This report is an abridged and free version of All Cap Index & Sectors: ROIC vs. WACC Through 2Q21, one of the reports in our quarterly series on fundamental market and sector trends, available to Pro and higher members. More free reports on the fundamental trends for the overall market and each sector are available here.

The full version of this report analyzes the drivers[1] of economic earnings [return on invested capital (ROIC), NOPAT margin, invested capital turns, and weighted average cost of capital (WACC)] for the NC 2000[2], our All Cap Index, and each of its sectors (last quarter’s analysis is here). Our research is based on the latest audited financial data, which is the 2Q21 10-Q for most companies. Price data is as of 8/18/21.

These reports leverage more reliable fundamental data[3] that overcomes flaws with legacy fundamental datasets. Our Earnings Distortion factor generates substantial idiosyncratic alpha.

NC 2000 ROIC Rises Year-Over-Year in 2Q21

The NC 2000’s ROIC rose from 6.7% in 2Q20 to 8.1% through 8/18/21. See Figure 1 in the full version of our report for the chart of ROIC vs. WACC for the NC 2000 from December 1998 through 2Q21. All NC 2000 sectors other than Industrials saw a year-over-year (YoY) improvement in ROIC.

Key Details on Select NC 2000 Sectors

Ten of eleven NC 2000 sectors saw an improvement in ROIC year-over-year (YoY) based on 2Q21 financial data. Last quarter, only five sectors – Technology, Real Estate, Consumer Non-cyclicals, Basic Materials, and Healthcare – saw a YoY improvement.

The Technology sector performed best over the past year, as measured by change in ROIC. This trend is not surprising given that the global shutdowns accelerated the enterprise and individual shift to cloud and other software solutions.

On the flip side, the Industrials sector was the only sector to not see a YoY increase in ROIC from 2Q20 to 2Q21.

Overall, the Technology sector earns the highest ROIC of all sectors, by far, and the Energy sector earns the lowest ROIC. Below, we highlight the Technology sector.

Sample Sector Analysis[4]: Technology

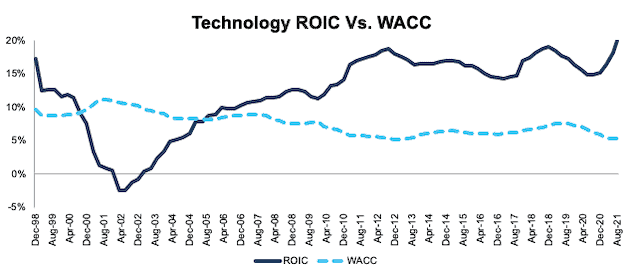

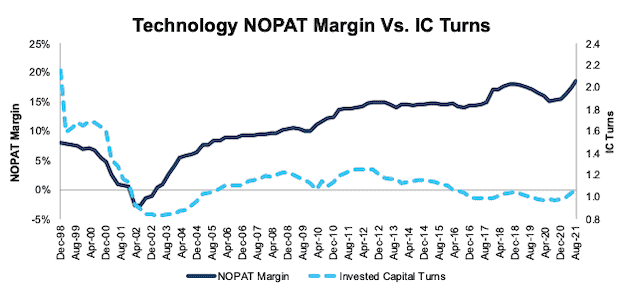

Figure 1 shows the Technology sector ROIC rose from 14.8% in 2Q20 to 20.0% in 2Q21. The Technology sector NOPAT margin rose from 15.3% in 2Q20 to 18.5% in 2Q21, while invested capital turns rose from 0.97 in 2Q20 to 1.1 in 2Q21.

Figure 1: Technology ROIC vs. WACC: Dec 1998 – 8/18/21

Sources: New Constructs, LLC and company filings.

The August 18, 2021 measurement period uses price data as of that date and incorporates the financial data from 2Q21 10-Qs, as this is the earliest date for which all the 2Q21 10-Qs for the NC 2000 constituents were available.

Figure 2 compares the NOPAT margin and invested capital turns trends for the Technology sector since December 1998. We sum the individual NC 2000/sector constituent values for revenue, NOPAT, and invested capital to calculate these metrics. We call this approach the “Aggregate” methodology.

Figure 2: Technology NOPAT Margin Vs. IC Turns: Dec 1998 – 8/18/21

Sources: New Constructs, LLC and company filings.

The August 18, 2021 measurement period uses price data as of that date and incorporates the financial data from 2Q21 10-Qs, as this is the earliest date for which all the 2Q21 10-Qs for the NC 2000 constituents were available.

The Aggregate methodology provides a straightforward look at the entire sector, regardless of market cap or index weighting and matches how S&P Global (SPGI) calculates metrics for the S&P 500.

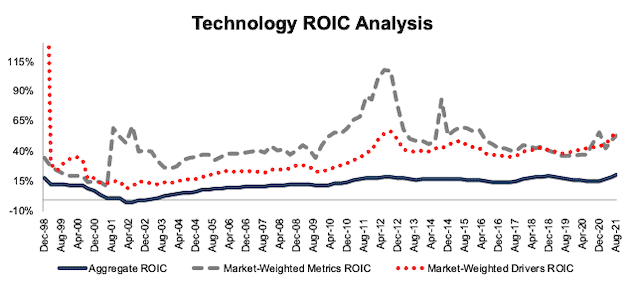

For additional perspective, we compare the Aggregate method for ROIC with two other market-weighted methodologies: market-weighted metrics and market-weighted drivers. Each method has its pros and cons, which are detailed in the Appendix.

Figure 3 compares these three methods for calculating the Technology sector’s ROICs.

Figure 3: Technology ROIC Methodologies Compared: Dec 1998 – 8/18/21

Sources: New Constructs, LLC and company filings.

The August 18, 2021 measurement period uses price data as of that date and incorporates the financial data from 2Q21 10-Qs, as this is the earliest date for which all the 2Q21 10-Qs for the NC 2000 constituents were available.

This article originally published on September 2, 2021.

Disclosure: David Trainer, Kyle Guske II, Alex Sword, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Appendix: Analyzing ROIC with Different Weighting Methodologies

We derive the metrics above by summing the individual NC 2000/sector constituent values for revenue, NOPAT, and invested capital to calculate the metrics presented. We call this approach the “Aggregate” methodology.

The Aggregate methodology provides a straightforward look at the entire sector, regardless of market cap or index weighting and matches how S&P Global (SPGI) calculates metrics for the S&P 500.

For additional perspective, we compare the Aggregate method for ROIC with two other market-weighted methodologies:

- Market-weighted metrics – calculated by market-cap-weighting the ROIC for the individual companies relative to their sector or the overall NC 2000 in each period. Details:

- Company weight equals the company’s market cap divided by the market cap of the NC 2000/its sector

- We multiply each company’s ROIC by its weight

- NC 2000/Sector ROIC equals the sum of the weighted ROICs for all the companies in the NC 2000/each sector

- Market-weighted drivers – calculated by market-cap-weighting the NOPAT and invested capital for the individual companies in the NC 2000/each sector in each period. Details:

- Company weight equals the company’s market cap divided by the market cap of the NC2000/its sector

- We multiply each company’s NOPAT and invested capital by its weight

- We sum the weighted NOPAT and invested capital for each company in the NC 2000/each sector to determine the NC 2000/sector’s weighted NOPAT and weighted invested capital

- NC 2000/Sector ROIC equals weighted NC 2000/sector NOPAT divided by weighted NC 2000/sector invested capital

Each methodology has its pros and cons, as outlined below:

Aggregate method

Pros:

- A straightforward look at the entire NC 2000/sector, regardless of company size or weighting in any indices.

- Matches how S&P Global calculates metrics for the S&P 500.

Cons:

- Vulnerable to impact of by companies entering/exiting the group of companies, which could unduly affect aggregate values despite the level of change from companies that remain in the group.

Market-weighted metrics method

Pros:

- Accounts for a firm’s size relative to the overall NC 2000/sector and weights its metrics accordingly.

Cons:

- Vulnerable to outsized impact of one or a few companies. This outsized impact tends to occur only for ratios where unusually small denominator values can create extremely high or low results.

Market-weighted drivers method

Pros:

- Accounts for a firm’s size relative to the overall NC 2000/sector and weights its NOPAT and invested capital accordingly.

- Mitigates potential outsized impact of one or a few companies by aggregating values that drive the ratio before calculating the ratio.

Cons:

- Can minimize the impact of period-over-period changes in smaller companies, as their impact on the overall sector NOPAT and invested capital is smaller.

[1] We calculate these metrics based on SPGI’s methodology, which sums the individual NC 2000 constituent values for NOPAT and invested capital before using them to calculate the metrics. We call this the “Aggregate” methodology..

[2] The NC 2000 consists of the largest 2000 U.S. companies by market cap in our coverage. Constituents are updated on a quarterly basis (March 31, June 30, September 30, and December 31). We exclude companies that report under IFRS and non-U.S. ADR companies.

[3] For 3rd-party reviews, including The Journal of Financial Economics, on our more reliable fundamental research click here and here.

[4] The full version of this report provides analysis for every sector like what we show for this sector.