Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

Domo, Inc. (DOMO: $20.50/share midpoint of IPO price range), a business intelligence and data visualization provider, will IPO on Thursday, June 28. At a price range of $19 to $22 per share, the company plans to raise up to $189 million and has an expected market cap of $511 million. At the midpoint of its price range, DOMO currently earns our Very Unattractive rating.

Domo’s proposed valuation is less than a quarter of the $2.3 billion valuation assigned by its last private funding round in April 2017. The company comes to market burning cash at a rapid rate and needing an infusion of capital to fund its operating costs. Meanwhile, concerns over slowing growth and CEO Josh James’ history of self-dealing have investors justifiably spooked.

Some investors may view these recent struggles as a buy low opportunity, but that could be a big mistake. Despite the recent price drop, Domo still has highly optimistic growth expectations baked into its stock price. Investors should stay away from this IPO.

Record Low Profitability

Domo has the unenviable distinction of earning the lowest return on invested capital (ROIC) of any of the 2,800+ companies we cover. With an ROIC of -344%, it lost over three dollars for every dollar invested in its business in 2017. Since ROIC is the primary driver of valuation,[1] Domo’s extremely negative ROIC is a major red flag for investors.

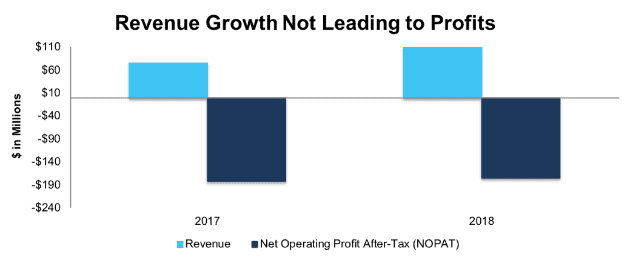

Figure 1 shows that DOMO’s losses have remained steady. Even as revenue grew by 46% in 2016, after-tax operating profit (NOPAT) remained roughly flat at negative $175 million.

Figure 1: DOMO Revenue and NOPAT Since 2016

Sources: New Constructs, LLC and company filings

A deeper look at the number doesn’t reveal much cause for optimism. Gross margin did increase slightly in 2017, from 56% to 59%, but that increase was driven solely by a shift in the revenue mix from Professional Services to Subscription revenue. Subscription gross margins actually declined slightly from 63.4% to 62.9%.

Marketing Spend Is Unsustainable

In addition to its comparatively low gross margins, Domo’s huge losses are driven by its sky-high marketing spend. The company spent $132 million – 121% of revenue – on sales and marketing in 2017.

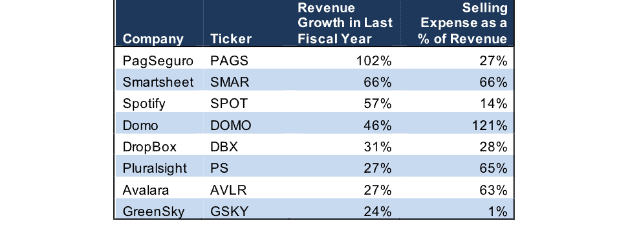

Potential investors should be alarmed that Domo’s large marketing budget has not led to higher growth. Figure 2 compares Domo to several other high-profile tech IPOs in 2018 on the basis of revenue growth and selling expense as a percentage of revenue. It shows that Domo ranks in the middle of pack in terms of growth despite spending nearly double that of the next highest company.

Figure 2: Revenue Growth and Selling Expenses for Recent Tech IPOs

Sources: New Constructs, LLC and company filings

Even worse, Domo’s revenue growth is slowing even as its sales and marketing budget remains sky-high. Revenue growth slowed to 32% year over year in Q1 while the company spent 124% of revenue on sales and marketing.

Domo’s huge marketing budget led to free cash flow of -$160 million in 2017. With just $72 million in cash on hand, the company must cut back on its expenses significantly or constantly raise new capital.

One place where Domo has already cut costs is in research and development, where its spending declined by 3% in 2017. Underinvesting in the product while overspending on marketing could be a bad sign for the long-term health of the company.

Shareholders Have Little Control: CEO Gets 86% of Voting Power

Domo follows in the footsteps of other recent IPOs like Dropbox (DBX) and Snapchat (SNAP) by issuing dual class shares that keeps voting power in the hands of its founder. Despite holding just 15% of the company’s shares, CEO Josh James will have 86% of the voting power, meaning outside shareholders will effectively have no say in the direction of the company.

CEO Has History of Self-Dealing With Family Businesses

The dual-class share structure is especially concerning for Domo, as CEO Josh James has revealed a troubling lack of judgement in the past. The company has been involved in a significant amount of self-dealing, such as leasing a jet and hiring catering and furnishing services from companies owned by James and his siblings. The company recently filed an amended S-1 saying it has terminated these relationships, but the existence of these conflicts in the first place is a major red flag.

Family, Friends and Insiders Seek Loophole to Avoid Lock-up

In that amended filing, Domo also brought up a new red flag with the announcement of a direct share program to sell shares in the IPO to company insiders as well as their friends and families. Notably, the friends and families would not be subject to any lockup period in this agreement, meaning they could buy shares at the IPO price and quickly flip them for a profit in the event of a first-day pop.

Taken together, all these governance issues point to a company that is run for the benefit of insiders and executives rather than for shareholders.

Our Discounted Cash Flow Model Reveals More Potential Downside Risk

Despite the 75% decline in its valuation over the past year, the growth expectations for Domo are still unrealistically high. Our dynamic DCF model quantifies exactly what kind of future cash flows the market price of a stock implies a company will generate.

To justify the midpoint IPO price of $20.50/share, Domo must achieve pre-tax margins of 15% – comparable to large enterprise software provider like IBM (IBM) – and grow revenue by 20% compounded annually for the next seven years. The proposed IPO valuation implies that Domo can significantly cut back on its marketing expenses while still maintaining a relatively high growth rate.

Specifically, the company would have to cut sales and marketing costs from 120% to 35% of revenue, maintain its current gross margin on subscription revenue of 63%, and keep all other operating costs at current levels while still growing revenue at 20% annually. Also, Domo would go from having the worst ROIC of any company in our coverage universe to earning a top-quintile 37% ROIC in seven years. See the math behind this dynamic DCF scenario here.

If Domo achieves 10% pre-tax margins and grows revenue by 11% compounded annually for the next decade, the stock is worth just $8/share today, 62% below the midpoint of the IPO range. In this scenario, Domo would go from having the worst ROIC of any company in our coverage universe to earning a top-quintile 24% ROIC in ten years. See the math behind this dynamic DCF scenario here.

Critical Details Found in Financial Filings By Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[2] findings in Domo’s S-1:

Income Statement: we made $2 million of adjustments, with a net effect of removing $2 million in non-operating expense (2% of revenue). Our biggest adjustment was removing $1 million in non-operating expense due to the implied interest cost on operating leases. You can see all the adjustments made to DOMO’s income statement here.

Balance Sheet: we made $17 million of adjustments to calculate invested capital with a net increase of $16 million. The largest adjustments was $17 million in operating leases. This adjustment represented 62% of reported net assets. You can see all the adjustments made to DOMO’s balance sheet here.

Valuation: we made $84 million of adjustments with a net effect of decreasing shareholder value by $84 million. There were no adjustments that increased shareholder value. Outside of the operating leases mentioned above, the largest adjustment to shareholder value was $20 million in outstanding employee stock options. This option adjustment represents 4% of DOMO’s proposed market cap.

This article originally published on June 25, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” demonstrates the link between an accurate calculation of ROIC and shareholder value.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.