This report is one of a series on the adjustments we make to convert GAAP data to economic earnings. This report will focus on an adjustment we make to convert the reported balance sheet assets into invested capital.

Reported assets don’t tell the whole story of the capital invested in a business. Accounting rules provide numerous loopholes that companies can exploit to hide issues and obscure the true amount of capital invested in a business over its life.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivaled due diligence on 5,500 10-Ks every year for the past decade.

Reserves are contra asset accounts that reduce asset values for probable future losses (in the case of inventory reserves or loan-loss provisions) or resolve the difference in accounting treatments (in the case of LIFO reserves). Reserves are for probable rather than actual losses. Since probable losses are calculated at management’s discretion, companies can use reserve accounts to manipulate earnings and the carrying values of the assets to which the reserves apply.

Inventory reserves are included in our calculation of invested capital. We also add back the change in reserves to net operating profit after tax (NOPAT), which we covered in a prior report.

Accounting standards allow companies to choose how they expense inventory when it is sold, which means different expenses are reported when companies choose different accounting methods. To ensure comparability of companies using different accounting methods, our models convert all companies to the FIFO (First In First Out) method of inventory accounting by including the LIFO Reserve (the difference between the LIFO and FIFO method) in invested capital. LIFO reserves are found almost exclusively in the footnotes (see an example from SENEA).

Without careful footnotes research, investors would never know that total assets exclude a significant portion of reserves due to loss provisions and alternative accounting practices.

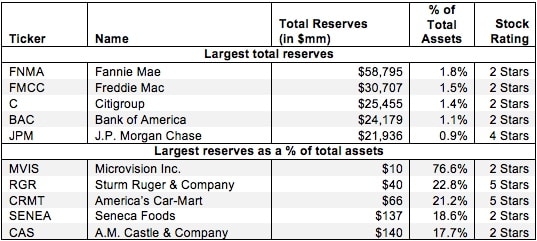

Figure 1 shows the five companies with the largest total reserves included in invested capital in 2012 and the five companies with the larges reserves as a percent of total assets.

4 replies to "Off-Balance Sheet Reserves – Invested Capital Adjustment"

Dear Sir/Madam

Thank you for making some of the material publicly available – I find it educational and useful.

On calculating ROIC for financial institutions e.g. Fannie Mae, is it correct to add back loan loss provision (“LLP”) for the fiscal year to calculate NOPAT – isn’t LLP a true “operating” cost for lending institutions and should, in my view, be deducted in arriving at any return metrics.

Your thoughts on my query will be much appreciated.

Kind Regards

Zohair Motiwala

Thanks for your comment.

The loan loss provision is not an expense, it is a liability–or more specifically a contra-account that diminishes the value of the loans on a financial institution’s balance sheet. The LLP does not reflect operating expenses it the current year, it reflects the company’s expectations for the portion of its loans that will be non-performing in the future.

We adjust for the yearly change in the LLP in our NOPAT calculation so that changes in future expectations don’t impact NOPAT in the current year. This practice is especially benefit because the LLP is one area where management has significant discretion and can easily manipulate earnings.

I agree to the point that reserves should be added to Invested Capital. But reserves are also typically invested by the company in government bonds. Should we not consider that income while calculating NOPAT?

We want to only include income that comes from operating activities in NOPAT. Since interest on government bonds if finance income, that should not be considered a part of NOPAT. If we included interest earned on reserves in NOPAT, a company could look like it was improving its profitability simply because treasury yields increased, and that would misrepresent the actual economics of the business.