to make this business model work, i.e. generate enough cash flow, are far, far beyond what the company has achieved so far. We think they are far beyond what the company will achieve.

Netflix has been able to report significant increases in GAAP profits by understating the content costs in earnings. However, free cash flow tells a truer story of the company’s profitability, which has only gotten worse over time, from -$450 million in 2013 to -$3 billion TTM.

Other businesses have had negative free cash flow during their growth period before evolving into high return businesses (think Walmart), but those companies were investing in assets with far longer shelf lives. Content is, for the most part, not a long-term asset. Most shows and movies pique interests for, maybe 6-12 months. A Wal-Mart store can generate revenue, and believe it or not, cash flow, for decades. Netflix must keep spending on content to retain and attract more users, which makes it very challenging for the company to generate positive cash flows anytime in the near future.

Goldilocks Conditions Will Come to an End

Netflix’s rapid growth and price increases over the past several years have come under perfect economic conditions for the company. Strong economic growth and falling unemployment increase the demand for the service while low interest rates help the company fund its huge content spending at cheap prices.

This perfect equilibrium won’t last forever. As discussed above, Netflix already faces rising borrowing costs, and a recent OECD report suggests global growth may have peaked.

In addition to the potential for worsening economic conditions, Netflix’s first-mover advantage in streaming video continues to decline. The company has held its perch as the largest streaming service through its high content spend, but it still faces the threat of increased competition from deep-pocketed companies like Apple (AAPL), Disney (DIS), and Amazon (AMZN).

As these companies increase the amount of content on their own streaming services, and as Disney and others pull their back-catalog off of Netflix, its relative value to consumers will decline.

To justify its valuation, Netflix will need to keep up its track record of price hikes and subscriber growth under less friendly economic conditions for many years. We’re skeptical that it can accomplish this feat.

A Price Hike Is Already Priced In

Even after the recent drop in NFLX’s valuation, any “pricing power” is more than fully priced in to this stock. For Netflix to justify its current valuation of ~$290/share, the company must double its NOPAT margin to 17% (equal to Disney) and grow revenue by 30% compounded annually for 8 years. In year 8, it would be earning $95 billion in revenue, which, if it doubled its average price to $20/person/month, would give it 396 million subscribers, versus 137 million currently. See the math behind this dynamic DCF scenario. For comparison, we note that Disney’s TTM revenue is $58 billion.

We think doubling prices and maintaining such rapid member growth is overly optimistic. If Netflix can achieve NOPAT margins of 12%, halfway between its current margins and Disney’s, and grow revenue by 20% compounded annually for 10 years, the stock is worth just $137/share today, a 53% downside. In year 10 of this scenario, Netflix would have $72 billion in revenue, which equates to 402 million subscribers at $15/person/month. See the math behind this dynamic DCF scenario.

Notably, both scenarios assume Netflix’s invested capital grows at only half the rate of revenue. This would be a dramatic shift from the past three years, when invested capital, driven mostly by additions to the streaming content library, grew at nearly double the rate of revenue – 55% compounded annually versus 29%.

To believe in Netflix at this price, you have to believe that the company can drastically increase its prices, reduce the growth in its content spending, and continue to grow its subscriber base at double-digit rates for nearly a decade. The stock’s falling price shows that investors increasingly understand how unlikely this scenario is.

This article originally published on October 31, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Netflix’s Average Monthly Revenue per Paying Member in its domestic segment grew by 6% compounded annually from 2013-2017, but its content spending grew 34% compounded annually over that same time.