Our note on Overstated Street Earnings in 3Q22 shows Street Earnings (based on Zacks Earnings) overstate profits for the majority of S&P 500 companies in 3Q22. However, there are over 140 S&P 500 companies whose Street Earnings understate their true profits. These companies are more profitable than investors realize and undervalued in many cases.

This report shows:

- the prevalence and magnitude of understated Street Earnings in the S&P 500

- why Street Earnings (and GAAP earnings) are flawed

- five S&P 500 companies with understated Street Earnings and Very Attractive Stock Ratings

Over 140 S&P 500 Companies Have Understated Street Earnings

For 143 companies in the S&P 500, or 29%, Street Earnings understate Core Earnings[1],[2] for the trailing-twelve-months (TTM) ended calendar 3Q22. In the TTM ended 2Q22, 153 companies understated their earnings.

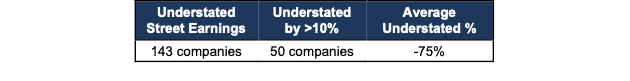

When Street Earnings understate Core Earnings, they do so by an average of -75% per company, per Figure 1. Street Earnings understate Core Earnings by more than ten percent for about 10% of S&P 500 companies.

Figure 1: Street Earnings Understated by -75% on Average in TTM Through 3Q22[3]

Sources: New Constructs, LLC and company filings.

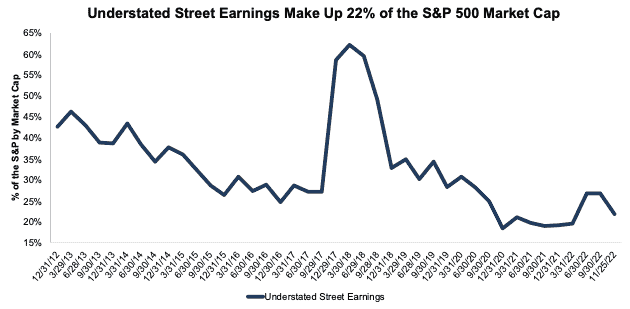

The 143 companies with understated Street Earnings represent 22% of the market cap of the S&P 500 as of 11/25/22, which is down from 27% in the TTM ended 2Q22.

Figure 2: Understated Street Earnings as % of Market Cap: 2012 through 11/25/22

Sources: New Constructs, LLC and company filings.

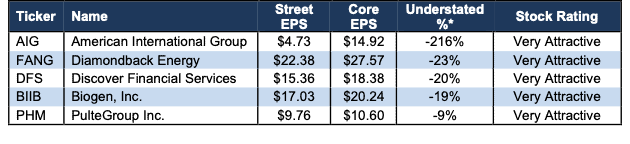

The Five Most Understated Earnings in the S&P 500

Companies that understate earnings are rarer than in past quarters, but you can find them if you know how to look.

Figure 3 shows five S&P 500 stocks with Very Attractive Stock Ratings and the most understated Street Earnings (based on Street Distortion as a % of Street Earnings per share) over the TTM through 3Q22. “Street Distortion” equals the difference between Core Earnings per share and Street Earnings per share. Investors relying only on Street Earnings miss the true profitability of these businesses.

Figure 3: S&P 500 Companies with Most Understated Street Earnings: TTM Through 3Q22

Sources: New Constructs, LLC and company filings.

*Measured as Street Distortion as a percent of Street EPS

In the section below, we detail the hidden and reported unusual items that distort GAAP Earnings for PulteGroup Inc. (PHM). All these unusual items are removed from Core Earnings.

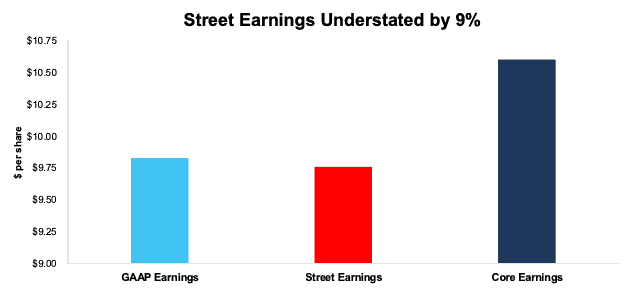

PulteGroup’s (PHM) TTM 3Q22 Street Earnings Understated by $0.84/share

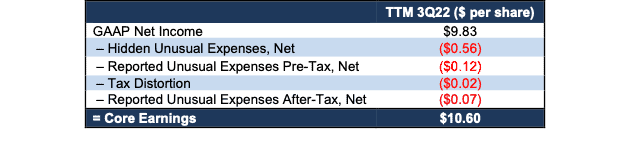

The difference between PulteGroup’s TTM 3Q22 Street Earnings ($9.76/share) and Core Earnings ($10.60/share) is $0.84/share, per Figure 4. We call that difference “Street Distortion,” which equals 9% of Street Earnings.

PulteGroup’s TTM 3Q22 GAAP Earnings ($9.83/share) understate Core Earnings by $0.77/share.

This example shows how Street Earnings suffer from many of the same shortcomings as GAAP measures of earnings. Our proprietary process for adjusting financial filings corrects these inaccuracies and reflects true profitability.

Figure 4: Comparing PulteGroup’s GAAP, Street, and Core Earnings: TTM Through 3Q22

Sources: New Constructs, LLC and company filings.

Below, we detail the differences between Core Earnings and GAAP Earnings so readers can audit our research. We would be happy to reconcile our Core Earnings with Street Earnings but cannot because we do not have the details on how analysts calculate their Street Earnings.

PulteGroup’s Earnings Distortion Score is Beat and its Stock Rating is Very Attractive, in part due to its return on invested capital (ROIC) of 17% and price-to-economic book value (PEBV) ratio of 0.3.

Figure 5 details the differences between PulteGroup’s Core Earnings and GAAP Earnings.

Figure 5: PulteGroup’s GAAP Earnings to Core Earnings Reconciliation: TTM Through 3Q22

Sources: New Constructs, LLC and company filings.

More details:

Total Earnings Distortion of -$0.77/share, which equals -$185 million, is comprised of the following:

Hidden Unusual Expenses, Net = -$0.56/per share, which equals -$135 million and is comprised of

- -$159 million in interest expensed in the TTM period based on

- $41 million in 3Q22

- $38 million in 2Q22

- $34 million in 1Q22

- $46 million in 4Q21

- $25 million in adjustments to previously recorded reserves in 4Q21

Reported Unusual Expenses Pre-Tax, Net = -$0.12/per share, which equals -$29 million and is comprised of

- -$38 million in write-offs of deposits and pre-acquisition costs in the TTM period based on

- -$24 million in 3Q22

- -$5 million in 2Q22

- -$4 million in 1Q22

- -$5 million in 4Q21

- $9 million in miscellaneous income in the TTM period based on

- $1 million in 3Q22

- $3 million in 2Q22

- $3 million in 1Q22

- $2 million in 4Q21

Tax Distortion = -$0.02/per share, which equals $4.6 million

Reported Unusual Expenses After-Tax, Net = -$0.07/per share, which equals $17 million and is comprised of

- -$16 million in undistributed earnings allocated to participating securities in the TTM period based on

- -$4 million in 3Q22

- -$4 million in 2Q22

- -$3 million in 1Q22

- -$6 million in 4Q21

- -$0.9 million in earnings distributed to participating securities in the TTM period based on

- -$0.2 million in 3Q22

- -$0.2 million in 2Q22

- -$0.2 million in 1Q22

- -$0.3 million in 4Q21

While not exactly equal, the similarities between Street Earnings and GAAP Earnings for PulteGroup indicate that Street Earnings miss many of the unusual items in GAAP Earnings. The $0.84/share Street Distortion highlights that Core Earnings include a more comprehensive set of unusual items when calculating PulteGroup’s true profitability.

This article was originally published on December 13, 2022.

Disclosure: David Trainer, Kyle Guske II, Matt Shuler, and Italo Mendonça receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] The Journal of Financial Economics features the superiority of our Core Earnings in Core Earnings: New Data & Evidence.

[2] Our Core Earnings research is based on the latest audited financial data, which is the calendar 3Q22 10-Q in most cases. Price data as of 11/25/22.

[3] Average understated % is calculated as Street Distortion, which is the difference between Street Earnings and Core Earnings.