We published an update on this Long Idea on September 15, 2023. A copy of the associated report is here.

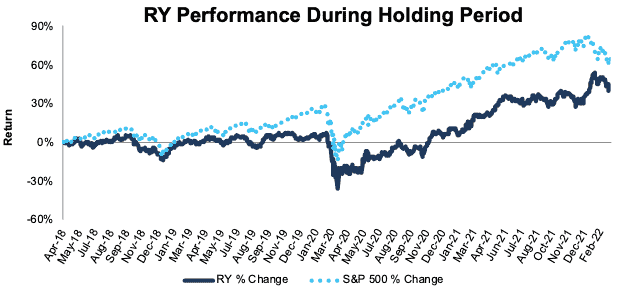

We first made Royal Bank of Canada (RY: $110/share) a Long Idea in April 2018. Since then, the stock is up 43% compared to a 63% gain for the S&P 500. Despite underperforming the market, the stock could conservatively be worth $170+/share today – a 55%+ upside.

We leverage more reliable fundamental data[1], shown to provide a new source of alpha, with qualitative research to pick this Long Idea.

Royal Bank of Canada’s Stock Has Strong Upside Based on:

- its growth in Canadian and the United States

- diversified business segments

- its ability to generate profits in low-interest rate environment

- strong market position in Canada funds growth plans in the U.S. market

- the current valuation of the stock implies profits will permanently fall 30% below current levels

Figure 1: Long Idea Performance: From Date of Publication Through 3/1/2022

Sources: New Constructs, LLC

What’s Working

Large and Growing Canadian Business: Royal Bank of Canada boasts the largest retail network in Canada with 1,182 branches and 4,032 ATMs. For comparison, Toronto-Dominion Bank (TD) has 1,061 branches and 3,381 ATMs while Bank of Nova Scotia (BNS) has 954 branches and 3,766 ATMs. Royal Bank of Canada’s large retail presence helps the bank achieve #1 or #2 in market share for all its major personal & consumer banking products in Canada.

Royal Bank of Canada is growing its Canadian business. The bank’s average deposits in fiscal (FYE is 10/31) 1Q22 was $408 billion, or 31% above 1Q20, and average loan balances in fiscal 1Q22 of $415 billion were 15% above 1Q20.

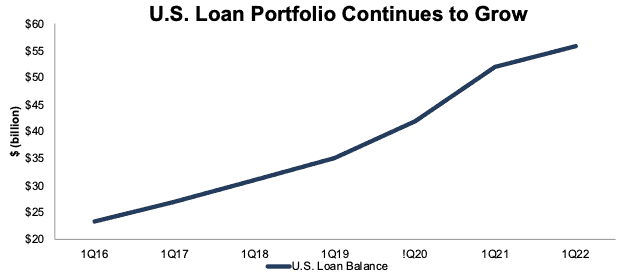

U.S. Provides More Growth Opportunities: Royal Bank of Canada notes in its 2021 40-F that it “leverages its balance sheet to support clients and making ongoing investments in talent and technology to support future growth” in its U.S. market. Royal Bank of Canada’s acquisition of the U.S.-based City National Bank enables City National Bank to offer “big bank capabilities” to its clients. Additionally, the U.S. business benefits from the annual $4 billion Royal Bank of Canada spends on technology. Ever since the acquisition in fiscal 2016, City National Bank’s loan portfolio has grown. Per Figure 2, the company’s City National Bank segment’s loan balances grew to $56 billion in fiscal 1Q22, or nearly 2.5x fiscal 1Q16 levels.

Figure 2: U.S. Loan Balance: Fiscal 1Q16 – 1Q22

Sources: New Constructs, LLC and company filings

Diversified Business Reduces Risk: Royal Bank of Canada operates in five segments, which positions the bank to generate profits in a variety of ways across different market environments. Over time, the bank has diversified away from its largest segment, personal & consumer banking. Personal & consumer banking accounted for 56% of the bank’s reported net income in fiscal 2012 compared to 48% in fiscal 1Q22. Meanwhile, the bank’s wealth management segment rose from 11% to 19% of total reported net income over the same time.

Royal Bank of Canada’s insurance, investor & treasury services, and capital markets segments accounted for 33% of total reported net income in fiscal 1Q22.

Non-Interest Income Generates Profits in Low-Interest Rate Environments: The bank’s large and growing non-interest income helped it generate profits in low-interest rate environments, such as the past decade. The rise in non-interest income from $16.7 billion in fiscal 2012 to $29.6 billion over the trailing-twelve-months (TTM) have helped the bank grow its Core Earnings from $7.4 billion to $13.2 billion.

What’s Not Working

End of PPP Programs Will Hurt Loan Balances: Like nearly all banks operating in the U.S., Royal Bank of Canada’s U.S. loan portfolio grew under the paycheck protection program (PPP). The bank expects its PPP loans to largely end by the end of fiscal 2022, which will negatively affect its loan balances. However, in fiscal 1Q22, PPP loans represented just 4% of the total U.S. loan portfolio, and strong growth in the rest of the U.S. market should counter the decline. Excluding PPP loans, the bank’s U.S. loan balance grew 15% year-over-year (YoY) in fiscal 1Q22.

Supply Chain and Labor Issues Increase Credit Risk: The ongoing supply chain crisis and labor shortages have resulting in operational disruptions at some businesses, interrupting cash flows and increasing the credit risk of the bank’s loan portfolio. However, high underwriting standards and appropriate risk pricing should provide a buffer from this risk. The bank’s provision for credit losses (PCL) on impaired loans in fiscal 1Q21 are below pre-pandemic average levels. Therefore, a major deterioration in credit conditions will require additional provisions, causing a drag on earnings.

Fears of Long-Term Fintech Disruption Weigh on the Stock: As a traditional bank, investors may believe it is ill-equipped to compete in an ever-digitized economy. However, Royal Bank of Canada has methodically invested in technology for years, and the bank’s growth during the pandemic reveals it is well-suited for a more digitized financial future. Furthermore, as the largest (by revenue) bank in Canada, Royal Bank of Canada can scale technology across its network in much a much more cost-efficient way than its peers. Given that banks literally create money, it seems more likely they will acquire disruptive fintech firms and absorb them rather than be supplanted.

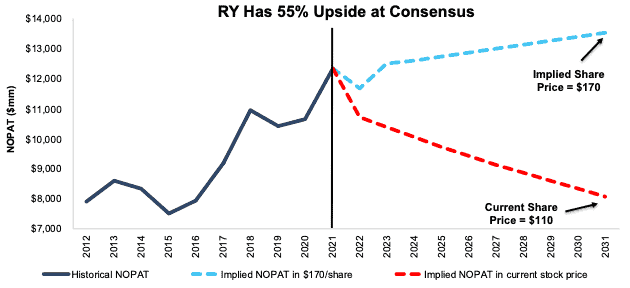

Stock Is Priced For a 30% Profit Decline

Royal Bank of Canada’s price-to-economic book value (PEBV) ratio of 0.7 means the stock is priced for profits to fall, permanently, by 30% from current levels. Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for Royal Bank of Canada.

In the first scenario, we assume Royal Bank of Canada’s:

- NOPAT margin falls to 24% (five-year average vs. 26% in fiscal 2021) from fiscal 2022 – 2031 and

- revenue falls by 3% (vs. fiscal 2022 – 2023 consensus CAGR of +4%) compounded annually through 2031.

In this scenario, Royal Bank of Canada’s NOPAT falls 4% compounded annually over the next decade and the stock is worth $110/share today – equal to the current price. For reference, Royal Bank of Canada grew NOPAT by 9% compounded annually over the past five years. In this scenario, NOPAT would fall to $8.1 billion, which would be Royal Bank of Canada’s lowest NOPAT since 2016.

Shares Could Reach $170 or Higher

If we assume Royal Bank of Canada’s:

- NOPAT margin falls to 25% (compared to 26% in fiscal 2021) in fiscal 2022 – 2031,

- revenue grows at a 4% CAGR (equal to fiscal 2022 – 2023 consensus) through 2023, and

- revenue grows by just 1% compounded annually from fiscal 2024 – 2031, then

the stock is worth $170/share today – 55% above the current price. In this scenario, Royal Bank of Canada’s NOPAT grows by just 1% compounded annually over the next decade. Should Royal Bank of Canada grow NOPAT faster, the stock has even more upside.

Figure 3: Royal Bank of Canada’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on March 2, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.