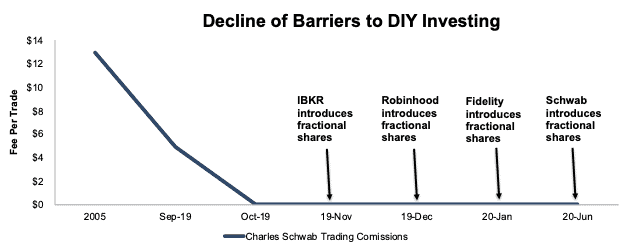

Online trading removed the need for middlemen brokers and made do-it-yourself (DIY) investing in stocks and funds possible. Add in the ability to trade for free and buy fractional shares and now DIY ETFs are possible. Investors are no longer dependent on mutual fund managers or ETF providers to construct portfolios for them.

Figure 1 shows how quickly trading commissions declined from ~$13/trade in 2005 to $0 today, a trend led by Charles Schwab and followed by nearly every other DIY trading platform.

Even with $0 cost trades, DIY investors could not get exposure to large numbers of stocks unless the bought ETFs or mutual funds. The requirement to purchase shares in round lots (as high as 100 shares until recently) prevented DIY investors from being able to build and manage portfolios. Almost no one but institutions are investing enough money to be able to buy round lots of shares given that one round lot could be more than many investors’ entire savings. For example, one round lot of shares in Apple (AAPL) on 6/23/22 equals nearly $14,000. For many DIY investors, their entire savings might be just $14,000. Figure 1 also shows how recently the major brokerages gave investors the ability to buy fractional shares.

Figure 1: It’s Never Been Easier to Do It Yourself

Sources: New Constructs, LLC and Bloomberg

Removing trading costs and allowing the purchase of fractional shares means investors are now free to create their own ETF with almost any amount of money.

Why Pay for Something You Can Do for Free

Given that the holdings and weightings of most funds are regularly, if not daily, disclosed to the public, investors have all the information needed to create their own version of these ETFs with zero management fees.

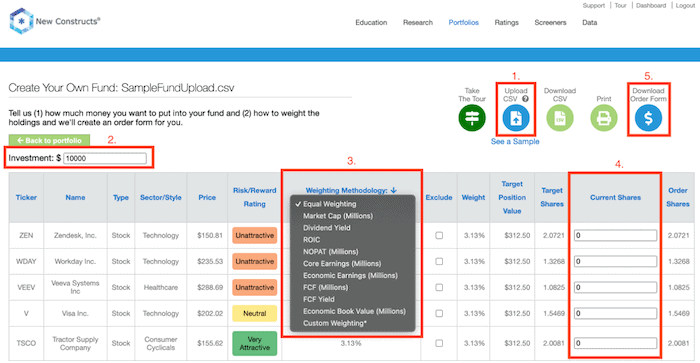

For example, investors can download all the holdings and positions sizes for Invesco QQQ here. With that data, investors only need a few seconds to upload that data into our system and produce an order form for their broker to recreate the QQQ in their account without paying any management fees.

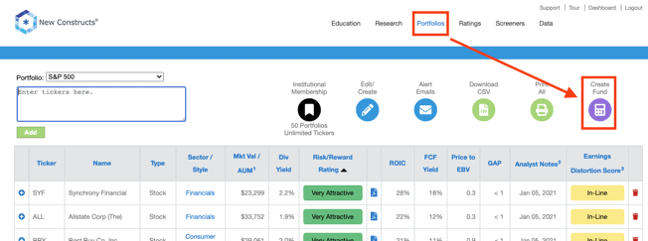

In fact, our DIY ETF technology enables all investors to create their own ETF based on any list of stocks.

Figure 2: DIY Fund Tool

Sources: New Constructs, LLC

Goodbye Fund Fees, Hello Better Asset Allocation

It is just as easy to re-balance an existing portfolio by uploading it and updating the allocations or amount of money you want to invest in the portfolio. There’s no reason for investors with access to our DIY ETF technology to pay anyone to manage a portfolio of stocks for them. Add the facts that most mutual funds underperform and ETFs are passive, and it’s hard to make a straight-faced argument for investors to pay any management fees.

Figure 3: DIY ETF without any Management Fees

Sources: New Constructs, LLC

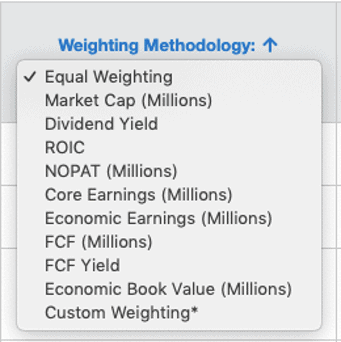

Once their holdings are in our system, investors can employ more sophisticated weighting methodologies than available from legacy ETF and mutual fund providers. For example, our clients can weight holdings based on proven-superior fundamental metrics: return on invested capital (ROIC), free cash flow (FCF), Core Earnings, etc. See Figure 4 for a list of our unique weighting methodologies. Clients can also screen, rank and select stocks based on these metrics. Our DIY ETF technology is unrivalled.

Figure 4: Weight Your Portfolio Using Better Metrics

Sources: New Constructs, LLC

While certainly not the first to enable investing in portfolios weighted based on fundamentals, (Research Affiliates has been selling non cap-weighted strategies since 2004), our DIY technology puts the power to do so in investors’ hands.

Case Study 1: DIY with Better Weighting Methodologies

Below we provide an example of how to create a custom ETF based on an existing fund’s holdings while also optimizing that fund by allocating more capital to higher-quality stocks.

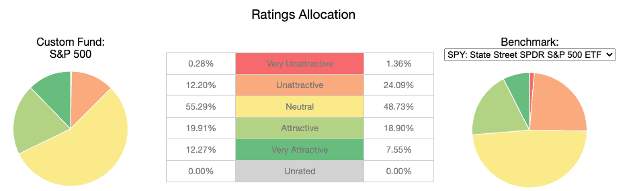

In this example, we’re looking at the State Street SPDR S&P 500 ETF (SPY), a common proxy for “the market”. Based on this ETF’s market-cap-weighting methodology, it allocates:

- 26% of assets to Attractive-or-better rated stocks

- 25% of assets to Unattractive-or-worse rated stocks.

If, instead of weighting by market cap, we weight by ROIC, a key driver of shareholder value, our DIY ETF fund allocates:

- 32% of assets to Attractive-or-better rated stocks

- 12% of assets to Unattractive-or-worse rated stocks.

Figure 5 compares the quality of stock allocations for our chosen weighting methodology, ROIC, and the chosen benchmark. We enable clients to compare their DIY ETFs to 23 different benchmarks.

Figure 5: DIY ETF Weighting vs. Benchmark Weights

Sources: New Constructs, LLC

Case Study 2: Stop Buying Stocks Just Based on Size

With our DIY ETF technology, investors can get exposure to the same bundle of stocks in any ETF or mutual fund, and they can do so with greater exposure/allocation to the best stocks of the bunch based on sophisticated fundamental research previously available only to Wall Street insiders.

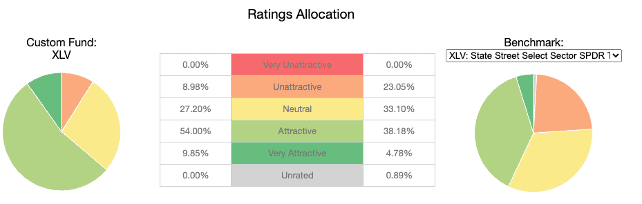

For example, State Street Health Care Select Sector SPDR Fund (XLV), which, with over $25 billion in assets under management, is the largest Healthcare ETF in our coverage universe. As we’ll show, it’s possible to gain exposure to all the stocks in this fund, but with significantly greater allocation to the highest quality stocks.

Based on its traditional market-cap weighting, XLV allocates:

- 43% of assets to Attractive-or-better rated stocks

- 23% of assets to Unattractive-or-worse rated stocks.

If, instead of weighting by market cap, we weight by Core Earnings, our DIY ETF allocates:

- 64% of assets to Attractive-or-better rated stocks

- 9% of assets to Unattractive-or-worse rated stocks.

Figure 6 shows the comparison between the two weighting methodologies.

Figure 6: Weighting XLV by Core Earnings Provides Higher-Quality Asset Allocation

Sources: New Constructs, LLC

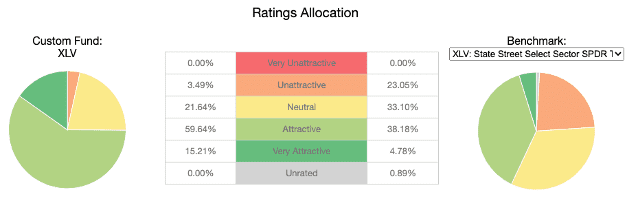

If we weight by economic earnings, our DIY ETF allocates:

- 75% of assets to Attractive-or-better rated stocks

- 3% of assets to Unattractive-or-worse rated stocks.

Figure 7 shows the difference in ratings allocation between weighting XLV’s holdings by economic earnings versus weighting its holdings by the standard methodology.

Figure 7: Weighting XLV by Economic Earnings vs. Market-Cap Weighted

Sources: New Constructs, LLC

Cost Savings Can Be In the Thousands of Dollars, Too

Below we provide an example of how large the cost savings can be for investors who build DIY ETFs instead of investing in Dunham Focused Large Cap Growth Fund (DAFGX).

Dunham Focused Large Cap Fund is one of the most expensive Large Cap funds under coverage with total annual costs of 4.03% compared to just 0.21% for the style benchmark, iShares Russell 1000 Growth ETF (IWF).

DAFGX’s holdings earn an ROIC greater than the stocks in the S&P 500. Given the strong ROIC of its holdings, it’s reasonable that an investor may want to recreate this portfolio but do so without the excessive total annual costs.

If we assume a 10-year holding period, a $10,000 initial investment, and a 10% annual return for the fund, the accumulated total costs of owning DAFGX are:

- $1,351 over 3 years

- $5,091 over 10 years

In other words, using our DIY ETF technology to recreate DAFGX with no fees could save upwards of $5,000 in fees over 10 years.

This article originally published on January 25, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

1 Response to "The Paradigm Shift to DIY ETFs"

Most people are too lazy to trade their own accounts. Their are so many institutional options available people should utilize. Pay the fee, it is worth it.