For years, we’ve been adding mutual funds to the Danger Zone because they get good ratings from legacy research providers yet have poor holdings and high costs. Heeding these warnings can protect your portfolio from blowups and help you outperform.

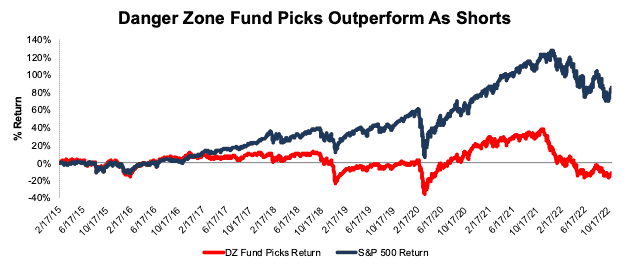

The 36 mutual funds we’ve put in the Danger Zone have generated an equal-weighted cumulative -11% return while the SPY is up 84%. 35 of those 36 mutual funds, starting with the first pick in February 2015, have underperformed[1] the S&P 500, as measured by State Street SPDR S&P 500 ETF (SPY). Performance stats are as of October 31, 2022.

When we put a mutual fund in the Danger Zone, investors would be wise to steer clear. Figure 1 shows the performance of our Danger Zone Fund picks versus the S&P 500 since our first Danger Zone mutual fund pick.

Figure 1: Danger Zone Fund Picks: Performance Since Inception Through October 31, 2022

Sources: New Constructs, LLC

Note: Performance analysis excludes ETF costs, transaction costs, and dividends.

Our performance-tracking method assumes equal-weighting of all positions, e.g. each mutual fund gets $1 of investment when added to the Danger Zone. The performance of each mutual fund is based on the return on the $1 allocated to it. The return is based on the price movement of the mutual fund for as long as that mutual fund is in the Danger Zone. When measuring the performance of the overall portfolio, the returns of each mutual fund are weighted equally. When a mutual fund is removed from the Danger Zone, the gain (or loss) will be fixed and remain unchanged in terms of contribution to the overall return of the Danger Zone picks since inception.

Anyone focused on fulfilling the fiduciary duty of care recognizes that analyzing the holdings of a mutual fund is critical to finding funds with attractive risk/reward. Our forward-looking mutual fund and ETF ratings are based on proven superior[2] fundamental research on each individual fund holding. This approach captures the future risk/reward of a fund and differs from traditional fund research that’s backward-looking and based on past price performance.

We’re here to help investors navigate these turbulent times. Our uniquely rigorous fundamental research consistently earns SumZero’s #1 ranking for stock picking in 10+ categories, including the #1 All-Time ranking. Investors deserve reliable fundamental research, more than ever, to protect their portfolios from overvalued stocks, ETFs, mutual funds, and Zombie Stocks.

This article originally published on November 17, 2022.

Disclosure: David Trainer, Kyle Guske II, Matt Shuler, and Italo Mendonça receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Performance of each mutual fund Danger Zone pick is tracked from the closing price on the day our Danger Zone report was published through October 31, 2022 or, in the case of closed Danger Zone picks, the date we closed the Danger Zone pick.

[2] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School & MIT Sloan and published in The Journal of Financial Economics.