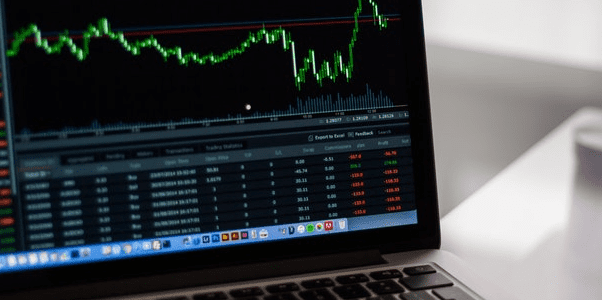

Featured Stock in October 2021’s Safest Dividend Yields Model Portfolio

Three new stocks make our Safest Dividend Yields Model Portfolio this month. Get a free look at one of the stocks in this month's portfolio.

Alex Sword