When we write our Long Ideas, we try to anticipate every possible outcome. We discuss and attempt to refute the bear case, model multiple DCF scenarios, and try to account for how macroeconomic factors, competitive pressures, and management incentives might impact future operating performance.

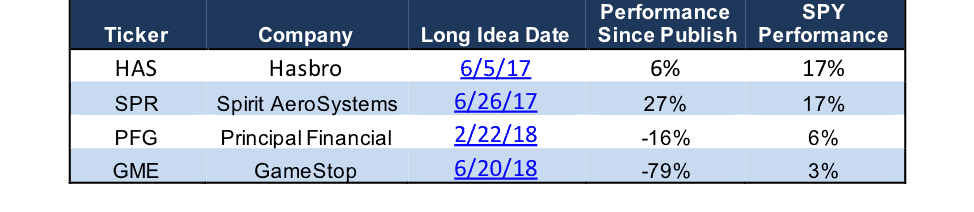

Nevertheless, sometimes we get things wrong. Maybe, we underestimate the validity of the bear case or place too much faith in the management team. Maybe, there are unexpected macroeconomic or industry-specific shocks that throw the company’s business into disarray. Figure 1 shows four Long Ideas that have faced issues we did not anticipate and compares their performance to the S&P 500 (SPY).

Figure 1: Performance of HAS, SPR, PFG, and GME vs. SPY

Sources: New Constructs, LLC and company filings

Below we review what went wrong with these picks and whether to close or keep the positions open. In short, we are reiterating Spirit AeroSystems (SPR) and GameStop (GME) as this week’s Long Ideas and closing positions in Hasbro (HAS) and Principal Financial (PFG).

Spirit AeroSystems (SPR)

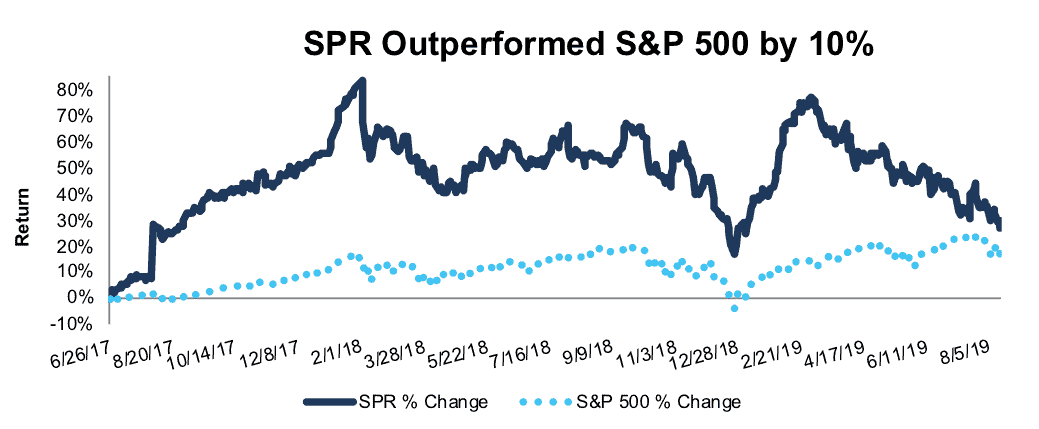

We first picked Spirit AeroSystems (SPR) as a Long Idea in June 2017. The stock has risen 27% since then and outperformed the S&P 500, which is up 17%, per Figure 2.

Figure 2: SPR Performance Vs. S&P 500

Sources: New Constructs, LLC and company filings

In our original report, we highlighted SPR’s rising margins and return on invested capital (ROIC), more efficient operations than peers, and its extensive relationship with both Airbus and Boeing. The relationship with the latter has been a drag on the stock’s performance after questions arose about the safety of Boeing’s 737 MAX following two deadly crashes. SPR is down 27% since March of this year.

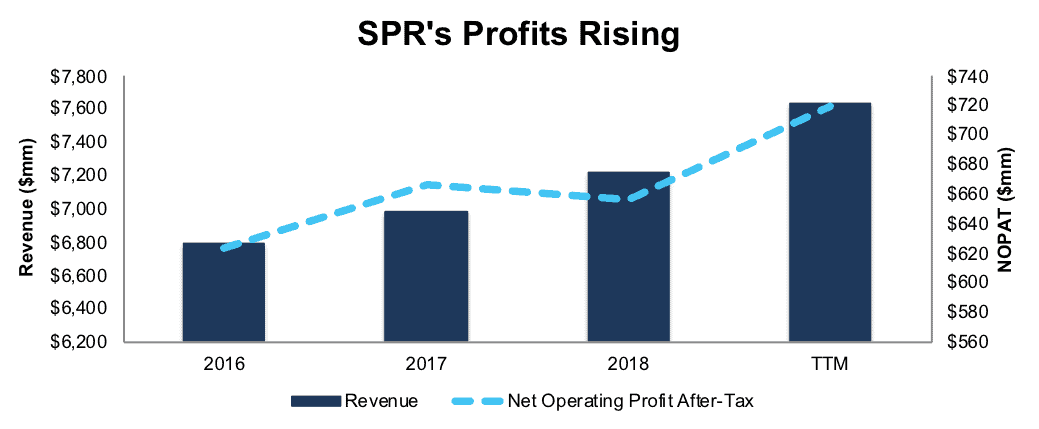

On the surface, the grounding of an important plane, such as the 737 MAX would be a negative for a parts supplier such as SPR. However, due to the firm’s contract with Boeing, and the expectations that the plane will return to service, SPR’s fundamentals have improved since our original report. Per Figure 3, revenue and NOPAT have grown 3% compounded annually since 2016.

Figure 3: SPR’s Revenue & Profits on the Rise

Sources: New Constructs, LLC and company filings

Despite the grounding, Boeing remains confident that the 737 MAX will return to the skies. To ensure it can meet deliveries once the ground is lifted, Boeing and SPR have agreed that SPR will continue producing fuselages for the plane at a rate of 52 units per month, even while Boeing has limited its own production. SPR expects to maintain this production rate throughout next year, and has enacted certain cost measures, such as reducing overtime and external contractors, to maintain high margins on the production of the plane.

Industry Expects 737 MAX Will Return. The 737 has been Boeing’s best-selling plane for years, and in March of this year, the company had 4,700 unfilled orders for 737s. In the short-term, the grounding creates capacity issues for airlines, as they shuffle routes, add older planes to their fleet, or flat out cancel certain flights. Longer-term, the 737 MAX is an integral part to meeting growing demand for air travel.

The good news for suppliers such as SPR is industry executives expect the plane to be cleared to fly again. possibly as soon as the end of this year.

- Boeing’s CEO, Dennis Muilenburg, expects the plane will fly again by the end of 2019

- The Federal Aviation Administration associate administrator for aviation safety, Ali Bahrami, said there’s no timeline for return, but that Boeing’s CEO’s expectations “sounded correct.”

- American Airlines “ remains confident” the plane will be recertified in 2019 and recently scheduled new routes flying the 737 MAX in November.

- Ryanair Holdings expects the plane to be cleared before the end of 2019.

Air Travel Demand Remains Robust. Beyond the 737, demand for air travel remains in a long-term uptrend, which bodes well for the industry at large. According to the International Civil Aviation Organization(ICAO), passengers carried on aircraft has grown from 1.6 billion in 2002 to 4.3 billion in 2018, or 6% compounded annually. The International Air Transport Association (IATA) expects passengers carried could double, and reach 8.2 billion by 2037.

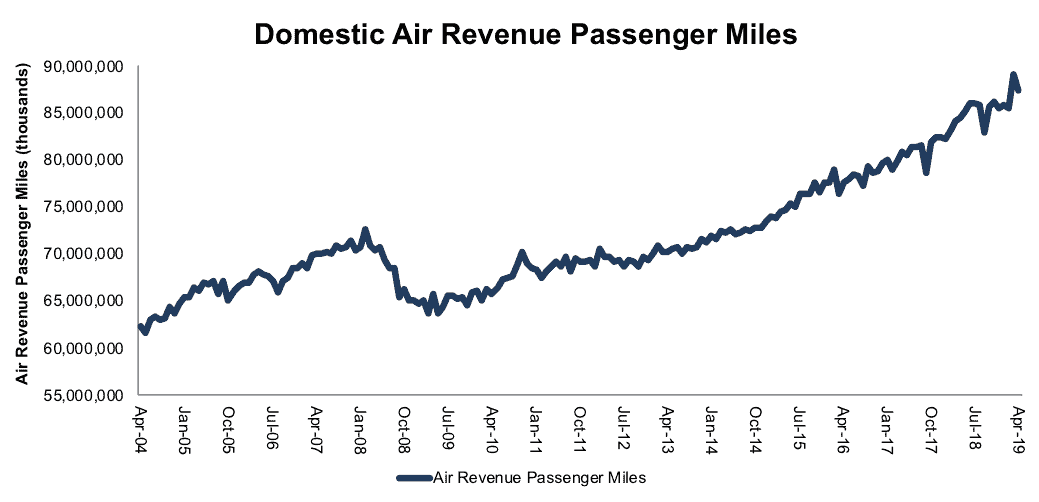

More important than passenger growth alone is the increase in airline traffic. Per Figure 4, seasonally adjusted revenue passenger miles (RPM), or the number of miles paying customers travel by air, has increased 2% compounded annually in the U.S. since 2004.

The IATA reports global passenger traffic (measured as revenue passenger kilometers or (RPK)) has increased year-over-year in each of the last six years, and is expected to increase YoY again in 2019.

Figure 4: U.S. Air Passenger Miles Growth over Last 15 Years

Sources: U.S. Bureau of Transportation and New Constructs, LLC

SPR Remains Undervalued. Despite outperforming the S&P 500 since our original report, SPR remains undervalued after its large fall in 2019. At its current price of $71/share, SPR has a price-to-economic book value (PEBV) ratio of 0.8, which means the market expects its NOPAT to permanently decline by 20%. This expectation seems overly pessimistic given SPR’s ability to grow profits in recent years, and the expectations for the 737 remaining positive.

If SPR can maintain 2018 NOPAT margins (9%, and slightly below TTM), and grow NOPAT by just 4% compounded annually for the next decade, the stock is worth $99/share today – a 34% upside. See the math behind this dynamic DCF scenario.

GameStop (GME)

We first made GameStop (GME: $3/share) a Long Idea on June 20, 2018, in our article “Beat Private Equity to the Punch on This Value Opportunity”. At the time, the company had undertaken a strategic review process that included the possibility of selling itself, and we believed it had potential upside in the case of a private equity buyout.

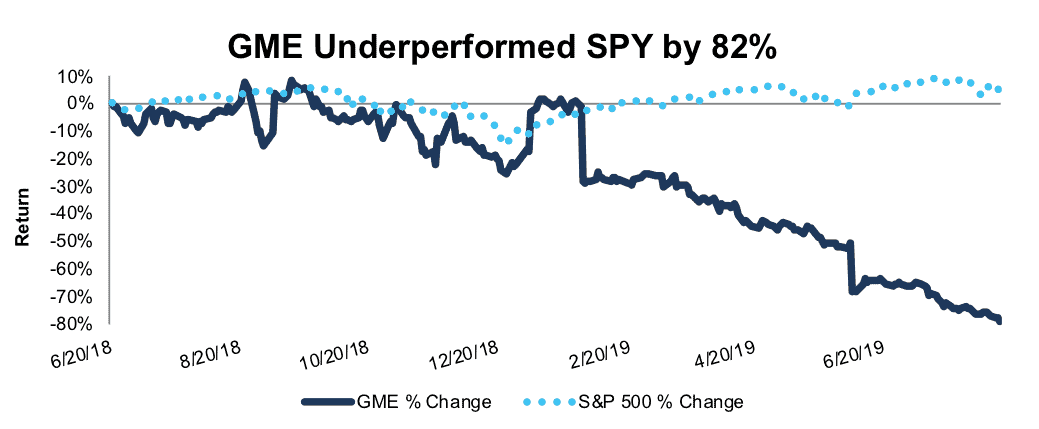

Over the next seven months, the stock seesawed back and forth on various rumors of potential buyouts. However, the company finally announced in January 2019 that they were concluding the process without selling the company. The stock immediately fell 25%, and it has been on a steady decline ever since, as shown in Figure 5.

Figure 5: Performance History: GME vs. SPY Since June 20, 2018

Sources: New Constructs, LLC and company filings

With the potential of a buyout removed, GME has been unable to find a floor, and shorts continue to pile in to the stock. There are currently 67 million shares sold short (67% of the float) a 40% increase from the prior month. The constant influx of shorts has driven down the stock in recent months, but it also creates the potential for a short squeeze on any positive news going forward.

Can New Management Stabilize Profits? In part due to its exploration of a sale, GME delayed identifying a permanent replacement for its former CEO Michael Mauler, who resigned in May of 2018 after just three months on the job. Interim CEO Shane Kim oversaw the company for nearly a year before the company finally chose a permanent CEO in George Sherman in March of this year. Over the following months, the company replaced its CFO and chief merchandising officer as well.

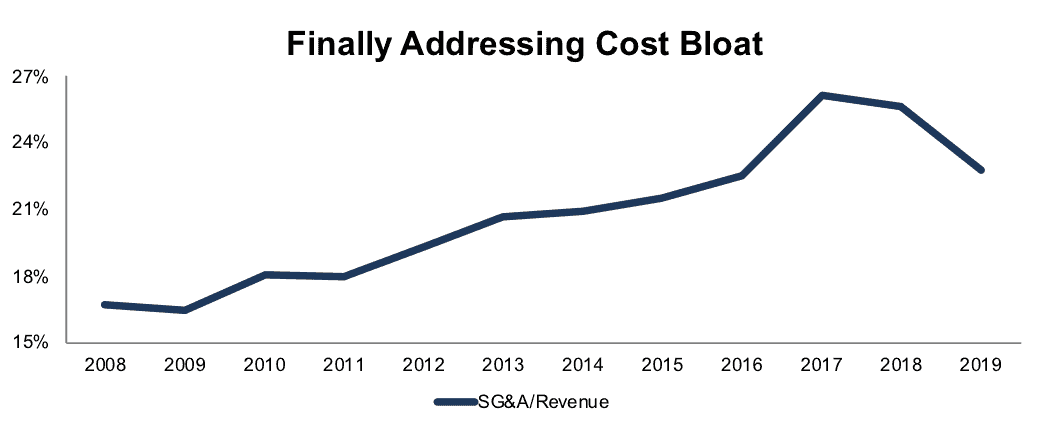

With a new, permanent management team in place for the first time in over a year, GME can finally start to address some of the persistent issues that have plagued the company in recent years. Most notably, GME’s leadership will aim to streamline the company’s bloated cost structure. As Figure 6 shows, GME’s selling, general, and administrative (SG&A) expense increased from 17% of revenue in 2008 to 26% in 2018.

Figure 6: GME SG&A as a % of Revenue: 2007-2019

Sources: New Constructs, LLC and company filings

SG&A declined in 2019 after the sale of the company’s Spring Mobile business, but it remains elevated by historical standards. Management has already made some moves to reduce the cost structure with the reported layoffs of 50 management-level employees.

Beyond cutting costs, the new management team’s main goal will be to find new growth opportunities to offset the decline in the company’s core used games business. Initiatives on this front include:

- Redesigning stores to better highlight accessories and collectibles and make the shopping experience more experiential

- Investing in esports to deepen its relationship with consumers and build a new generation of customers

- Integrating some of its properties – such as ThinkGeek – in order to deliver a more comprehensive product selection and experience

While these initiatives may take some time to start producing real cash flows, we believe these are the right moves to stabilize the business over the long-term. In addition, GME will get a nice tailwind next year with the expected launch of a new console generation for the PlayStation and Xbox. 2019 projects to be a difficult year, but there’s reason to be optimistic about the company’s results improving in 2020.

In addition to these business initiatives, GME’s new management will also need to implement better corporate governance practices. In particular, the company’s 2019 10-K revealed a material weakness in internal control over financial reporting. GME’s auditor found that the company had failed to maintain adequate controls over end-user access to IT systems involved in the financial reporting process. The new management team has promised to address and correct this deficiency by the end of this year.

All these issues mean that turning around GME will be a big task, but the management is pointing the business in the right direction, and the market has set the bar really low for them to get the stock moving up.

Valuation Provides Upside. At its current price of ~$3/share, GME has a PEBV ratio of 0.1. This ratio means the market expects the company’s profits to permanently decline by 90%.

Our reverse discounted cash flow model shows just how low the expectations for GME are. The company’s current stock price implies that its revenue will decline by 10% compounded annually and its profit margin will go to zero by year five. See the math behind this dynamic DCF scenario.

The market currently projects that GME will be out of business in five years. We think that’s overly pessimistic for a company that still has significant cash flows, a new management team, and potential short-term tailwinds from a new console cycle. In addition, surveys show that 66% of gamers still prefer physical discs, which contradicts the widely held notion that GameStop’s core business is on the brink of being obsolete.

If GME’s revenue declines by 10% compounded annually for the next five years, but then it’s able to stabilize revenue and maintain 2% NOPAT margins (down from 3% TTM) after that, the stock has a fair value of $12/share today – a 257% upside from the current stock price. See the math behind this dynamic DCF scenario.

This valuation is still below the stock price from our initial recommendation, and in retrospect we certainly erred by placing too much weight on a potential buyout deal and not enough on the company’s poor management. However, we think the market has now overreacted to GME’s issues. With a new management team in place, potential growth from a new console cycle in 2020, and the potential for a short squeeze, we are keeping GME open as a Long Idea and looking for a more attractive exit point to minimize our losses on this position.

Closed Positions

While we decided to maintain our positions in SPR and GME, we are closing our positions in HAS and PFG. We determined that SPR’s problems are more likely than not to be temporary, while GME’s valuation has dropped so low that it still presents an attractive risk/reward. HAS and PFG, on the other hand, appear to have more long-term issues than SPR, and their valuations are not nearly as appealing as GME.

Hasbro (HAS)

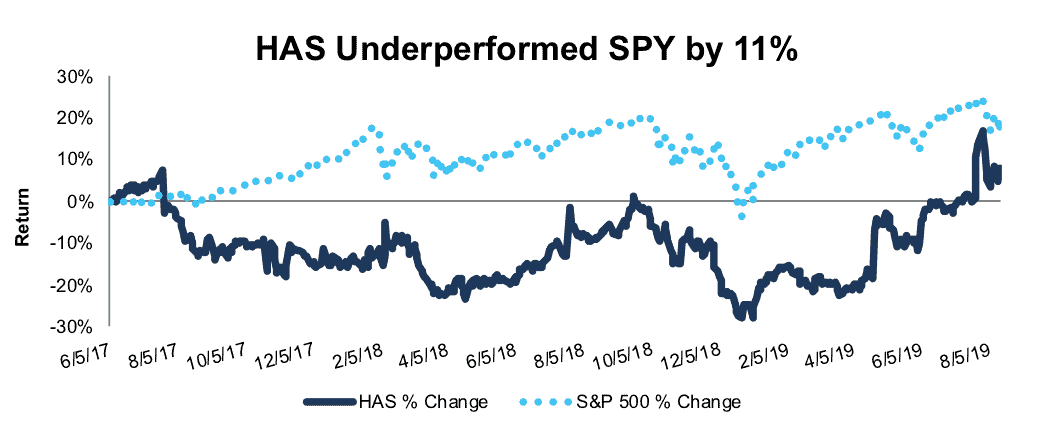

We first made Hasbro (HAS: $114/share) a Long Idea in June of 2017. The stock is up 6% since then and has underperformed the S&P 500, which is up 17%, per Figure 7.

Figure 7: Performance History: HAS vs. SPY Since June 5, 2017

Sources: New Constructs, LLC and company filings

In our original report, we highlighted the company’s industry-leading position, superior corporate governance, and growth potential from its brand partnership with Disney (DIS). Those factors all still remain in place, but we underestimated the bear case around the company’s reliance on its retail distribution partners, specifically Toys R’ Us.

Nightmare 2018. Toys R’ Us declared bankruptcy in September of 2017, and the announcement had an immediate impact on HAS’s stock, which fell by ~20%. The following year bore out the market’s concern, as HAS’s after-tax operating profit (NOPAT) declined by 32% in 2018, and its return on invested capital (ROIC) fell from 17% to 11%.

While Toys R’ Us represented the main headwind for Hasbro last year, it wasn’t the only issue the company faced. HAS’s revenue declined by 12% in 2018, while Toys R’ Us had only accounted for 9% of its sales in the previous year. Competition from Mattel (MAT) and private label toy brands selling through online channels also diminished the company’s market share.

In addition to these factors, continued tariff concerns weighed on the stock, as the majority of the company’s products are manufactured in China.

2019 Recovery. Since the beginning of 2019, however, HAS’s stock has been on a tear and is up 45% year to date. The company is starting to replace Toys R’ Us as a distribution channel, its Disney-branded products are growing rapidly due to Disney’s box office success, and other brands such as Magic: The Gathering are also experiencing a revival.

Despite this improvement, the fundamentals still look troubling. TTM NOPAT is $447 million, up just 1% from 2018, and ROIC remains at 11%. While there are encouraging signs of a recovery, the market seems to be getting ahead of the fundamentals slightly.

Valuation Implies Significant Growth. At its current stock price of $114/share, HAS looks expensive by traditional metrics. It currently has a P/E ratio of 47 and a price to book of 8.6, both significantly above the S&P 500 average.

HAS does not look as overvalued based on our numbers, but it is still expensive. The stock has a price to economic book value (PEBV) ratio of 2.3. This ratio is below the S&P 500 (SPY) weighted average of 3.0, but well above the level of a stock we would typically consider for a Long Idea.

In order to justify its stock price, HAS must achieve its 2016 NOPAT margin of 13% (up from 10% TTM) and grow NOPAT by 7% compounded annually over the next 14 years. See the math behind this dynamic DCF scenario.

Those are high expectations for any company. HAS certainly has significant growth opportunities as it bounces back from its nightmare 2018, but we’re hesitant to bet on that level of growth for any stock. As a result, we believe there’s better risk/reward in the market, and we’re closing our position for a slight gain.

Principal Financial Group (PFG)

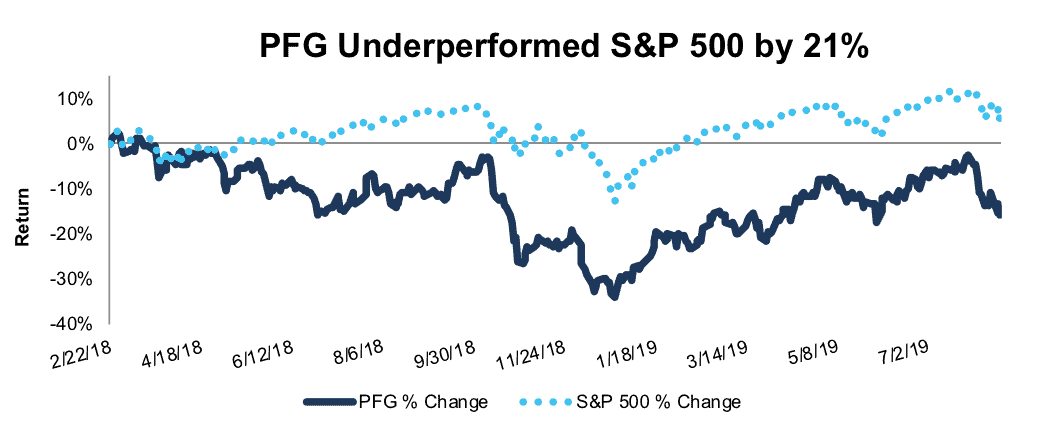

We first picked Principal Financial Group (PFG) as a Long Idea in February 2018. The stock has fallen 16% since then and underperformed the S&P 500, which is up 6%, per Figure 8.

Figure 8: PFG Performance Vs. S&P 500

Sources: New Constructs, LLC and company filings

In our original report, we highlighted PFG’s rising assets under management, the quality of its mutual funds, and its high NOPAT margins relative to peers.

While assets under management are still rising, its mutual fund offerings are no longer as attractive, and its business as a whole shows signs of weakness due to fee pressure across the industry. Moving forward, its ability to withstand the ongoing “war on fees” in the asset management industry, makes the stock less appealing than before.

Mutual Fund Quality Declined. In our original report, we noted PFG offered mutual fund with superior holdings and lower costs. At the time, 21% of PFG’s mutual funds received an Attractive-or-better rating, while only 19% received an Unattractive-or-worse. Peer fund providers, such as Invesco, Voya Financial, and Prudential Investments, earned Unattractive-or-worse ratings on 40%, 34%, and 47% of their funds.

Since then, the quality of PFG’s mutual fund offerings has deteriorated. Now, only 15% of its funds earn an Attractive-or-better rating while 37% receive an Unattractive-or-worse rating. PFG’s mutual fund ratings decline doesn’t give us confidence that it can sustain higher fees, as the only reason any manager can charge higher fees is by allocating to higher quality holdings that lead to outperformance.

Declining Fees Add Pressure to the Business. Since 2000, the cost of fund investing has been cut in half, according to Morningstar data. In 2018, average fund fees fell 6%, which was the second biggest year-over-year drop in two decades. The decline in fees is driven by an increase in low-cost passive investing, a trend we expect to continue. To maintain competitiveness and keep fund outflows to a minimum, some of the largest mutual fund providers have cut fees to or near-zero. Fidelity first offered a no-fee index fund in August 2018, and in response, J.P. Morgan, Vanguard, and BlackRock lowered fees on their top funds.

Falling fees put significant pressure on smaller fund providers like Principal Financial Group. In 2018, fee based revenue accounted for 30% of its total revenue. In each of the past three quarters, fee based revenue fell YoY due to a decline in fees combined with poor equity market performance.

Valuation Largely in Line with History. Since the financial crisis, PFG’s average PEBV ratio, which measures the markets expectations for future profits and the no-growth value of the stock, is 0.93, which is slightly above PFG’s current PEBV ratio of 0.9. PFG’s PEBV ratio implies that the markets expectations for the company’s future have remained the same for quite some time, and there’s no real sign of these expectations changing in the future.

Given the issues above, it’s hard to find reasons to believe PFG will trade at a multiple much higher than it has in the past. As such, we believe better risk/reward exists in the market and it’s time to cut our losses.

This article originally published on August 14, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

1 Response to "4 Long Ideas That Didn’t Go as Planned"

good job..

It’s refreshing to see somebody in your business who admits they’re less than perfect.

I have been impressed with the breadth of securities that show up in your work. Stuff like FF, AXL, etc.

With the situation in the equity market at the moment, I don’t mind buying stuff that may go( and does, go down). It is a comfort to know that the good stuff will rebound when things get back to normal. (Not the NEW normal, however).