UPDATE: As expected the Fed did announce that it would raise the Federal Funds rate another 0.25% on Wednesday, and the market dipped slightly on the news. Also of note, Fed Chair Janet Yellen signaled that long-term neutral interest rates would be lower going forward. It appears the Fed also now realizes that lower interest rates are the new normal.

Finally, the Fed is raising interest rates again. At least, that’s what 96% of Wall Street economists, analysts, and fund managers said when surveyed about the possibility of a December rate hike. Unless virtually everyone in the financial world is wrong, it appears we’ll be getting a second rate hike from the Fed exactly a year after the first one.

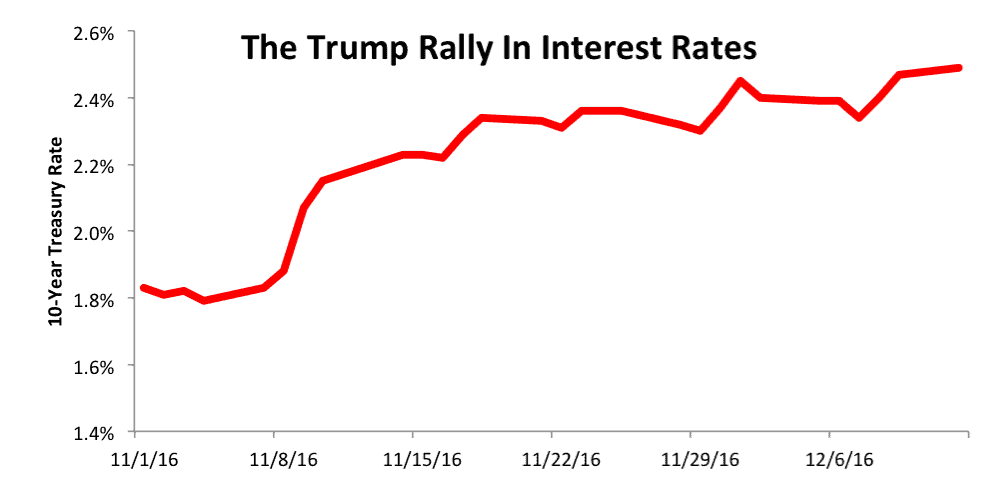

Except… haven’t rates already risen? Since the beginning of November, the yield on the 10-Year Treasury note is up from 180 basis points to 250. As Figure 1 shows, the spike began at the same time as Donald Trump’s election.

Figure 1: Yield On The 10-Year Treasury Bond Since November 1

Sources: New Constructs, LLC and company filings.

As we’ve argued in the past, the Fed is irrelevant. The market has already driven interest rates up in response to Trump’s election and a more positive economic outlook. If Yellen decides to raise rates as expected, it’s only because she’s following the signals from the market.

Investors Expect Stimulus

Donald Trump’s election has spurred a sharp increase in interest rates on the expectation that the president-elect will push through a large fiscal stimulus once he gets in to office. In particular, Trump has promised:

- The largest tax cut in history

- A tax repatriation plan to bring back some of the $2.5 trillion in corporate cash overseas

- A massive new investment in infrastructure spending[1]

Markets clearly expect these initiatives to provide a boost to economic growth and, consequently, inflation in the near-term. This shift in expectations has driven the change in interest rates, not the Federal Reserve.

The Fed Is Even More Irrelevant With Fiscal Policy On Center Stage

For the past six years, we’ve had a divided government that made it almost impossible to enact any large-scale changes to fiscal policy. As a result, investors assigned a massive importance to monetary policy, scouring Fed minutes line-by-line for any clue to future actions.

Now, Republicans control both the executive and the legislative branches and have the ability to push through material changes in tax rates, spending priorities, and regulatory matters. Now, in a dramatic reversal of recent trends, the market is surging to all-time highs in the face of a rate hike.

The events of the past month show that the Fed is a lagging, not leading, indicator for interest rates. The Fed doesn’t drive the market; the market drives the Fed.

Rates Should Stay Low In The Long-Term

Despite the recent rise in rates, our long-term thesis for low interest rates remains intact. Trump’s fiscal policy might spur growth in the long-term, but it won’t reverse the structural changes that have lowered the cost of capital and dampened inflation in recent years.

Trends such as automation, aging demographics, and the decentralization of capital allocation have all combined to push inflation and interest rates down, and all these trends should continue unabated for many years to come.

The flattening yield curve shows that investors are still not pricing in a significant rise in interest rates or inflation over the long-term.

This article originally published here on December 14, 2016.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

[1] We discussed the bipartisan support for corporate tax repatriation and infrastructure spending before the election, and the 4 stocks we recommended in that piece are up an average of ~18% since election day vs. 9% for the S&P 500.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.