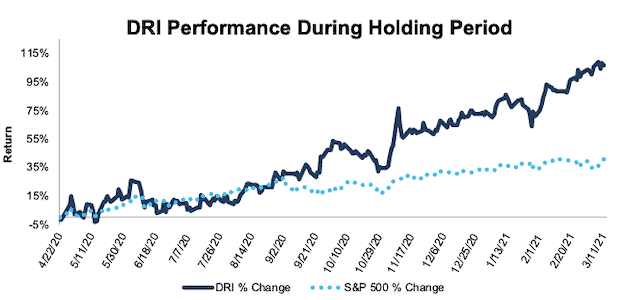

Darden Restaurants (DRI) – Closing Long Position – up 107% vs. S&P up 41%

We made Darden Restaurants (DRI: $141/share) a Long Idea on April 22, 2020, as one of our See Through The Dip picks. At the time, DRI received a Very Attractive rating. We felt the market was overly focused on the dip in economic activity brought on by the COVID-19 pandemic, rather than the potential recovery, which created the opportunity to buy this industry leader at a significant discount.

This report, along with all of our research[1], leverages our more reliable fundamental data[2] to get the truth about earnings, as shown in the Journal of Financial Economics paper, “Core Earnings: New Data and Evidence.”

During the 324 day holding period, DRI outperformed as a long position, rising 107% compared to a 41% gain for the S&P 500.

While the firm hasn’t gotten entirely through the dip (management expects fiscal 3Q21 revenue to be down 30-35% year-over-year), the stock price is another story (up 108% since April 22, 2020). With COVID-19 cases on the decline, vaccinations on the rise, and the reopening of the economy underway, the good news is already fully priced into Darden shares. We’re taking the gains and closing this long position as the stock no longer provides the same risk/reward.

Figure 1: DRI vs. S&P 500 – Price Return – Successful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on March 11, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Three independent studies from respected institutions prove the superiority of our data, models, and ratings. Learn more here.