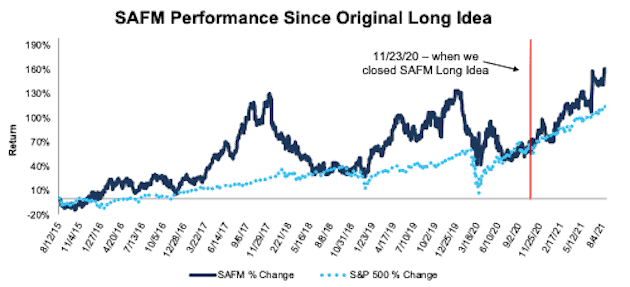

Sanderson Farms (SAFM: $193/share) disclosed on August 9, 2021 that it is being acquired for $203/share, a 30% premium to the firm’s valuation prior to the announcement. Despite long-term conviction in Sanderson Farms, we closed the long position on November 23, 2020 (at $136/share), after losing patience in the position.

We originally made Sanderson Farms a Long Idea on August 12, 2015 and reiterated our opinion on August 17, 2017 and January 30, 2019.

During the 5+ year holding period, SAFM outperformed as a long position, rising 80% compared to a 71% gain for the S&P 500. If we had held this position to the present day, SAFM would have outperformed the S&P 500 by 47% as opposed to the 9% outperformance when we closed the position.

Should the acquisition go through, (shares trading below the acquisition price indicate some skepticism by the market), outperformance would be even greater.

Sometimes, as in the case of Sanderson Farms, it pays to stand by your convictions. Luckily, this Long Idea still outperformed when we closed it, but those that held through the temporary decline in fundamentals stand to outperform even more.

Figure 1: SAFM vs. S&P 500 – Price Return – Leaving Gains on the Table

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on August 20, 2021.

Disclosure: David Trainer, Kyle Guske II, Alex Sword, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.