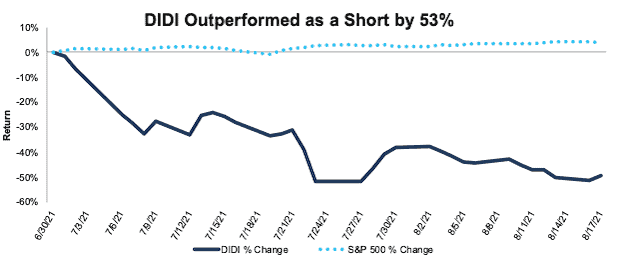

Didi Global (DIDI) – Closing Short Position – down 49% vs. S&P up 4%

We made Didi Global (DIDI: $8/share) a Danger Zone pick on June 21, 2021 and reiterated our opinion on June 28, 2021. The firm’s IPO was on June 30, 2021. At the time of our report, DIDI earned an Unattractive rating, and we explained why we thought the firm’s business model was broken and would never be profitable. We also warned about the regulatory risks of investing in Didi.

This report, along with all of our research[1], leverages our more reliable fundamental data[2] to get the truth about earnings, as shown in the Journal of Financial Economics paper, “Core Earnings: New Data and Evidence.”

During the 48-day holding period, DIDI outperformed as a short position by 53% (401% annualized), falling 49% from the opening price on IPO day compared to a 4% gain for the S&P 500. Didi raised $4.4 billion from investors, and in the month-and-a-half since its IPO, has lost around $29 billion in market cap.

Didi still earns our Unattractive rating and its business remains broken and unprofitable. Nevertheless, with such strong outperformance in such a short period of time, we’re taking gains and closing this short position.

Figure 1: DIDI vs. S&P 500 – Price Return – Successful Short Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

Return measured from opening prices on June 30, 2021, which is Didi Global’s IPO date.

This article originally published on August 18, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features our Robo-Analyst research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Three independent studies from respected institutions prove the superiority of our data, models, and ratings. Learn more here.