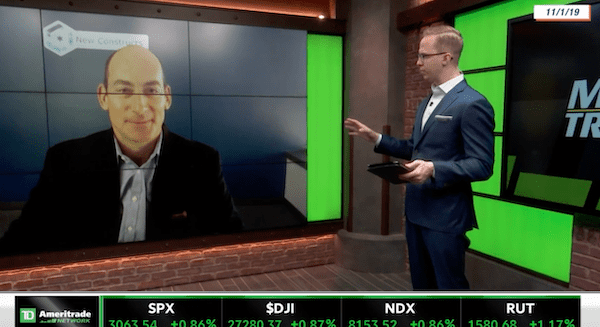

How Consensus Earnings Distortion Costs You – Yahoo Finance

We joined Yahoo Finance’s The Ticker to provide insights into earnings distortion, market inefficiencies, and how using consensus earnings estimates could be costing you money.

Kyle Guske II, Senior Investment Analyst, MBA