For most of the past 15-20 years, the market has been flush with cash, and many stocks have traded at astronomical heights without real businesses to support them. In this exuberant market, fundamentals mattered little while momentum and technical rule the day. However, as excess liquidity dries up and global economic concerns weigh on the minds of investors, the reconciliation between cash flows and valuations has arrived. Now, fundamentals matter…a lot. Over the long term, it only makes sense to deploy capital into those businesses that actually generate adequate returns on invested capital (ROIC). Due to change in market mentality, and in light of the recent downturn in the market, we felt it time to revise our price target for Square Inc. (SQ: $9/share)

Square’s Business Model Lacks Viability

We put Square in the Danger Zone in December 2015. Since then, SQ is down 29% while the S&P 500 is down only 10%. In our report, we highlighted multiple problems with Square business, which included:

- Lack of profit throughout its existence

- Use of misleading non-GAAP metrics

- Strong, entrenched competition

- A flawed business model

- An unrealistic valuation

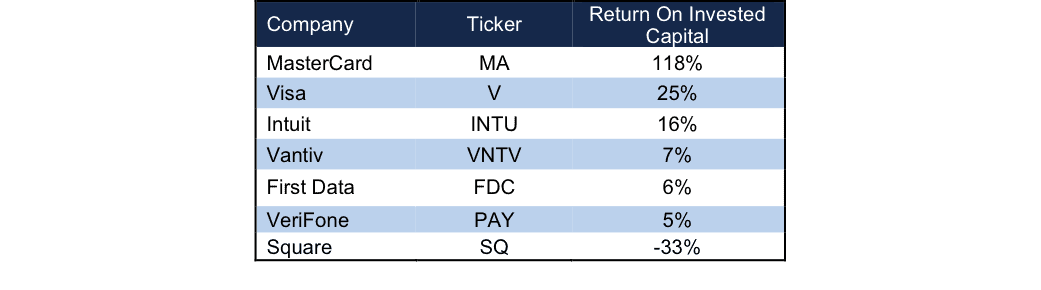

Figure 1 showcases the uphill battle Square faces. With a -33% ROIC, Square’s lack of profitability gives it zero pricing power and little flexibility. Those payment providers already entrenched in the market have built businesses serving clients that generate cash flows to sustain and grow their businesses. Square’s valuation implies it can supplant these incumbents. The only alternative is to serve small merchants that their competitors have chosen to ignore due to low profitability.

Figure 1: Square’s Competitors Are Far More Profitable

Sources: New Constructs, LLC and company filings

Misleading Non-GAAP Metrics Attempt To Hide Problems

Like many unprofitable IPO companies, Square wants investors to focus on any one of its non-GAAP metrics such as adjusted EBITDA, gross payment volume, or adjusted revenue. Each of these metrics removes key costs of business such as stock based compensation and interchange fees that Square must pay card issuers. Worst of all, Square isn’t able to report a profit even after the removal of these operating costs.

Shares Remain Overvalued

Square was able to finish its IPO before the market headed in a downward spiral. Even though Square priced well below its IPO range, shares were overvalued at the time and remain overvalued. In order to justify its current price of $9/share, Square must immediately achieve pre-tax margins of 9% (-14% in 2014) and grow revenue by 20% compounded annually for 12 years. In this scenario, Square would be generating over $7.5 billion in revenue in 12 years, which is greater than each of INTU, VNTV, FDC, and PAY’s last fiscal year revenue.

Even if we look at a more reasonable scenario, in which Square achieves limited profitability, but maintains an elevated revenue growth rate due to its smaller size, the stock still has significant downside risk. If Square can achieve pre-tax margins of 5% and grow revenue by 10% compounded annually for the next decade, the stock is worth less than $1/share today – a nearly 99% downside. Without the upheaval of market incumbents and significant margin expansion, Square’s business could be worth $0. Always remember, just because a business offers a good product for its consumers (connecting small merchants to credit card commerce), it is not good for public market equity investors.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Photo Credit: cnnmoney.com