2016 earnings brought cheers for the end of the “earnings recession.” Analysts are saying that earnings growth is accelerating.

However, quarterly earnings omit valuable information. They are unaudited and don’t provide financial footnotes or the management discussion and analysis (MD&A) that investors need to accurately measure profits.

The footnotes and MD&A are present only in annual 10-K reports, which is why 10-K filing season (late February to the end of March) should be the most important time of year for analysts and investors. In reality, these reports and the important details in them are overlooked because most investors and analysts do not have the time to read these 200+ page reports. Our Robo-Analyst technology automates the mundane parts of analyzing 10-Ks so that our analyst team can review all of them with more precision than traditional analysts.

Our analysis of the latest 10-K filings for the 2,600[1]+ largest and most actively-traded companies shows that the much-hyped end to the earnings recession is an accounting illusion. Our review of 500+ first quarter financial reports published to date show the illusion continuing.

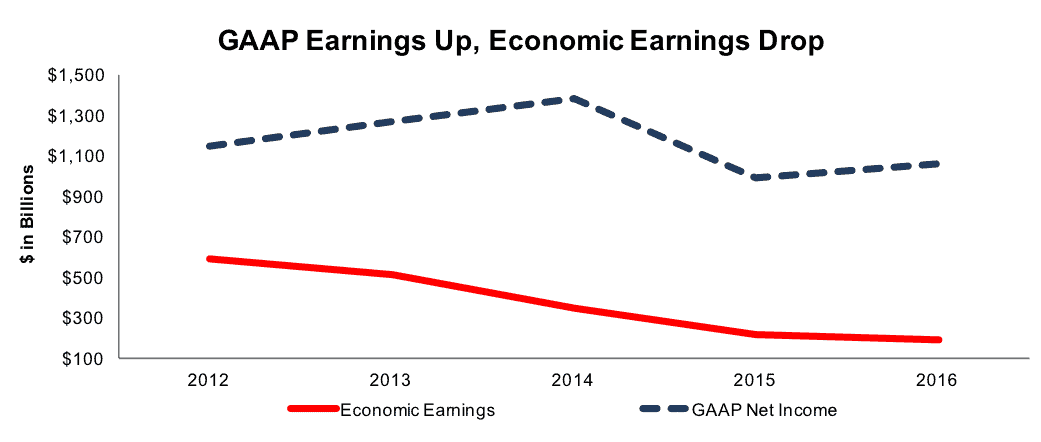

Figure 1: GAAP Earnings Offer Misleading Trend in Profits in 2016

Sources: New Constructs, LLC and company filings.

Figure 1 paints a much less rosy picture for investors looking for an earnings recovery. GAAP net income may have risen $72 billion, but economic earnings fell $26 billion. 2016’s drop in economic earnings was smaller than the $129 billion decline in 2015, but there’s definitely no recovery in corporate profits.

The primary differences between economic and GAAP earnings is that economic earnings reverse accounting distortions and capture changes in balance sheets. The most important drivers of economic earnings are net operating profits after tax (NOPAT) and invested capital, the measure of all capital invested in a business over its life regardless of financing form.

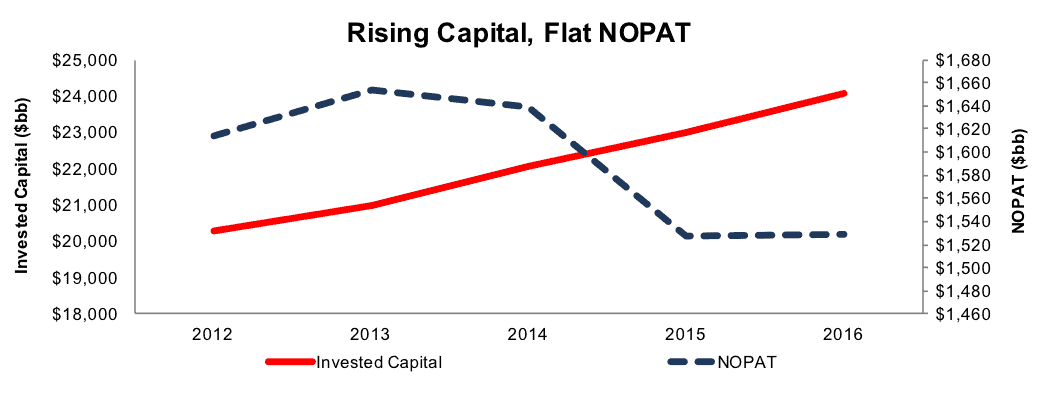

Figure 2 shows the source of the discrepancy between GAAP and economic earnings comes mostly from invested capital growth that has not resulted in growth in NOPAT. Specifically, in 2016, companies increased invested capital by $1.1 trillion while NOPAT was flat. This analysis shows how companies can grow accounting earnings through financial engineering even though cash flows are declining.

Figure 2: Trends In Net Operating Profit After Tax & Invested Capital For The Broader Market

Sources: New Constructs, LLC and company filings.

Why was NOPAT flat when GAAP net income rose last year? When we analyzed the footnotes for these companies, we discovered 21,094 adjustments with a total value of $1.1 trillion that applied to GAAP income statement results.

However, as noted above, it’s the growth in invested capital that drives the biggest wedge between GAAP earnings and economic earnings. We had to look in the footnotes to find the truth about the growth in balance sheets as well because companies hid most of this growth by writing assets down.

Asset write-downs allow companies to erase assets and shareholder equity from the balance sheet forever with a stroke of a pen. You see the charges for write-downs on the income statement about 75% of the time.

To hold companies accountable for all capital put into their business, we include written-down assets (after-tax) in our calculation of invested capital. We also add the charges for them on the income statement back to our calculation of NOPAT. In short, we normalize the effect of these unusual events for our calculation of economic earnings (and ROIC).

In 2015, companies wrote down $350 billion of assets, $78 billion of which were hidden in the footnotes or MD&A. These write-downs were driven largely by falling commodity prices.

As commodity prices stabilized in 2016, companies wrote down only $192 billion in assets, $63 billion of which were hidden in the footnotes and MD&A.

Unusually large write-downs in 2015 drove GAAP earnings artificially low comps, which set up good comps and allowed companies to report rising GAAP earnings in 2016 despite a lack of any real increase in operating profit and an economic earnings decline. The end of the earnings recession is an accounting mirage.

This article originally published on May 4, 2017.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] With an aggregate market cap of $6 trillion (more than the Russell 3000), these 2,600+ companies offer a representative sample of the overall market.

Click here to download a PDF of this report.

Photo Credit: gotcredit.com (Flickr)

2 replies to "The Earnings Recovery Is A Sham"

Thanks. This is a good piece and at this time in the market advance it is refreshing to read a comment with a fact based healthy dose of skepticism. If this information could be provided at the sector level it would be even better. Is that possible? There is allusion in this piece to commodity price related writedowns. How about away from the energy sector? What is going on in the technology sector? How about consumer staples?

Thanks for reading and commenting. We do have the ability to break this information out at the sector level, and we will certainly look into providing that data in future reports.