GameStop (GME) – Closing Long Position – up 1132% vs. S&P up 37%

We made GameStop (GME: $197/share) a Long Idea on June 20, 2018. At the time, GME received an Attractive rating. Our long thesis focused on the attractiveness of GameStop’s business to a private equity buyer. We saw untapped potential in a business whose stock had been trounced by the “retail apocalypse” narrative. While no buyer materialized at the time, the recent investment by Ryan Cohen of RC Ventures, and his subsequent appointment to the Board of Directors, signals that other investors see similar potential and are willing to put significant investment behind a strategy to extract more value out of the GameStop concept.

This report, along with all of our research[1], leverages our superior fundamental data[2] to get the truth about earnings, as shown in the Journal of Financial Economics paper, “Core Earnings: New Data and Evidence.”

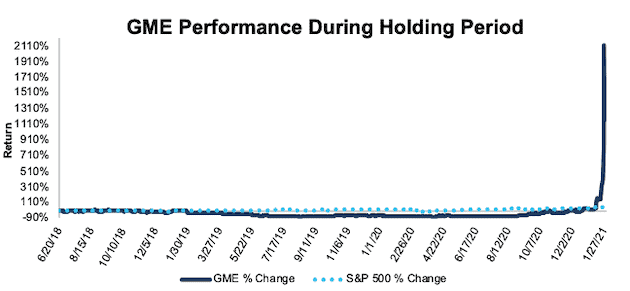

During the 2+ year holding period, GME outperformed as a long position, rising 1132% compared to a 37% gain for the S&P 500.

More recently, the stock’s strong performance caught the attention of momentum traders and sparked a short-squeeze that sent shares soaring. Now, the stock price implies the firm must grow revenue by consensus estimates and achieve NOPAT margins greater than any achieved throughout the history of the firm.

While Ryan Cohen has experience running an e-commerce-focused business, and his plan of closing underperforming stores and selling non-core operations could improve margins, owning GME at current levels presents too much risk versus reward. As a result, we are closing this long position.

Figure 1: GME vs. S&P 500 – Price Return – Successful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on January 28, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Three independent studies from respected institutions prove the superiority of our data, models, and ratings. Learn more here.