The Financial Accounting Standards Board (FASB) introduced ASU 2016-02 (Topic 842) to require companies to recognize operating lease assets and liabilities on the balance sheet. Details here. However, companies have found other ways to continue to hide lease debt from their balance sheets as detailed in Variable Leases Under ASC 842: First Evidence on Properties and Consequences. As a result, we’re updating our models to ensure they capture all liabilities related to operating leases, both on and off-balance sheet.

Background

As part of ASU 2016-02, companies can exclude variable lease payments from the initial recognition of the total operating lease obligation if certain criteria are met. Companies can classify a lease as variable if it is linked to an index or specific rate or based on a performance metric or output.

Lease payments based on a performance metric or output are excluded from the initial calculation of the total lease obligation. As the performance metrics are met, a company incurs variable lease costs in lieu of revaluing the total obligation.

Because companies can exclude these variable lease costs from the total operating lease obligation, they can materially reduce the amount of lease liabilities reported on the balance sheet. As a result, we updated our models to capture variable lease costs in our standardized present value of future operating leases calculation.

Additionally, ASU 2016-02 requires companies to provide information on leases that are signed and create significant rights or obligations for the lessee but have not yet commenced. These “Not-Yet -Commenced” leases are also excluded from the operating lease obligation, and we updated our models to capture them in our standardized present value of future operating leases calculation.

The Update: Including Variable and Not-Yet-Commenced Lease Expenses in Operating Leases

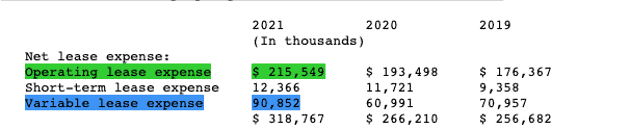

Variable Lease Expense: Starting on February 10, 2023, we will include variable lease expenses in our standardized present value of future operating leases calculation. We use a multiplier (Variable Lease Expense / Operating Lease Expense) to value the variable lease expense; so we can and add it to our present value of operating leases calculation. For example, using the data in Figure 1, we divide the disclosed variable lease expense of $90,852 on page 66 of Lululemon Athletica’s (LULU) 2022 10-K by the operating lease expense of $215,549 to calculate a multiplier of 0.42. We then multiply our standardized present value of operating leases by the multiplier (e.g. 0.42) to determine the present value of variable leases. Then, we add the present value of variable leases to the standardized present value of operating leases.

Figure 1: Variable Lease Expense In Lululemon’s 2022 10-K

Sources: New Constructs, LLC and company filings.

These model changes will impact Invested Capital and net operating profit after-tax (NOPAT) for companies with material variable lease expenses. More details below.

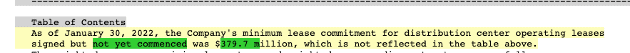

Not-Yet-Commenced Lease Expense: Starting on February 10, 2023, we will include Not-Yet-Commenced leases in our standardized present value of future operating leases calculation. Similar to our adjustment for variable lease expenses, we use a multiplier (Not -Yet-Commenced / Total Lease Payments) to value the Not-Yet-Commenced leases; so we can and add it to our present value of operating leases calculation.

For example, using the data in Figure 2, we divide the disclosed value of Not-Yet-Commenced leases of $379.7 million on page 67 of Lululemon’s 2022 10-K by the disclosed total lease payments of $944.8 million to calculate a multiplier of 0.40. We then multiply our standardized present value of operating leases by the multiplier (e.g. 0.40) to determine the present value of not-yet-commenced leases. Then, we add the present value of Not-Yet-Commenced leases to the standardized present value of operating leases.

Figure 2: Not-Yet-Commenced Leases In Lululemon’s 2022 10-K

Sources: New Constructs, LLC and company filings.

Impacts on our Models

Our updated calculations to capture variable and Not-Yet-Commenced leases will increase both Invested capital and net operating profit after tax (NOPAT) for affected companies. Invested capital will increase since variable and Not-Yet-Commenced leases will be added to total invested capital. NOPAT will increase since the interest expense related to variable leases will be removed to ensure an apples-to-apples, unlevered measure of the company’s profits.

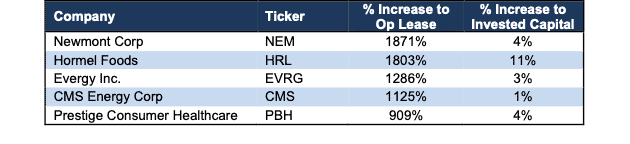

Figure 3 highlights companies that will have the largest change to the present value of future operating leases due to the inclusion of variable leases.

Figure 3: Largest Changes in PV of Future Operating Leases Due to Variable Leases

Sources: New Constructs, LLC and company filings.

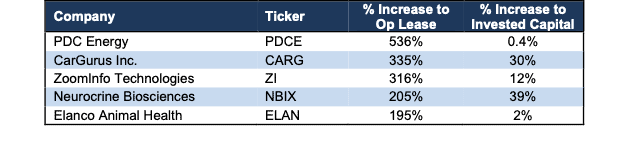

Figure 4 highlights the companies that will have the largest change to the present value of future operating leases due to the inclusion of Not-Yet-Commenced leases.

Figure 4: Largest Changes in PV of Future Operating Leases Due to Not-Yet-Commenced Leases

Sources: New Constructs, LLC and company filings.

This article was originally published on February 10, 2023.

Disclosure: David Trainer, Kyle Guske II, Matt Shuler, and Sam Moorhead receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.