In early 2017, as Snap, Inc. (SNAP: $9/share) prepped for its IPO, CEO Evan Spiegel received fawning profiles in the pages of prominent papers like the LA Times and the New York Times. These profiles painted a portrait of Spiegel as an enigmatic genius, the latest in a line of tech visionaries that would revolutionize the world. The New York Times profile even quoted Google chairman Eric Schmidt as calling him “the next Gates or Zuckerberg.”

Fast forward to September 2018, with mounting losses, slowing growth, and a stock that has fallen more than 50% from its IPO price, few people still view Spiegel as Snap’s greatest asset. Instead, he’s presented as a liability, the brains behind failed ventures such as the ill-fated redesign of the app and the money losing Spectacles. However, with no mechanism to hold Spiegel accountable for his missteps, Snap’s investors can only watch the company’s ongoing struggles with frustration. A recent Bloomberg Businessweek article summed up this exasperation, asking “What Is Snapchat Doing?”

Public Investors Have No Recourse: Co-Founders Control 96% of the voting rights

What Snapchat is doing, the article reveals, is trying to mold Spiegel into a competent CEO. Through management coaching and feedback from employees, Spiegel is trying to put the mistakes of his past behind him and become a more open and communicative leader. He has a long way to go, as this paragraph from the aforementioned Bloomberg piece reveals:

“Snap employees complain about his dictatorial management style and penchant for secrecy. In January the company’s chief counsel sent around a memo threatening jail time for employees who leaked proprietary information to the press. It was a strange threat because, according to several Snap employees, the bigger problem was that they didn’t have much information in the first place. That same month, workers were told they wouldn’t be receiving cash bonuses because the company didn’t meet its goals. They hadn’t been told what the goals were.”

In a normal company, a CEO that oversaw a 50% decline in the stock price and punished employees for missing nonexistent goals wouldn’t receive management training, he’d receive a pink slip. Snap is not a normal company though. Its dual-class share structure means public shareholders have no say in corporate governance while Spiegel and co-founder Robert Murphy control 96% of the voting rights in the company.

The lack of shareholder rights was made abundantly clear at the company’s latest “shareholder meeting,” which lasted only three minutes and consisted only of a recorded message from the company’s lawyer. The lawyer reminded investors that executives hold 96% of the voting rights and a more traditional meeting was unnecessary. A new board member was also announced via this recording.

One would think that Spiegel, who has acknowledged the problems his lack of communication has caused, would want to take advantage of the opportunity to outline the company’s goals and strategies to investors. Instead, the only message this “meeting” communicated to investors was “We don’t care about you.”

Spiegel Is No Zuckerberg

Investors tolerated this unfavorable share class structure at first when they thought that Spiegel might be the next Zuckerberg. The similarities where there on the surface: both were college dropouts that founded massively popular social media companies and took them public while still in their twenties.

However, Zuckerberg has demonstrated competence in ways Spiegel has not. Facebook generates billions in profits, has navigated through multiple re-designs, has a successful management structure. Moreover, Zuckerberg has attracted talented leaders and been able to surround himself with competent people like COO Sheryl Sandberg. Spiegel, on the other hand, has alienated his fellow executives and led to constant C-Suite turnover, most recently with the departure of Chief Strategy Officer Imran Khan.

Facebook was already a highly profitable company at its IPO, with a return on invested capital (ROIC) of 21%. It continues to grow revenues and users faster than SNAP. Snapchat loses hundreds of millions of dollars a year and has seen its growth slow to a halt as all its best features are co-opted by non-other than Facebook.

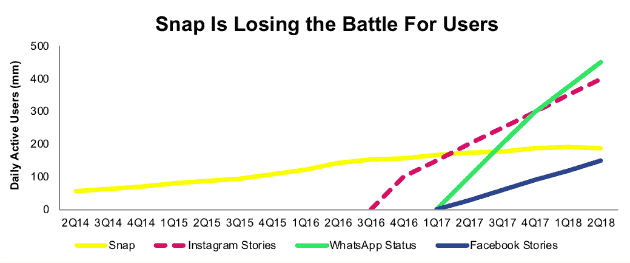

Snap’s daily active users reached 188 million in 2Q18 (+8% year-over-year (YoY). For comparison, Facebook’s daily active users reached 1.47 billion (+11% YoY). More alarming is the speed at which Facebook’s copycat competition is growing, and surpassing, Snap in DAU’s. Per Figure 1, Instagram Stories, launched in August 2016, reached 400 million DAUs in 2Q18 (+60 YoY). WhatsApp Status, a Snapchat lookalike launched in February 2017, reached 450 million DAUs in May 2018 (+157% YoY). Lastly, Facebook Stories, another Snapchat clone that exists directly within the Facebook app launched in March 2017 and already has 150 million DAUs (no YoY comparison available).

Figure 1: Snap’s DAUs Dwarfed by Competition from Facebook

Sources: New Constructs, LLC, company filings, and company announcements

Figure 1 proves both the success of Spiegel’s initial vision for Snapchat and the failure of Spiegel as an executive to implement that vision. Disappearing stories are wildly popular with users, but it’s Facebook, not Snapchat, that is capitalizing on this new feature.

Advertising Giants Increase Competitive Pressure on Snap’s Margins

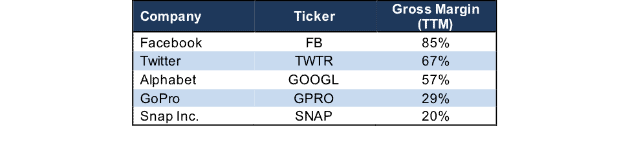

User base aside, Snap’s heavy reliance on advertising dollars (97% of 2017 revenue, up from 96% of 2016 revenue) pits it against some of the largest media/internet firms in the market. Specifically, Snap faces direct competition from Facebook (FB), Alphabet (GOOGL), Twitter (TWTR), and more. For comparison sake, we included GoPro (GPRO), as Snap claims to be a camera company (despite its failed attempt to make a camera). Per Figure 2, Snap’s trailing twelve months (TTM) gross margin ranks well below its main competitors and is closer to a hardware company like GoPro rather than a social media company.

Figure 2: Snap’s Margin Lags All Competition

Sources: New Constructs, LLC and company filings

SNAP Still Priced as if It’s the Next Facebook, Despite Evidence to the Contrary

Despite trading 61% below the price its IPO opened at ($24/share), SNAP is still vastly overvalued. SNAP’s valuation indicates that a significant amount of noise traders[1] are still propping the stock up, as the expectations baked into its current stock price imply that SNAP will grow into a platform that rivals Facebook’s margins and market share.

Comparisons to Facebook make sense on the surface, since both compete for user engagement and must find ways to monetize users. However, these firms have vastly different economics, even when going back to Facebook in its infancy.

First, when Facebook went public in 2012, it’s after-tax operating profit (NOPAT) was $1.1 billion and the company achieved a 21% NOPAT margin whereas Snap’s NOPAT in 2016 was -$498 million with a -123% margin. Facebook has continued to grow its revenue, user base, and improve margins.

Second, when Facebook first entered the market, it did not have to unseat a large, firmly established and highly profitable incumbent. To become the next Facebook, Snap would need to take huge chunks of market share from Facebook, a feat it has proven unable to accomplish to date, while also drastically improving its margins. So, what does it all mean? How much lower could Snap fall as the noise turns negative and the fundamentals are exposed?

To justify its valuation of ~$9/share, Snap must immediately achieve a NOPAT margin of 25% and grow revenue by 40% compounded annually for the next six years – both numbers are comparable to Facebook’s results in its first few years after its IPO. The high expectations embedded in the stock price even after its 60% drop shows just how irrational the market was at its IPO. See the math behind this dynamic DCF scenario.

As discussed above, Snap does not really live up to the Facebook comparison. Twitter (TWTR) is probably a better comp, although even Twitter has an advantage over Snap due to the differentiation of its service. If SNAP can only achieve a 5.5% NOPAT margin (slightly below TWTR) and grow revenue by 40% compounded annually for the next decade, the stock is worth just $5/share today – a 46% downside. See the math behind this dynamic DCF scenario.

Snap Is Not Alone

Snap is far from the only recent IPO to prevent public shareholders from having any say in the company. Domo (DOMO), Dropbox (DBX), and GreenSky (GSKY) have all recently gone public with dual-class share structures that concentrate voting power in the hands of founders. As we predicted, all three stocks are down since their first day of trading.

Hopefully the failure of these IPO’s will convince investors to avoid future dual-class offerings. The success of Facebook and Alphabet led investors to believe that concentrating power in the hands of a visionary founder is a good idea, but most founders are not Mark Zuckerberg, Sergey Brin, or Larry Page.

Bondholders would never give a company money without some form of collateral or liquidation rights. Preferred stockholders get preferred access to cash flows. Investors should not buy stocks in companies that attempt to strip of them of the basic right to vote on the management of the company.

This article originally published on September 13, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Shiller, Robert J., et al. “Stock Prices and Social Dynamics.” Brookings Papers on Economic Activity, vol. 1984, no. 2, 1984, pp. 457–510. JSTOR, JSTOR, www.jstor.org/stable/2534436.

Click here to download a PDF of this report.

Photo Credit: TeroVesalainen (Pixabay)