For those who have followed our prior reports on Twitter (TWTR: $20/share), today’s news that Alphabet (GOOGL), Apple (AAPL), and Disney (DIS) are unlikely to bid for the firm should come as no surprise. We think these companies (and many investors) are doing the same work we have done and simply cannot stomach paying anywhere close to Twitter’s current price. For those who haven’t followed, the issues which make Twitter a poor acquisition target at current prices include no profits and large cash losses over its life, a broken business model that is not likely to generate profits, and a highly overvalued stock price. TWTR’s 20% drop is not only warranted, but could get worse. As more suitors recognize Twitter’s weak bargaining position, more suitors will walk away, and the stock will continue to slide.

Where Are The Profits?

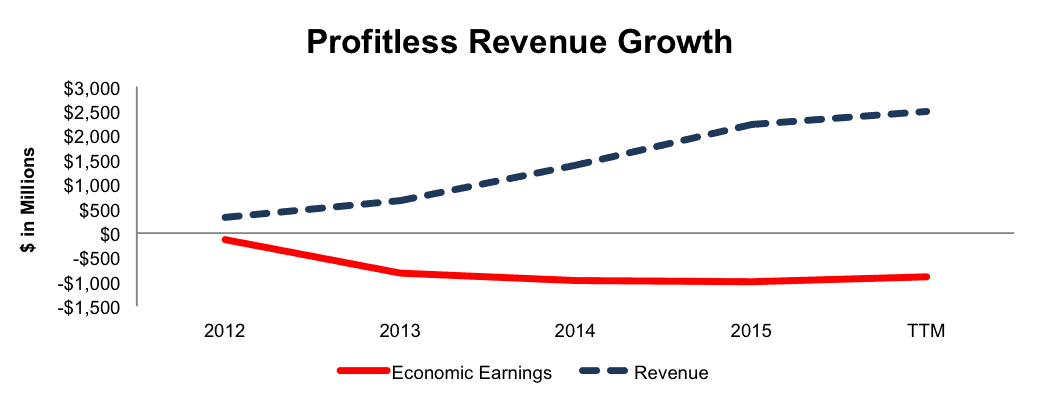

When we first warned investors about Twitter, in June 2015, we noted the company has been great at growing revenue but not profits. Since our report, losses have slightly improved, but remain large (-36% of revenue). Figure 1 shows that while revenue has grown from $317 million in 2012, to $2.5 billion over the last twelve months (TTM), economic earnings have declined from -$134 million to -$886 million over the same time.

Figure 1: Twitter’s Negative Economic Earnings

Sources: New Constructs, LLC and company filings

Broken Business Model Compounds Issues

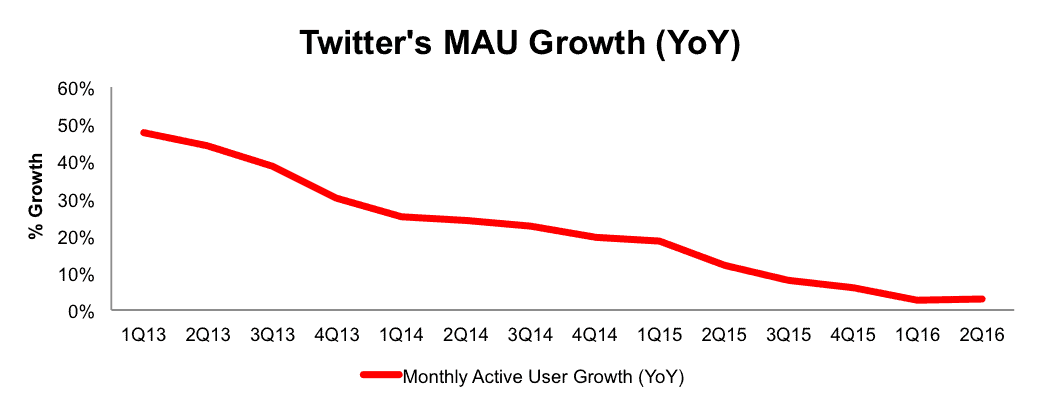

As a social media service, Twitter is often compared to the likes of Facebook, LinkedIn, Instagram, or Snapchat. For each of these services, the ability to monetize a user base will ultimately determine the lasting success (or lack thereof) at the firm. As Figure 1 above shows, Twitter has not been efficient in monetizing its user base. Making matters worse, recent efforts to grow the user base show limited success. Per Figure 2, Twitter’s year-over-year (YoY) growth in monthly average users has steadily declined, from 48% in 1Q13, to 3% in 2Q16.

Figure 2: Twitter’s Declining User Growth

Sources: New Constructs, LLC and company filings

One of the biggest obstacles to growing the user base stems from Twitter’s flawed business model, which we first highlighted in our original Danger Zone report. The best interests of the users (i.e. quick, easy access to the content of their choosing) are not aligned with the best interests of advertisers (i.e. getting more attention of users not necessarily looking for them). This conflict makes us wonder how successful Twitter’s business can be. If Twitter shows more ads, it risks putting off users and seeing user growth falter, or even turn negative. If Twitter does not give advertisers more access to its users, its profits will continue to struggle.

Acquisition Analysis Shows Current Stock Price Is Too High

As if the profit concerns and slowing user growth weren’t enough, our previous analysis into a potential acquisition of Twitter revealed the firm to be worth well below its current valuation. In June 2016, we analyzed a potential deal between Alphabet and Twitter, and found that the most Alphabet should pay for Twitter was $1.55/share, or $1.1 billion – 92% downside to its current valuation.

With Alphabet reportedly turning down the opportunity to buy, we analyze a potential acquisition by Salesforce (CRM) and assess how much Marc Benioff’s firm should pay, based on the (rather large) assumption that he cares about the economics, not just the optics, of such a deal. To begin, TWTR has liabilities of which investors may not be aware that make it more expensive than accounting numbers suggest:

- $761 million in off-balance-sheet operating leases (5% of market cap)

- $210 million in outstanding employee stock options (2% of market cap)

After adjusting for these liabilities we can model multiple purchase price scenarios. Even in the most optimistic of scenarios, TWTR is worth well below the current share price.

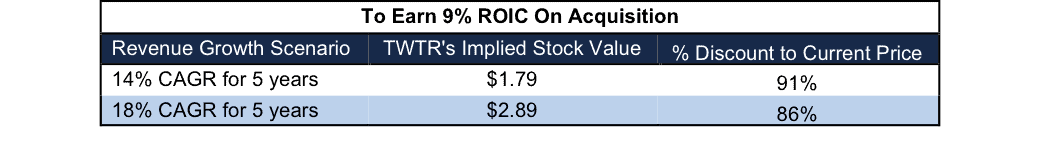

Figures 3 and 4 show what we think Salesforce should pay for TWTR to ensure it does not destroy shareholder value. Despite any potential benefits of Twitter merging with a large cloud platform, there are limits on how much CRM should pay for TWTR to earn a proper return, given the NOPAT or free cash flows being acquired.

Each implied price is based on a ‘goal ROIC’ assuming different levels of revenue growth. In each scenario, the estimated revenue growth rate in year one and two equals the consensus estimates for 2016 (16%) and 2017 (13%). For the subsequent years, we use 13% in scenario one because it represents a continuation of 2017 expectations. We use 20% in scenario two because it assumes a merger with Salesforce could create additional revenue growth.

We conservatively assume that Salesforce can grow TWTR’s revenue and NOPAT without spending on working capital or fixed assets. We also assume TWTR achieves an 8.5% NOPAT margin, which is the average NOPAT margin of Alphabet, Facebook, LinkedIn, and Twitter. For reference, Twitter’s TTM NOPAT margin is -11%.

Figure 3: Implied Acquisition Prices For CRM To Achieve 9% ROIC

Sources: New Constructs, LLC and company filings.

Figure 3 shows the ‘goal ROIC’ for CRM as its weighted average cost of capital (WACC) or 9%. Even if Twitter can grow revenue by 14% compounded annually with a nearly 9% NOPAT margin for the next five years, the firm is not worth its current price of $20/share. It’s worth noting that any deal that only achieves a 9% ROIC would be only value neutral and not accretive, as the return on the deal would equal CRM’s WACC.

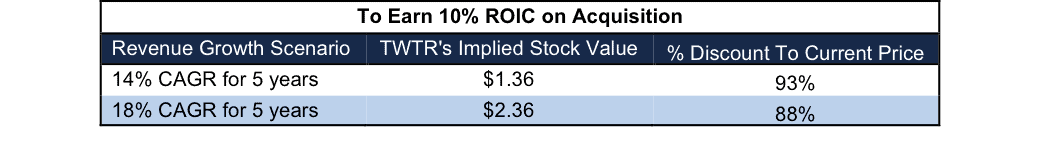

Figure 4: Implied Acquisition Prices For CRM To Achieve 10% ROIC

Sources: New Constructs, LLC and company filings.

The next ‘goal ROIC’ is 10%, which is well above CRM’s current ROIC of 2%, and above its WACC, which ensures the deal would be truly accretive to shareholders. Even in the best-case scenario, the most CRM should pay for TWTR is $2.36/share (88% downside).

The bottom line is that Salesforce’s management would have some explaining to do to justify an acquisition at $20/share, the current price of TWTR.

Highly Overvalued As A Standalone Firm

Even with the 20% drop in value, TWTR is still up 42% since June 10, when Microsoft (MSFT) announced intent to buy LinkedIn (LNKD) and rumors began resurfacing about a Twitter takeover. This price increase with no improvement in the deteriorating fundamentals leaves TWTR significantly overvalued, especially as a standalone firm. To justify the current price of $20/share, Twitter must immediately achieve 9% NOPAT margins (average of FB, GOOGL, LNKD, and TWTR, as compared to -11% TTM) and grow revenue by 19% compounded annually for the next 15 years. In this scenario, Twitter would be generating over $31 billion in revenue (15 years from now), which is greater than Facebook’s 2015 revenue.

Twitter Needs To Be Acquired To have Any Hope Of Achieving Expectations In Current Valuation

We think it is fair to say it is highly unlikely that Twitter could ever achieve anything close to the profit growth required to justify its current valuation. In other words, Twitter needs a buyer to bail it out before the market catches on to just how unprofitable this business model is. As more suitors recognize Twitter’s weak bargaining position, more suitors will walk away, and the stock will continue to slide.

Even if we assume Twitter can achieve 9% NOPAT margins and grow revenue by 13% compounded annually for the next decade, the stock is only worth $5/share today – a 75% downside. Each of these scenarios also assumes the company is able to grow revenue and NOPAT/free cash flows without spending on working capital or fixed assets. For reference, Twitter’s invested capital has grown on average $1.9 billion (86% of 2015 revenue) per year since 2013.

Are Markets Getting Smarter About M&A?

It’s clear that Twitter is not an attractive acquisition target, nor an attractive standalone investment for anyone who cares about the economics of businesses. Unfortunately, similar circumstances have not stopped firms from misallocating capital in the past. For recent examples, look no further than Microsoft’s acquisition of LinkedIn or Salesforce’s recent acquisition of Demandware. However, the reaction to the Twitter deal may signal a shift in sentiment regarding low quality mergers and acquisitions. Capital is not free. Eventually, the market punishes those who waste it.

The 10% drop in CRM’s stock over the past three months as rumors grew it was interested in acquiring TWTR signals that investors do not like this deal. Our research shows why the market’s reaction is rational.

The days where firms did acquisitions to distract from the problems within their business operations may be coming to an end. Investors are paying more attention to the economics of proposed deals, not just the headlines. New Constructs makes it easy for investors to see through the headline to the true economics of a deal and make more informed, lower risk decisions.

This article originally published here on October 6, 2016.

Disclosure: David Trainer, Kyle Guske II, and Kyle Martone receive no compensation to write about any specific stock, style, or theme.

Scottrade clients get a Free Gold Membership ($588/yr value). Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.

Click here to download a PDF of this report.

Photo Credit: Scott Beale/Laughing Squid (Flickr)