We closed the PVH position on August 20, 2021. A copy of the associated Position Update report is here.

We published an update on MTH on August 4, 2021. A copy of the associated Earnings Update report is here.

We closed the DRI position on March 12, 2021. A copy of the associated Position Update report is here.

Since mid-April, we’ve encouraged investors to “See Through the Dip” by looking past the interim economic impact of the COVID-19 pandemic. Instead, we recommend focusing on industry leaders positioned to gain market share from the firms that are forced to fold.

This report highlights three previously-featured “See Through the Dip” stocks that earn a Very Attractive rating and have a price-to-economic book value (PEBV) ratio of 0.7 or less. While these stocks’ relative performance to the S&P 500 are varied, each still offers excellent risk/reward. HCA Healthcare Inc (HCA: $159/share), Meritage Homes Corp (MTH: $88/share), and Intel Corporation (INTC: $51/share) are this week’s Long Ideas.

Per Figure 1, the equal weighted portfolio return of the See Through the Dip stocks is 35% as it outperformed the S&P 500 by 14%. 16 out of 26 (62%) stock picks outperformed the S&P 500 since publication of the reports.

Figure 1: See Through the Dip Stocks Vs. S&P 500 – Prices Through December 8, 2020

Sources: New Constructs, LLC and company filings.

We recently noted in our 3Q20 analysis of the S&P 500’s Core Earnings[1] that the S&P 500 is more expensive than at any time since 2004, which means finding value is much more difficult in today’s market.

These three stocks are not only undervalued, but the underlying businesses are strong and ready to grow in the economic recovery. Further, each company shares the following:

- Strong cash position to weather the prolonged downturn

- Positive and rising Core Earnings

- Superior and/or faster rising return on invested capital (ROIC) compared to peers

- Strong market position in their respective industry

Investors looking for long-term-value-creating stocks in this market should start here.

HCA Healthcare Inc (HCA: $159/share) – Very Attractive Rating

Get all the details from our previous report here: This Healthcare Provider Is Ready for the Future.

Since publishing our report on June 22, 2020, the stock is up 62% (S&P 500 +19%). While the stock price has risen, the firm is well positioned to further improve its profitability and grow profits, which gives the stock more upside potential.

HCA Trades Below Its Economic Book Value: Despite rebounding from its March lows, at $159/share, HCA trades at its lowest economic book value, or no-growth value, since 2016. At a price-to-economic book value (PEBV) ratio of 0.7, the market expects HCA Healthcare’s NOPAT to permanently decline by 30%. This expectation seems overly pessimistic over the long term. For reference, HCA Healthcare grew NOPAT by 7% compounded annually over the past decade.

HCA Healthcare’s current economic book value is $219/share – a 38% upside to the current price.

Current Price Implies Prolonged Business Downturn: Below, we use our reverse DCF model to quantify the cash flow expectations baked into HCA Healthcare’s current stock price.

In this scenario, we assume:

- NOPAT margin falls to 10% (10-year low vs. 11% TTM) and remains at that level from 2020 to 2029

- Revenue falls 2% (well below consensus estimates for -0.5% revenue decline) compounded annually from 2020 to 2029

In this scenario, HCA Healthcare’s NOPAT declines by 3% compounded annually over the next decade (including a 12% YoY drop in 2020) and the stock is worth $159/share today – equal to the current price. See the math behind this reverse DCF scenario.

For comparison, HCA Healthcare grew NOPAT by 8% compounded annually over the past five years. It’s not often investors get the opportunity to buy a strong firm in a growing industry at such a discounted price.

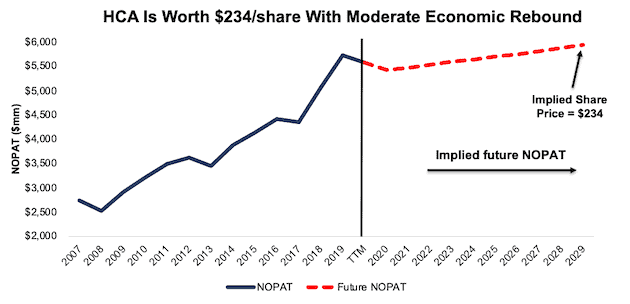

Moderate Long-Term Growth Could Be Very Profitable: If we assume, as does the International Monetary Fund (IMF) and many other economists around the world, that the global economy rebounds and returns to growth starting in 2021, HCA is undervalued.

In this scenario, we assume:

- HCA Healthcare maintains its TTM NOPAT margin of 11% from 2020-2029

- Revenue falls 1% (vs 0.3% consensus estimate) in 2020 and grows just 1% compounded annually from 2021 to 2029

In this scenario, HCA Healthcare’s NOPAT only grows by 1% compounded annually over the next decade (including a 12% YoY drop in 2020) and the stock is worth $234/share today – a 47% upside to the current price. See the math behind this reverse DCF scenario.

Figure 2 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT.

Figure 2: Implied Profits Assumes 2029 NOPAT Is Just 3% Higher Than 2019

Sources: New Constructs, LLC and company filings.

Superior Profitability and Competitive Advantages Will Drive Future Profit Growth: Our 3Q20 analysis of the S&P 500 sectors return on invested capital (ROIC) revealed the Healthcare sector has the second leading ROIC among all 11 sectors. HCA Healthcare’s TTM ROIC of 16% shows that the firm is significantly more profitable than the Healthcare sector, which has a TTM ROIC of 9%.

HCA Healthcare has several competitive advantages that enable the firm to maintain its superior ROIC and not just to survive the dip in elective procedures but also thrive in a recovery. Some of these advantages include:

- Economies of scale that drive superior efficiency

- Superior quality of service

- Ability to adapt in an ever-changing Healthcare industry

In addition to these advantages, HCA Healthcare’s concentration in high-growth states and the aging U.S. population position the firm to grow profits after the pandemic.

Meritage Homes Corp (MTH: $88/share) – Very Attractive Rating

Get all the details from our previous report here: Build a Stronger Portfolio with This Growing Homebuilder.

Since publishing our report on June 29, 2020, the stock is up 20% (S&P 500 +21%). Despite this slight underperformance, MTH continues to present excellent risk/reward for investors.

MTH Is Undervalued: Despite strong fundamentals and industry tailwinds, MTH still trades significantly below its economic book value. At its current price of $88/share, MTH has a PEBV ratio of 0.7. This ratio means the market expects MTH’s NOPAT to permanently decline by 30%. This expectation seems overly pessimistic over the long term for a firm that has grown NOPAT by 16% compounded annually over the past two decades.

MTH’s current economic book value is $111/share – a 26% upside to the current price.

Current Price Means Slow NOPAT Growth Over the Next Decade: Below we use our reverse DCF model to quantify the cash flow expectations baked into MTH’s current stock price. In this scenario, we assume:

- NOPAT margin falls to 6.5% (company 10-year average compared to 8.6% TTM)

- Revenue grows 2% annually from 2020 to 2029 (vs. average consensus estimates of 15% from 2020 to 2023)

In this scenario, Meritage Homes’ NOPAT falls by 1% compounded annually over the next decade (including a 22% YoY decline in 2020), and the stock is worth $88/share today – equal to the current stock price. See the math behind this reverse DCF scenario.

For reference, MTH’s NOPAT increased by 36% compounded annually over the past decade.

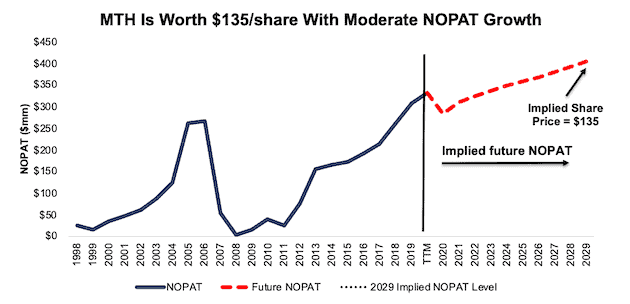

Cheap Valuation Provides Significant Upside: If we assume that Meritage Homes’ revenue grows at less than half of its consensus estimates, MTH still looks undervalued.

In this scenario, we assume:

- NOPAT margin falls to 7.1% (five-year company average compared to 8.6% TTM)

- Revenue grows 7% per year from 2020 to 2023 (vs. average consensus estimates of 15% from 2020 to 2023)

- Sales continue to grow at 3% a year, or the average global GDP growth rate since 1961, each year thereafter

In this scenario, MTH’s NOPAT grows by under 3% compounded annually over the next decade, and the stock is worth $135/share today – a 52% upside to the current price. See the math behind this reverse DCF scenario.

For comparison, Meritage Homes has grown NOPAT by 13% compounded annually over the past five years.

Figure 3 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT.

Figure 3: Implied Profits Assuming Moderate NOPAT Growth

Sources: New Constructs, LLC and company filings.

Positioned for Continued Core Earnings Growth: In our report “Only Three S&P 500 Sector’s Core Earnings Improved in 2020” we noted that Core Earnings in the Consumer Cyclicals sector have fallen by 30% since the end of 2019. However, Meritage Homes has significantly outperformed its sector and has grown Core Earnings by 22% over the same time.

Meritage Homes has several competitive advantages that will help the firm continue to grow profits during and after the COVID-19-related disruptions. Some of these include:

- Leading homebuilder expanding into underserved (affordable housing) market

- Streamlined sales and design process

- Large backlog growth driving future demand

Intel Corporation (INTC: $51/share) – Very Attractive Rating

Get all the details from our previous report here: Put Your Chips on the Table With This Semiconductor Firm.

We made Intel a Long Idea on August 6, 2020. Since then, the stock is up just 4% (S&P 500 +11%). While the stock has underperformed, the underlying fundamentals of the business mean the stock has plenty of upside potential.

INTC Is Undervalued: Despite strong fundamentals, INTC still trades significantly below its economic book value. At its current price of $51/share, INTC has a PEBV ratio of 0.6. This ratio means the market expects INTC’s NOPAT to permanently decline by 40%. This expectation seems overly pessimistic over the long term for a firm that has grown NOPAT by 6% compounded annually over the past two decades.

INTC’s current economic book value is $81/share – a 59% upside to the current price.

INTC Is Priced for Permanent NOPAT Decline: Below we use our reverse DCF model to quantify the cash flow expectations baked into INTC’s current stock price. In this scenario, we assume:

- Intel’s NOPAT margin falls to 19% (company average since 1998 compared to 27% TTM) from 2020 to 2029

- Revenue falls by 5% a year from 2020 to 2022 (vs. average consensus estimates of +0.5% from 2020 to 2022)

- Sales grow by 2% compounded annually each year thereafter, which is below the average global GDP growth rate of 3% since 1961

In this scenario, where Intel’s NOPAT declines 3% compounded annually over the next decade (including a 26% YoY decline in 2020), the stock is worth $51/share today – equal to the current stock price. See the math behind this reverse DCF scenario.

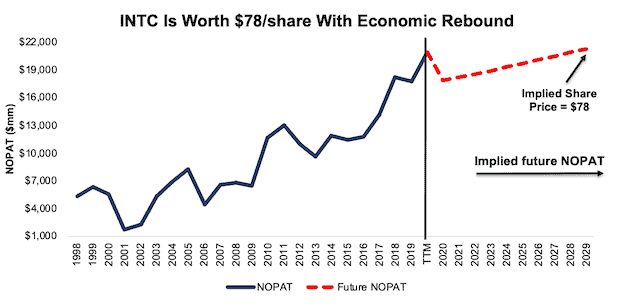

Limited NOPAT Growth Still Means Large Upside: Even if we assume that Intel’s NOPAT growth significantly slows starting in 2021, INTC is undervalued.

In this scenario, we assume:

- Intel’s NOPAT margin falls to 24% (vs. 27% TTM) in 2020 and remains unchanged through 2029

- Revenue grows at 2% a year, which is below the average global GDP growth rate since 1961

In this scenario, where Intel’s NOPAT grows by 2% compounded annually over the next decade, the stock is worth $78/share today – a 53% upside to the current price. See the math behind this reverse DCF scenario.

For comparison, Intel has grown NOPAT by 11% compounded annually over the past decade.

Figure 4 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT.

Figure 4: Implied Profits Assuming Moderate NOPAT Growth

Sources: New Constructs, LLC and company filings

One of the Leaders in the Technology Sector: In our recent analysis of the Technology sector, we warned that the Core Earnings in the sector are unevenly concentrated among just a handful of companies. However, Intel is one of the four companies that have driven the majority of the sector’s Core Earnings growth since the end of 2019.

Intel has several competitive advantages that enable the firm to continue to grow profits even as it works through the delay of its next-generation 7nm chip. Some of these advantages include:

- Greater R&D spending and capacity to spend than peers

- Successfully moving into higher-growth markets

- Ability to attract talent to develop new product lines

Due Diligence Matters

The outperformance of our See Through the Dip portfolio demonstrates that investors who perform the due diligence to understand a firm’s fundamentals can achieve satisfactory results without putting their capital in risky momentum stocks or participating in crowded passive strategies.

Even now, when the market is at all-time highs and many sectors appear to be overvalued, many individual stocks such as HCA, MTH, and INTC still offer excellent risk/reward.

This article originally published on December 9, 2020.

Disclosure: David Trainer owns SYY, SPG, DHI, JPM, LUV, HCA, and H. Matt Shuler owns HFC. David Trainer, Kyle Guske II, Alex Sword, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1]Our Core Earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. Recently accepted by the Journal of Financial Economics, the paper proves that our data is superior to all the metrics offered by S&P Global (SPGI).