Gains and losses from investments in public securities can materially impact GAAP net income. This report highlights how our Robo-Analyst identified disclosures in a recent 10-Q that reveal how a company reported meaningfully overstated earnings.

Our cutting-edge technology creates superior data, as proven in The Journal of Financial Economics. Specifically, our research sees through accounting loopholes to provide clients with a cleaner and more comprehensive measure of Core Earnings[1].

New Constructs Analyst Sam Moorhead found unusual non-operating items related to an investment in equity securities in Worthington Industries (WOR) fiscal 1Q21 and 2Q21 10-Q’s, which resulted in GAAP net income materially misrepresenting the firm’s true profits.

Worthington’s Investment Treatment’s Effect on Fundamentals

In fiscal 1Q21, Worthington Industries (a metals manufacturer) reported a $796 million gain on its investment in Nikola (NKLA). Without this non-operating income, the firm would have reported a GAAP pre-tax loss of $14 million.

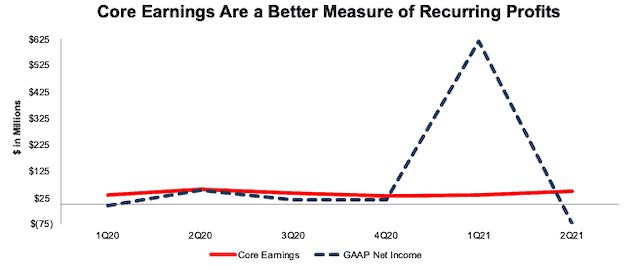

We remove this non-operating income in our calculation of Core Earnings to determine the true, recurring operating profits of a business. After all adjustments, we find that Worthington’s Core Earnings were just $33 million in fiscal 1Q21 compared to GAAP net income of $617 million. Figure 1 shows the impact of non-recurring items on the volatility of reported earnings.

Figure 1: Worthington’s Core Earnings vs. GAAP Net Income: Fiscal 1Q20 – 2Q21

Sources: New Constructs, LLC and company filings.

Recognizing non-operating income as operating in this situation create even more volatility in GAAP net income in fiscal 2Q21 when Worthington recognized a $144 million loss on their investment in Nikola. Without this non-operating loss, the firm would have had a pre-tax gain of $56 million instead of a pre-tax loss of $88 million. After all adjustments, we find that Worthington’s Core Earnings are $49 million in fiscal 2Q21 compared to GAAP net income of -$74 million.

No Substitute for Diligence

We adjust for all unusual items, both hidden and reported, on the income statement and balance sheet to calculate a more accurate measure of a firm’s profitability. While the non-operating income noted above was reported directly on the income statement, without finding and adjusting for all unusual items, you’ll never know when an adjustment will materially impact a firm’s true fundamentals, and in turn, its valuation.

Such diligence is why institutions from both the public and private sectors have written papers that prove the superiority of our proprietary fundamental data, earnings models, investment ratings, and research for stocks, bonds, ETFs, and mutual funds.

This article originally published on January 21, 2021.

Disclosure: David Trainer, Sam Moorhead, Kyle Guske II, Alex Sword, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our reports utilize our Core Earnings, a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence, a paper by professors at Harvard Business School (HBS) & MIT Sloan. Recently accepted by the Journal of Financial Economics, the paper proves that our data is superior to all the metrics offered elsewhere.