The Home Depot (HD) – Closing Long Position – up 34% vs. S&P up 34%

We made The Home Depot (HD) a Long Idea on March 4, 2020. At the time of the report, HD received an Attractive rating. We felt the firm, with its history of consistent profit growth, industry-leading profitability, and executive compensation tied to return on invested capital (ROIC), presented an excellent buying opportunity in the event of a market crash.

This report, along with all of our research[1], leverages our more reliable fundamental data[2] to get the truth about earnings, as shown in the Journal of Financial Economics paper, “Core Earnings: New Data and Evidence.”

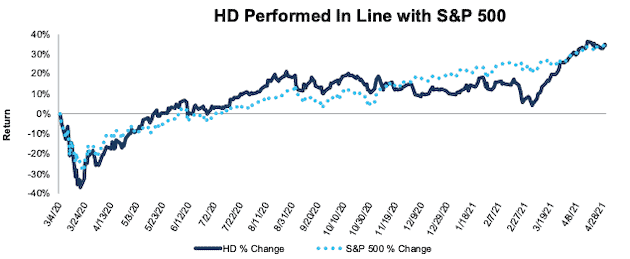

During the 1+ year holding period, HD performed in line with the S&P 500, with each rising 34%.

While the stock may continue to rise, based on momentum trading and investors’ exuberance around an improving economy, HD looks fully priced at current levels. Our reverse discounted cash flow (DCF) model reveals The Home Depot has to grow revenue by 2x consensus estimates to have any upside based on the current fundamentals.

While the company still earns an Attractive rating, we believe the stock no longer presents quality risk/reward and are closing this long position.

Figure 1: HD vs. S&P 500 – Price Return – In Line Performing Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on May 4, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features our Robo-Analyst research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Three independent studies from respected institutions prove the superiority of our data, models, and ratings. Learn more here.