New research from Nvidia proves that small language models (SLM) outperform large language models (LLM), like ChatGPT and Copilot, in real-world applications. This should not be news to our readers because you’ve seen the Robo-Analyst in action, and our Robo-Analyst is a small language model.

You’ve seen first-hand how our proven-superior data and analytics deliver superior stock picks.

When you ask the LLM-driven AIs, like Chat GPT, how to find the best stocks, the answers return the most popular names in the market like TSLA, NVIDIA, APPL. Not a lot of value in those answers compared to what we deliver.

For example, our Long Idea this week features a company with industry leading-market share and profitability, sales growth across all segments, and, best of all, an undervalued stock price.

Streaming dominates the headlines, but little else grabs viewers’ attention like live sports and events. These events’ massive audiences give advertisers one of the most powerful platforms in media. Just think about the hype around ads during the Super Bowl or the number of ads during a regular season NFL.

This legendary broadcaster consistently airs the most-watched channels and programs and continues to rank among the most profitable companies in the industry. Best of all, its stock is one of the cheapest in this expensive market. Fox Corp (FOXA: $59/share) is this week’s Long Idea.

FOXA offers favorable Risk/Reward based on the company’s:

- market leadership,

- highly differentiated media brands,

- expanding digital/streaming distribution,

- growing revenue and top-tier profits,

- quality shareholder return, and

- cheap stock valuation.

Two Growing Businesses

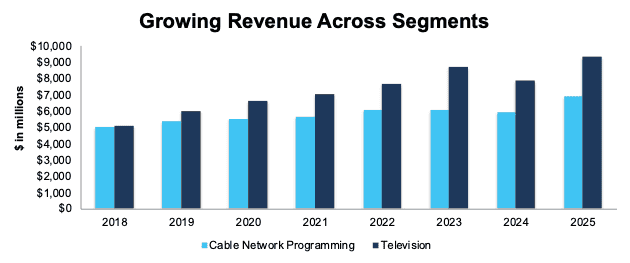

Fox operates two main segments: cable network programming and television.

Cable network programming refers to the production and licensing of news and sports content for distribution through traditional cable TV systems, direct broadcast satellite operators, telecommunication companies, virtual multi-channel video programming distributors, and other digital platforms.

Fox’s cable network programming segment revenue grew from $5.0 billion in fiscal 2018 (earliest available date) to $6.9 billion in fiscal 2025, or 5% compounded annually.

Television refers to the production, acquisition, marketing, and distribution of programming through the FOX broadcast network, Tubi, and operation of full power broadcast television stations, including duopolies and other digital platforms. Fox’s television segment revenue grew from $5.1 billion in fiscal 2018 to $9.3 billion in fiscal 2025, or 9% compounded annually. See Figure 1.

Figure 1: Fox’s Operating Segment Revenue: Fiscal 2018 – Fiscal 2025

Sources: New Constructs, LLC and company filings

King of TV

Fox is the biggest and most watched cable TV broadcaster in the U.S. and has been for decades. Fox’s cable TV channels span a variety of genres and include FOX News, FOX Business, FOX Sports Networks, FS1, FS2, The Big Ten Network, and FOX Deportes.

FOX reports in its 10-K that, based on data from Nielsen, FOX News has been the #1-rated national cable news channel in Monday-Friday primetime viewing for over 20-years. In Nielsen’s weekly viewership rankings for the week of August 11-August 17 (most recent data), FOX News programs make up all top 10 spots in the cable network TV category. Two Fox NFL related programs rank in the top 10 in the prime broadcast network TV category, with NFL on Fox Preseason taking the #1 spot.

FOX also notes in its 10-K that during the 2024-2025 broadcast season, FOX Entertainment featured two of the season’s top three debuts including the #1 Comedy Universal Basic Guys, along with television’s three highest-rated and most-watched cooking shows: Next Level Chef, Hell’s Kitchen, and Kitchen Nightmares.

FOX Television Stations (over-the-air) also cover 18 Nielsen-designated market areas (“DMAs”), including 14 of the 15 largest areas. These stations were the #1 or #2 rated news provider, among adults 25-54, in the hours of 5 a.m. – 9 a.m. in the majority of the markets in which they operate.

The stats are clear; Fox is the king of television.

One-of-a-Kind Sporting Events…

Despite the rise of on-demand streaming services, live tv still provides massive viewership for advertisers, particularly during live sports events from the NFL, MLB, college football, and more.

FOX shares rotating broadcast rights to the Super Bowl with other providers as part of the NFL’s current media rights deal, which runs through 2033. Per the deal, FOX will broadcast the Super Bowl again in 2029 and 2033.

FOX Sports’ presentation of Super Bowl LVII in February 2023 had an estimated 113 million viewers, and the Super Bowl LIX in February 2025 had 128 million viewers across all platforms, the latter of which was the new record for the most-watched Super Bowl.

Additionally, FOX Sports broadcasted the 2022 FIFA World Cup and has the exclusive rights to broadcast the upcoming 2026 FIFA World Cup.

The FIFA World Cup is the single most watched sporting event in the world, with an estimated 5 billion people watching the 2022 FIFA World Cup tournament in some capacity, up from the 3.6 billion viewers for the previous 2018 tournament. Additionally, the 2026 FIFA World Cup’s host countries are the U.S., Canada, and Mexico, which could drive greater viewership in the U.S. compared to previous tournaments.

Live events are increasingly important to advertisers as they pull in the most viewers and are “appointment-viewing”, not something to watch later or at your own leisure.

One-of-a-Kind Shows

FOX also delivers some of the most watched news and entertainment properties.

FOX News Channel dwarfs the other broadcast networks in primetime, per the latest monthly ratings. In July 2025, FOX News Channel averaged 2.4 million viewers in primetime, which is more than the 2.1, 2.0, and 2.0 million viewers of NBC, CBS, and ABC, respectively. FOX News Channel commanded 63% of the cable news share in July, while CNBC and MSNBC both saw double-digits declines to their market share over the same time.

More specifically, FOX programs like The Five, Jesse Watters Primetime, Gutfeld, Hannity, and FOX & Friends all ranked #1 in viewership in their respective categories. FOX’s number one program, The Five, was once again the most watched weekday show in all of cable.

Fox’s loyal viewers, along with the hard to replace live TV programs, give the company a competitive advantage when negotiating with advertisers. Placing ads with Fox ensures larger reach amongst key demographic groups.

Additionally, Fox can leverage these popular programs in its new direct-to-consumer (DTC) offering (more details below) to drive new revenue growth opportunities.

Fox’s Growing Digital Distribution

FOX is acutely aware of the consumer’s growing shift to on-demand streaming services.

The company is investing in and expanding its digital distribution offerings, including Tubi, an advertising supported video on demand (AVOD) network Fox acquired in 2020. Fox also just launched its own DTC subscription streaming service, FOX One.

Tubi is one of the fastest growing AVOD services in the U.S., with 13% YoY growth in total view time in fiscal 2025 and 100 million monthly active users. Tubi finished the fiscal year with approximately 2.2% market share of all television viewing according to Nielsen, which makes it the most watched free ad-supported streaming service in the U.S.

Fox One recently launched in August 2025 and gives consumers the ability to stream FOX’s existing lineup of live events, including the NFL and BIG Ten network, as well as daily entertainment programs. Importantly, Fox is marketing this service to the “cordless” consumers and is not pricing it a discount. Management noted the approach is aimed specifically to avoid taking existing cable subscribers. FOX One will also partner with ESPN’s newly released DTC app to create a sports bundle with the two services.

Combined, the Tubi service and FOX One provide an easy-to-use option for cordless viewers and put the company on path to the future of television.

Improving Fundamentals

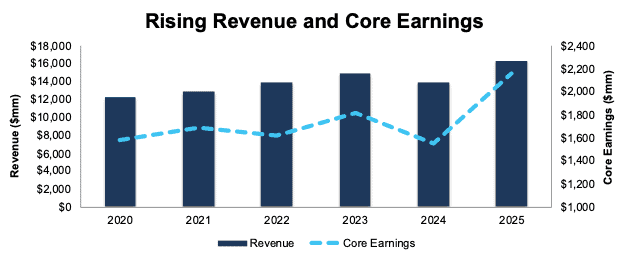

Fox has consistently grown its top- and bottom-line since beginning operations as a standalone business post Disney’s (DIS) acquisition of 21st Century Fox. Fox has grown revenue and net operating profit after-tax (NOPAT) by 6% and 5% compounded annually since fiscal 2020, respectively.

The company’s NOPAT margin fell slightly from 16% in 2020 to 15% in 2025, while its invested capital turns rose from 1.1 to 1.3 over the same time. Rising IC turns drive the company’s return on invested capital (ROIC) from 17% in fiscal 2020 to 19% in fiscal 2025.

Additionally, Fox’s Core Earnings, a cleaner version of earnings, grew from $1.6 billion in fiscal 2020 to $2.2 billion in fiscal 2025, or 7% compounded annually. See Figure 2.

Figure 2: Fox’s Revenue and Core Earnings Since Fiscal 2020

Sources: New Constructs, LLC and company filings

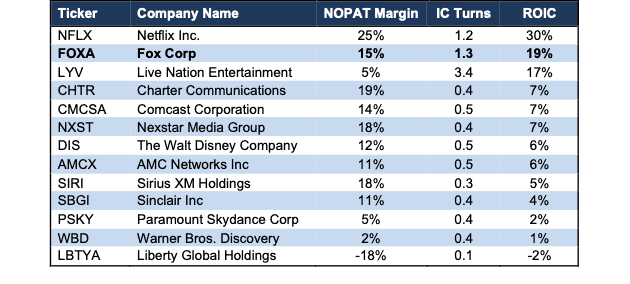

Superior Profitability Compared to Peers

Fox is not only the most watched, but it is also one of the most profitable among its peer group, as detailed in the company’s latest proxy statement.

Fox has the second highest invested capital turns and ROIC among publicly traded peers, which include Live Nation Entertainment (LVY), Walt Disney Company (DIS), Paramount Skydance Corp (PSKY), Warner Bros. Discovery (WBD), and more. See Figure 3.

Figure 3: Fox’s Profitability Vs. Peers: Trailing Twelve Months (TTM)

Sources: New Constructs, LLC and company filings

Quality Shareholder Return

Since fiscal 2020, Fox has paid $1.8 billion (7% of market cap) in cumulative dividends and has increased its semi-annual dividend from $0.23/share in calendar 1Q20 to $0.28/share in calendar 3Q25. The company’s current dividend, when annualized, provides a 0.9% yield.

Fox also returns capital to shareholders through share repurchases. From fiscal 2020 through fiscal 2025, the company repurchased $6.6 billion (25% of market cap) of shares.

In August 2025, the Board of Directors approved a new authorization to repurchase up to $5 billion of shares, with no specified expiration date. The company’s total stock repurchase authorization is now $12 billion. Should the company repurchase shares at its fiscal 2025 rate, it would repurchase $1 billion of shares over the next twelve months, which equals 3.8% of the current market cap.

When combined, the dividend and share repurchase yield could reach 4.7%.

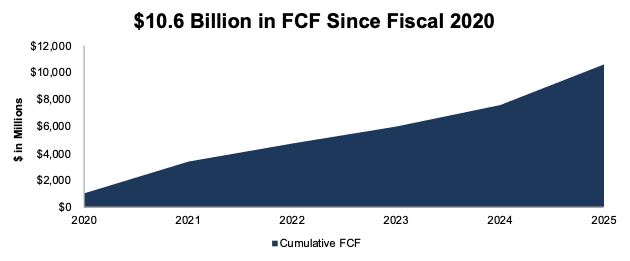

Strong Cash Flow Generation Supports Capital Return

Investors can take comfort in knowing Fox can afford to continue to pay its dividends and repurchase shares based on its large free cash flow (FCF). Per Figure 4, From fiscal 2020 through fiscal 2025, Fox generated $10.6 billion in FCF, which equals 37% of the company’s enterprise value.

Fox’s $10.6 billion in FCF since fiscal 2020 is more than enough to cover its $8.4 billion in combined dividend payments ($1.8 billion) and share repurchases ($6.6 billion).

Figure 4: Fox’s Cumulative FCF: Fiscal 2020 – Fiscal 2025

Sources: New Constructs, LLC and company filings

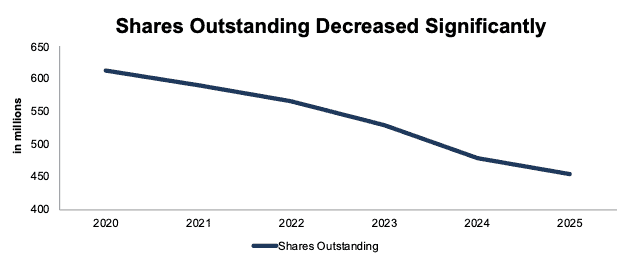

Fox’s repurchases have also meaningfully reduced its shares outstanding from 613 million in fiscal 2020 to 455 million in fiscal 2025. See Figure 5.

We like companies that choose to return capital to shareholders instead of spending it on costly acquisitions or executive bonuses that rarely drive shareholder value creation. Companies that sport strong enough cash flows to consistently lower their shares outstanding, like Fox, offer excellent value.

Figure 5: Fox’s Shares Outstanding: Fiscal 2020 – Fiscal 2025

Sources: New Constructs, LLC and company filings

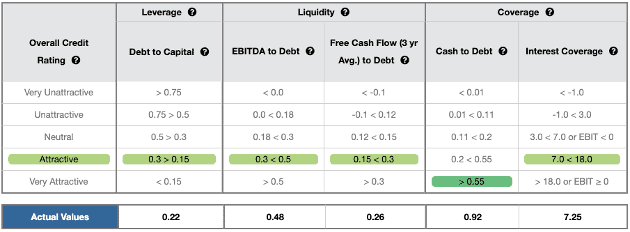

Strong Balance Sheet and Credit Rating to Weather Uncertainty

Fox has reduced its total debt from $8.5 billion in fiscal 2020 to $7.6 billion in fiscal 2025 while increasing its cash and equivalents from $4.6 billion to $5.4 billion over the same time. The result, Fox’s adjusted debt net of cash has fallen from $3.5 billion in fiscal 2020 to $1.4 billion in fiscal 2025.

Fox earns an Attractive overall Credit Rating and scores an Attractive-or-better rating for all five credit rating criteria.

Even if economic conditions deteriorate or viewership fluctuates, the company’s strong financial footing secures its operations for the foreseeable future.

Figure 6: Fox’s Credit Rating Details

Sources: New Constructs, LLC and company filings

Elephant in the Room Is More Than Priced In

It’s no secret that younger generations are more inclined to use on-demand streaming services rather than watch traditional broadcast/cable television. According to a survey done by Morning Consult, among total adults (ages 18+), 40% watch traditional TV while 38% watch streaming services. Meanwhile, 30% of Gen Z adults (ages 18-26) watch traditional TV while 46% watch streaming services.

The rise in streaming creates secular headwinds for the entire traditional broadcasting industry in the coming years, but it doesn’t mean that live TV will up and disappear, especially live sporting event broadcasts.

In 2024 for instance, NFL games made up 72 of the top 100 most-watched events. Sporting event were 80 of the top 100 events, with non-NFL rankings from Major League Baseball, college football, The Olympics, and women’s college basketball.

Going forward, Fox already holds rights to broadcast many of the most-watched live sporting events, including:

- the most NFL games in the 2025 season,

- FIFA World Cup in 2026,

- Major League Baseball, including the World Series, through 2028,

- UEFA European Championships in 2028,

- NASCAR races through 2031,

- Big Ten College football through 2030,

- and more.

Fox has the opportunity to expand its presence in the streaming market with continued investments in fast-growing Tubi and the addition of FOX One. Most importantly to those considering shares in the company, any decline in Fox’s profits is already more than priced into its current stock price, as we’ll show below.

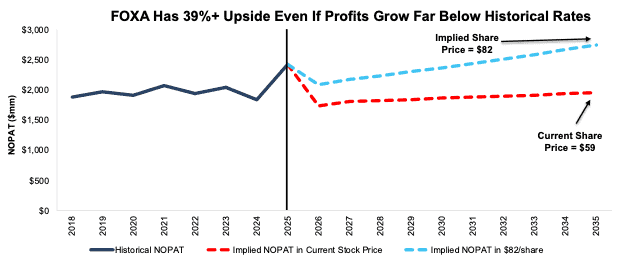

Current Price Implies Profits Will Permanently Decline

At its current price of $59/share, Fox has a price-to-economic book value (PEBV) ratio is 0.8. This ratio means the market expects the company’s NOPAT to permanently decline 20% from fiscal 2025 levels. This expectation seems overly pessimistic considering Fox has grown NOPAT by 5% compounded annually since fiscal 2020 and 4% compounded annually since fiscal 2018.

Below, we use our reverse discounted cash flow (DCF) model to analyze expectations for different stock price scenarios for FOXA.

In the first scenario, we quantify the expectations baked into the current price. If we assume:

- NOPAT margin falls to 11% from fiscal 2026 to 2035 (below the company’s lowest ever margin of 13% and fiscal 2025 margin of 15%),

- revenue grows at consensus rates in fiscal 2026 (-3%) and fiscal 2027 (4%), and

- revenue grows just 1% compounded annually through fiscal 2035 (below the company’s CAGR of 6% since fiscal 2020 and 7% since fiscal 2018).

the stock would be worth $59/share today – equal to the current stock price. In this scenario, Fox’s NOPAT would fall 2% compounded annually from fiscal 2026 – 2035.

Shares Could Go 39%+ Higher Even If Profits Grow Below Historical Rates

If we instead assume:

- NOPAT margin falls to 13% from fiscal 2026 to 2035 (equal to the company’s lowest ever margin and below its fiscal 2025 margin of 15%),

- revenue grows at consensus rates in fiscal 2026 (-3%) and fiscal 2027 (4%), and

- revenue grows 3% compounded annually through fiscal 2035, then.

the stock would be worth $82/share today – a 39% upside to the current price. In this scenario, Fox’s NOPAT would grow just 1% compounded annually through fiscal 2035. Should the company’s NOPAT grow more in line with historical levels, the stock has even more upside.

Figure 7: Fox’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Fox’s business will enable it to continue to generate higher NOPAT than the current market valuation implies:

- leading viewership among TV channels and programs,

- large presence in the live news and sports broadcasts,

- superior profitability compared to peers, and

- strong balance sheet.

What Noise Traders Miss with Fox Corp

These days, fewer investors focus on finding quality capital allocators with shareholder-aligned corporate governance. Due to the proliferation of noise traders, the focus is on short-term technical trading trends while more reliable fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- Fox’s differentiated brands provide reliable ad revenue,

- growing Core Earnings, and

- valuation implies profits will permanently decline by 20%.

Earnings Beats Could Send Shares Higher

Fox has beaten earnings estimates in each of the past 10 quarters, including the latest quarter ended fiscal 4Q25. Earnings beats and top- and bottom-line growth help explain FOXA outperforming the overall Consumer Discretionary sector since the beginning of this year. Year-to-date, FOXA is up 21% while the Consumer Discretionary Select Sector SPDR Fund (XLP) is up just 3%. Additional earnings beats could send shares even higher and further extend the stock’s outperformance.

Exec Comp Could Be Improved

Fox’s executives receive both annual incentives and long-term equity awards. The annual incentives are tied to adjusted EBITDA (75%) and qualitative factors (25%), which take into account “each named executive officer’s contributions to the Company’s financial and non-financial objectives, individually and as a group.”

Long-term equity awards are tied to adjusted FCF (15%), adjusted EPS (15%), and adjusted total shareholder return (TSR) (70%).

We would prefer the company tie executive compensation to ROIC. Doing so ensures that executives’ interests are more aligned with shareholders’ interests as there is a strong correlation between improving ROIC and increasing shareholder value. Improving ROIC requires attention to all areas of the business, so including it in an executive compensation plan would incentivize executives to improve the entire business, not just one sales goal or earnings number.

Despite using adjusted EBITDA and TSR goals in its executive pay, Fox’s management has grown economic earnings, the true cash flows of the business, from $1.4 billion in fiscal 2018 to $1.6 billion in fiscal 2025.

Insider Trading and Short Interest Trends

Over the past six months, insiders have purchased 812,943 shares and sold 45,249 shares for a net effect of 767.694 shares bought. These sales represent <1% of shares outstanding.

There are currently 3.5 million shares sold short, which equates to <1% of shares outstanding and three days to cover.

Attractive Funds That Hold FOXA

The following funds receive an Attractive-or-better rating and allocate significantly to FOXA:

- Independent Franchise Partners U.S. Equity Fund (IFPUX) – 4.5% allocation and Very Attractive rating.

- Deutsche DWS CROCI U.S. Fund (DCUCX, DCUIX, DCUAX, DCUSX) – 3.6% allocation and Very Attractive rating.

- Invesco S&P 500 Equal Weight Communication Services ETF (RSPC) – 2.9% allocation and Very Attractive rating.

- Invesco Leisure and Entertainment ETF (PEJ) – 2.6% allocation and Very Attractive rating.

- Burney U.S. Factor Rotation ETF (BRNY) – 2.6% allocation and Attractive rating.

This article was originally published on August 27, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.