It’s time for investors to stop obsessing over the Fed. We’ve argued for years that fiscal policy, not monetary, will have the greater role in determining the economy’s future. Lately, it’s become even clearer that the Fed is irrelevant, and low interest rates are the new normal in the market.

Instead of poring over the Fed minutes, investors looking to understand the direction of the economy should be studying up on the positions of Hillary Clinton and Donald Trump. One of those two people will be President of the United States and take the lead in developing a fiscal policy that could help unleash the economy’s pent-up potential or sink us back into a recession.

Much has been made of the candidates’ sharp differences, but there’s one area where they have put forward remarkably similar plans.

Both Candidates Agree: Repatriate Offshore Cash, Invest In Infrastructure

U.S. companies have stashed $2.5 trillion in cash overseas in order to avoid paying the 35% U.S. tax rate on repatriated foreign profits.

Meanwhile, there’s a broad consensus on both sides of the aisle that our nation’s infrastructure requires billions, if not trillions, of dollars in investment on repairs and modernization.

Both Hillary Clinton and Donald Trump seem to have come to a similar conclusion: we can kill two birds with one stone by convincing companies to bring back their cash from overseas and using some tax revenue from that cash to fund infrastructure investment.

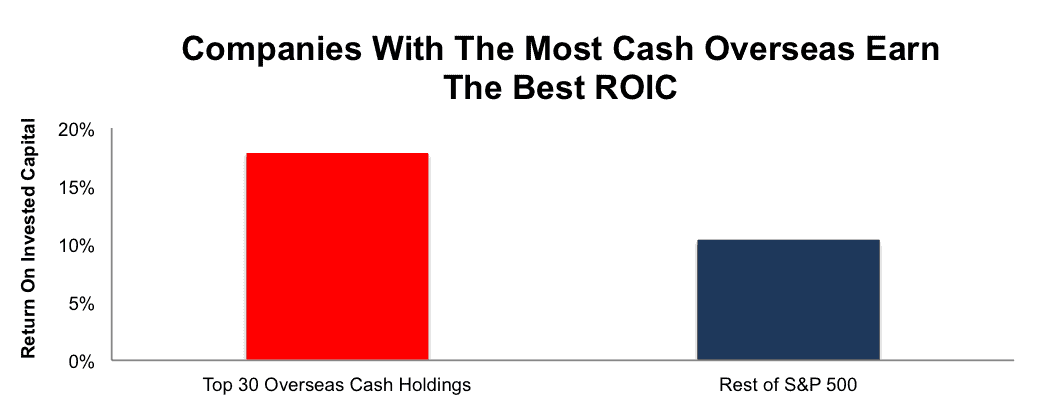

This plan would be great for the economy as a way to stimulate more investment. The companies with the most cash overseas are often the ones we want investing in America the most, as they have shown the ability to create the most value with their investments. As Figure 1 shows, the 30 companies with the most cash stashed overseas earn a much higher return on invested capital (ROIC) than the rest of the S&P 500.

Figure 1: Average ROIC: Companies With The Most Overseas Cash Vs. The Rest of the S&P 500

Sources: New Constructs, LLC and company filings.

A policy that convinces these companies to bring back their foreign profits would stimulate more investment in the U.S. from those with a proven track record of intelligent capital allocation. Using some of that cash to fund investment in infrastructure would create a platform for the economic leaders of the future to succeed.

Donald Trump wants to allow companies to repatriate their overseas cash at a 10% tax rate and has promised a massive investment in infrastructure.

Hillary Clinton also wants a large investment in infrastructure, including the creation of an “infrastructure bank.” She hasn’t specified how she’d pay for this infrastructure spending, but Bill Clinton has supported a “repatriation holiday” that would allow companies to bring back cash if they invested 10% in infrastructure bonds. Hillary Clinton voted for a similar law as a senator in 2004.

There are differences between the candidates’ plans, but the broad outline looks the same. Whoever wins in November will be deeply unpopular with a good segment of the public and likely facing a divided Congress. They’ll be looking for a policy achievement to tout early in their administration, and this plan, with its bipartisan support, makes a lot of sense.

What This Means For Investors

If this plan goes into place it should have a positive impact on the economy as a whole. However, there are four groups that would disproportionately benefit:

- Companies with a great deal of overseas cash would benefit from being able to bring that money back to the U.S. while avoiding the massive tax bill they would have faced otherwise.

- Construction companies would benefit from a surge in demand for their services.

- Companies that supply the raw materials for construction would also experience a spike in demand.

- Transportation companies that depend upon our nation’s infrastructure system would reap long-term rewards from upgrades.

Cisco Systems (CSCO) is our favorite stocks from Group 1 and earns our Very Attractive rating. With $53 billion stashed overseas, cutting the tax rate on repatriated profits to 10% could save the tech giant over $10 billion (6% of its market cap). That’s a nice boost to a company that is already cheaply valued as things stand. At its current price of ~$32/share, Cisco has a price to economic book value (PEBV) of just 0.9, which implies that the market expects a permanent 10% decline in after-tax profit (NOPAT).

Cisco has grown NOPAT by 7% compounded annually over the past decade and consistently earns one of the best ROICs in its industry. With the possibility of being able to bring tens of billions of dollars home to invest in new growth opportunities, it’s hard to imagine Cisco experiencing a permanent decline in profitability. Fiscal policy provides a potential upside catalyst for what is already a great value stock.

Access the rest of our investment recommendations to profit from the election for just $9.99. Subscribers with a Platinum or higher membership can access that report here.

This article originally published here on October 7, 2016.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Scottrade clients get a Free Gold Membership ($588/yr value). Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.

Click here to download a PDF of this report.

Photo Credit: reynermedia (Flickr)