This report analyzes[1] free cash flow (FCF) [2], enterprise value, and the trailing FCF yield for the NC 2000[3], our All Cap Index, and each of its sectors. This research is based on the latest audited financial data, which is the 1Q21 10-Q for most companies. Price data is as of 5/19/21.

For reference, we analyze the Core Earnings for the NC 2000 and each sector in All Cap Index & Sectors: Core Earnings Vs. GAAP Net Income Through 1Q21. We analyze return on invested capital (ROIC) and its drivers in All Cap Index & Sectors: ROIC Vs. WACC Through 1Q21.

Investors armed with our research enjoy a differentiated and more informed view of the fundamentals and valuations of companies and sectors.

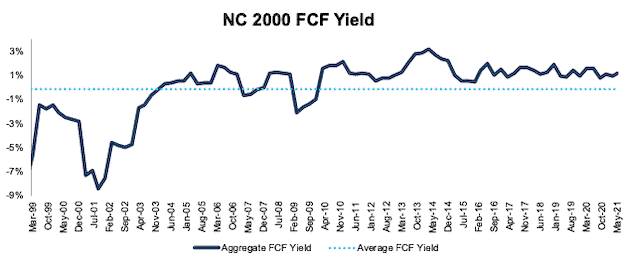

NC 2000 Trailing FCF Yield Rises in 1Q21

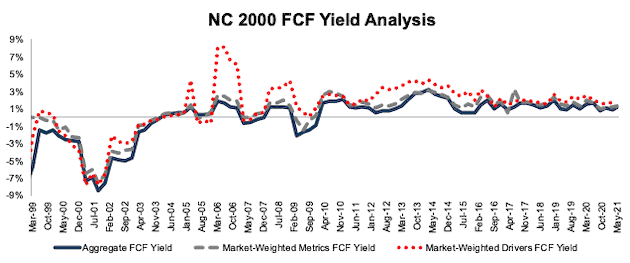

The trailing FCF yield for the NC 2000 rose from 0.9% in 4Q20 to 1.2% as of 5/19/21, the earliest date all NC 2000 companies provided 1Q21 data. See Figure 1. Only three NC 2000 sectors, Healthcare, Technology, and Industrials, saw an increase in trailing FCF yield year-over-year (YoY) based on 1Q21 financial data, as we’ll show below.

Figure 1: Trailing FCF Yield for the NC 2000 From March 1999 – 5/19/21[4]

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

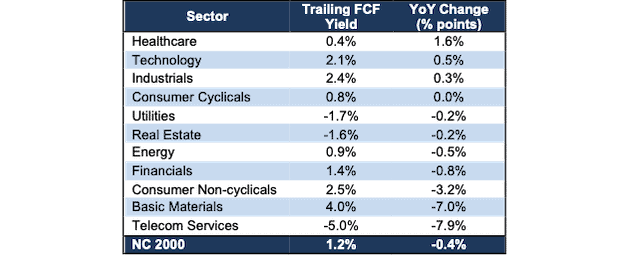

Ranking the NC 2000 Sectors by Trailing FCF Yield

Figure 2 ranks all 11 NC 2000 sectors by change in trailing FCF yield from 1Q20 to 1Q21 (based on prices as of 5/19/21 and financial data from 1Q21 10-Qs).

Figure 2: Trailing FCF Yield for All NC 2000 Sectors: 1Q20 to 1Q21

Sources: New Constructs, LLC and company filings.

Price as of 5/19/21, financial data from 1Q21 10-Qs

Investors are getting more FCF for their investment dollar in the Basic Materials sector than any other sector. On the flip side, the Telecom Services sector has the lowest trailing FCF yield of all NC 2000 sectors.

The Healthcare, Technology, and Industrials sectors have each seen an increase in trailing FCF yield from 1Q20 to 1Q21.

Details on Each of the NC 2000 Sectors

Figures 3-13 show the trailing FCF yield trends for every sector since March 1999.

Appendix I presents the components of trailing FCF yield: FCF and enterprise value for the NC 2000 and each sector.

Appendix II provides additional aggregated trailing FCF yield analyses that adjust for company size/market cap.

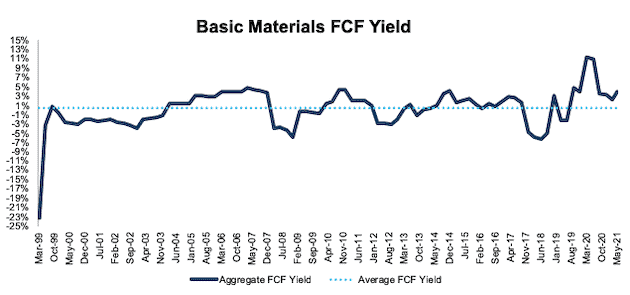

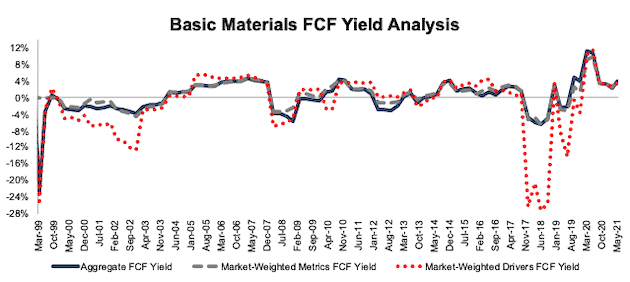

Basic Materials

Figure 3 shows trailing FCF yield for the Basic Materials sector fell from 11.0% in 1Q20 to 4.0% in 1Q21. The Basic Materials sector FCF fell from $136 billion in 1Q20 to $74 billion in 1Q21 while enterprise value increased from $1.2 trillion to $1.9 trillion over the same period.

Figure 3: Basic Materials Trailing FCF Yield: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

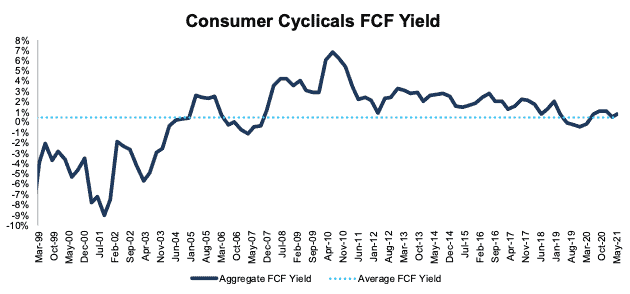

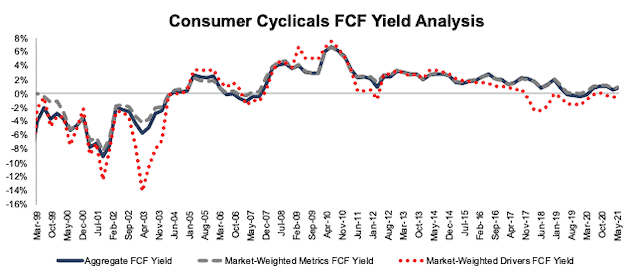

Consumer Cyclicals

Figure 4 shows trailing FCF yield for the Consumer Cyclicals sector remained flat from 1Q20 to 1Q21 at 0.8%. The Consumer Cyclicals sector FCF rose from $50 billion in 1Q20 to $67 billion in 1Q21 while enterprise value increased from $6.0 trillion in 1Q20 to $8.3 trillion in 1Q21.

Figure 4: Consumer Cyclicals Trailing FCF Yield: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

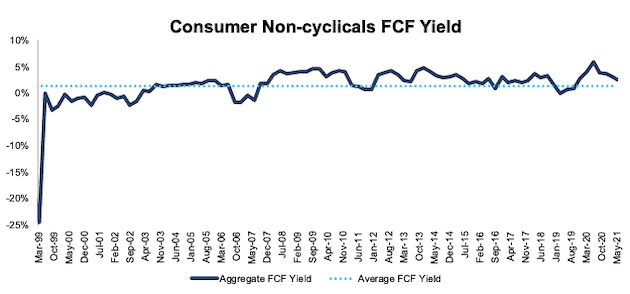

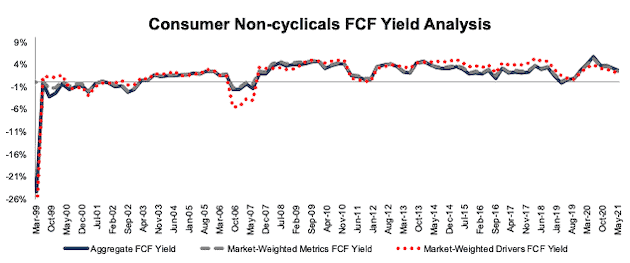

Consumer Non-cyclicals

Figure 5 shows trailing FCF yield for the Consumer Non-cyclicals sector fell from 5.8% in 1Q20 to 2.5% in 1Q21. The Consumer Non-cyclicals sector FCF fell from $174 billion in 1Q20 to $91 billion in 1Q21 while enterprise value increased from $3.0 trillion in 1Q20 to $3.6 trillion in 1Q21.

Figure 5: Consumer Non-cyclicals Trailing FCF Yield: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

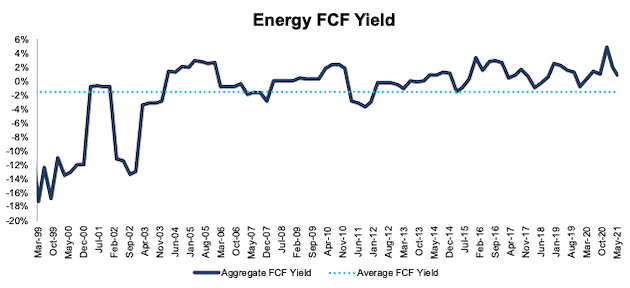

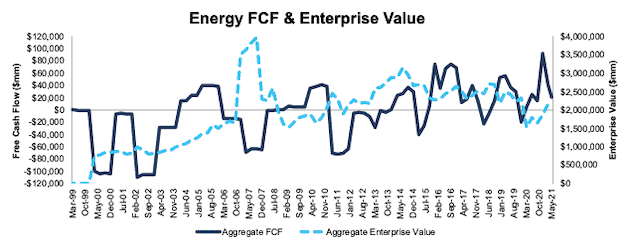

Energy

Figure 6 shows trailing FCF yield for the Energy sector fell from 1.4% in 1Q20 to 0.9% in 1Q21. The Energy sector FCF fell from $25 billion in 1Q20 to $20 billion in 1Q21 while enterprise value increased from $1.8 trillion in 1Q20 to $2.2 trillion in 1Q21.

Figure 6: Energy Trailing FCF Yield: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

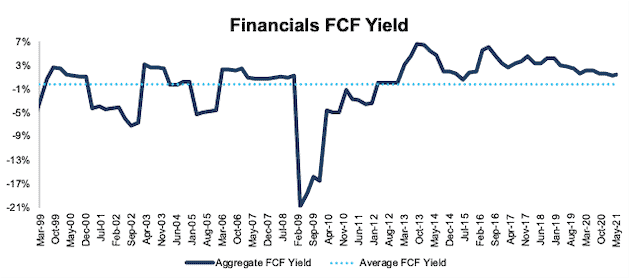

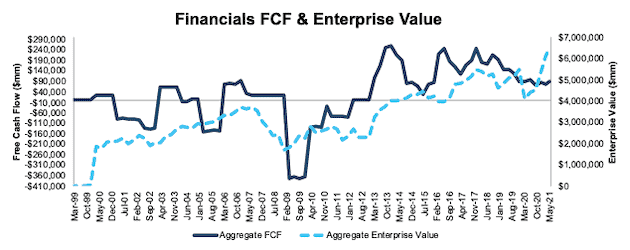

Financials

Figure 7 shows trailing FCF yield for the Financials sector fell from 2.2% in 1Q20 to 1.4% in 1Q21. The Financials sector FCF fell from $96 billion in 1Q20 to $89 billion in 1Q21 while enterprise value increased from $4.4 trillion in 1Q20 to $6.5 trillion in 1Q21.

Figure 7: Financials Trailing FCF Yield: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

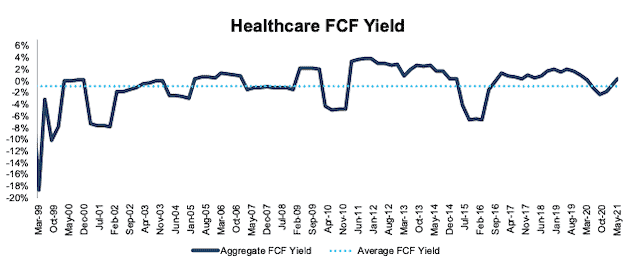

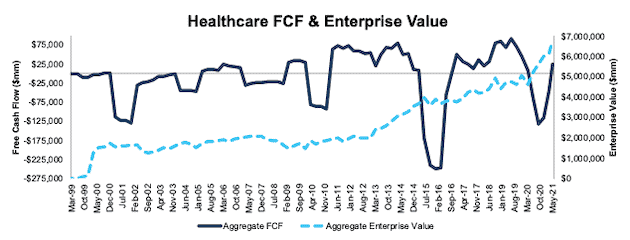

Healthcare

Figure 8 shows trailing FCF yield for the Healthcare sector rose from -1.2% in 1Q20 to 0.4% in 1Q21. The Healthcare sector FCF improved from -$64 billion in 1Q20 to $25 billion in 1Q21 while enterprise value increased from $5.2 trillion in 1Q20 to $6.8 trillion in 1Q21.

Figure 8: Healthcare Trailing FCF Yield: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

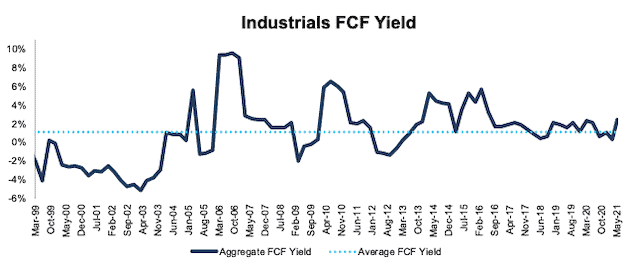

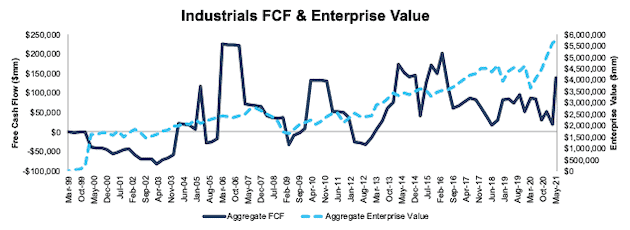

Industrials

Figure 9 shows trailing FCF yield for the Industrials sector rose from 2.1% in 1Q20 to 2.4% in 1Q21. The Industrials sector FCF improved from $85 billion in 1Q20 to $140 billion in 1Q21 while enterprise value increased from $4.0 trillion in 1Q20 to $5.7 trillion in 1Q21.

Figure 9: Industrials Trailing FCF Yield: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

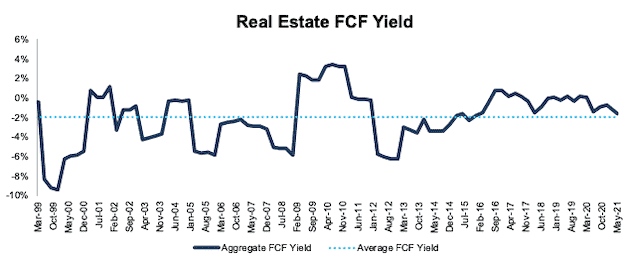

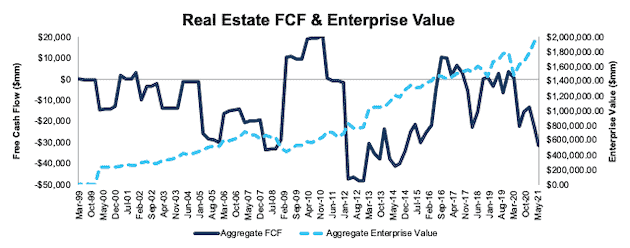

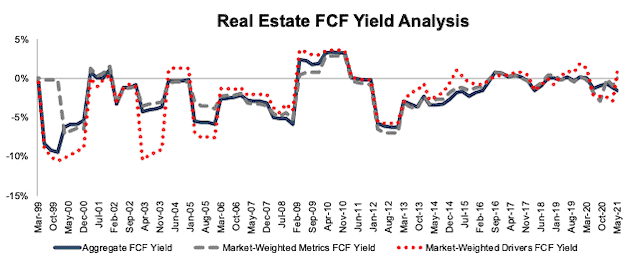

Real Estate

Figure 10 shows trailing FCF yield for the Real Estate sector fell from -1.4% in 1Q20 to -1.6% in 1Q21. The Real Estate sector FCF fell from -$22 billion in 1Q20 to -$31 billion in 1Q21 while enterprise value increased from $1.6 trillion in 1Q20 to $2.0 trillion in 1Q21.

Figure 10: Real Estate Trailing FCF Yield: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

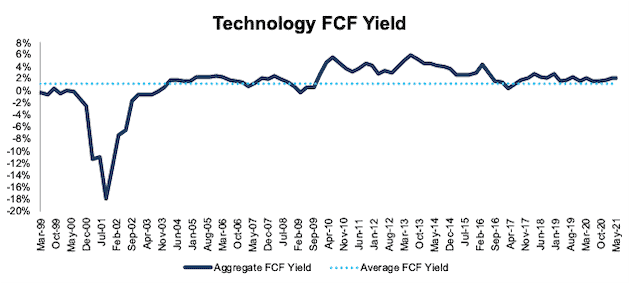

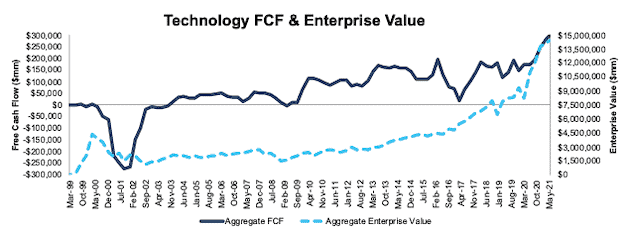

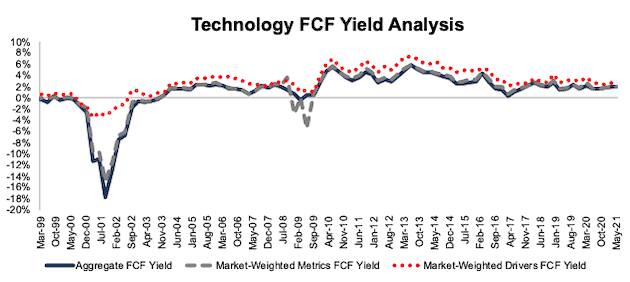

Technology

Figure 11 shows trailing FCF yield for the Technology sector rose from 1.6% in 1Q20 to 2.1% in 1Q21. The Technology sector FCF fell from $171 billion in 1Q20 to $299 billion in 1Q21 while enterprise value increased from $11.0 trillion in 1Q20 to $14.4 trillion in 1Q21.

Figure 11: Technology Trailing FCF Yield: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

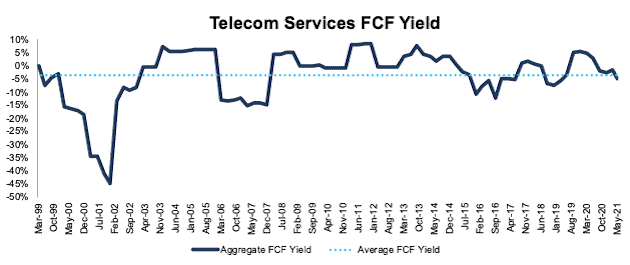

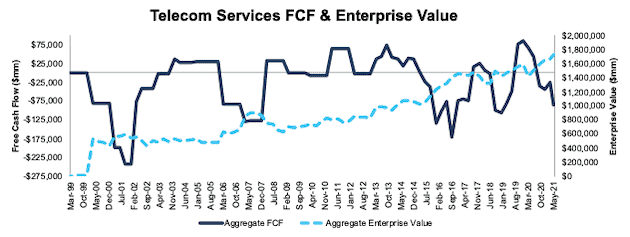

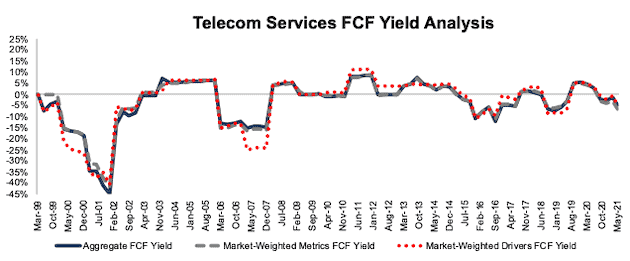

Telecom Services

Figure 12 shows trailing FCF yield for the Telecom Services sector fell from 3.0% in 1Q20 to -5.0% in 1Q21. The Telecom Services sector FCF fell from $45 billion in 1Q20 to -$86 billion in 1Q21 while enterprise value increased from $1.5 trillion in 1Q20 to $1.7 trillion in 1Q21.

Figure 12: Telecom Services Trailing FCF Yield: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

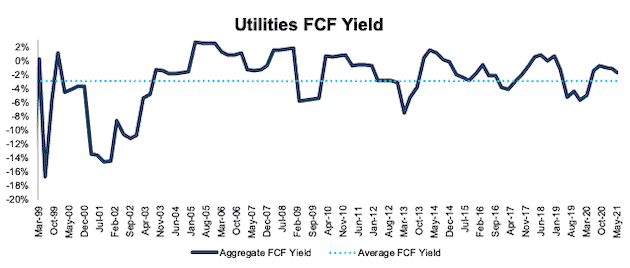

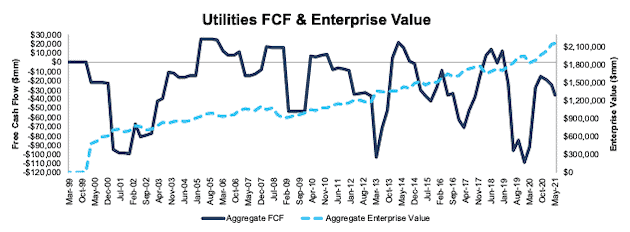

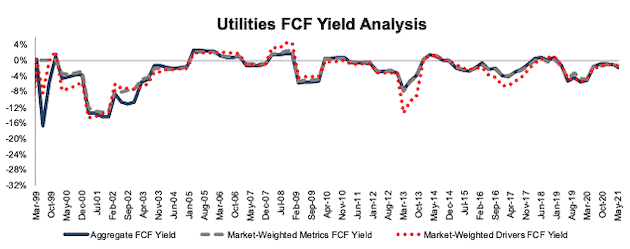

Utilities

Figure 13 shows trailing FCF yield for the Utilities sector fell from -1.5% in 1Q20 to -1.7% in 1Q21. The Utilities sector FCF fell from -$28 billion in 1Q20 to -$36 billion in 1Q21 while enterprise value increased from $1.9 trillion in 1Q20 to $2.2 trillion in 1Q21.

Figure 13: Utilities Trailing FCF Yield: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

This article originally published on June 7, 2021.

Disclosure: David Trainer, Kyle Guske II, Alex Sword, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Appendix I: Free Cash Flow and Enterprise Value Since 2004

This appendix shows the two drivers used to calculate trailing FCF yield – free cash flow and enterprise value – for the NC 2000 and each NC 2000 sector going back to March 1999. We sum the individual NC 2000/sector constituent values for free cash flow and enterprise value. We call this approach the “Aggregate” methodology, and it matches S&P Global’s (SPGI) methodology for these calculations. More methodology details in Appendix II.

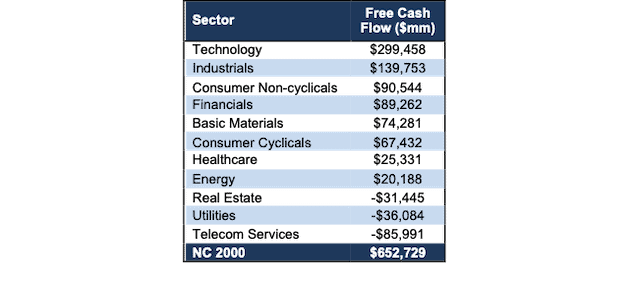

Figure 14 ranks all 11 sectors by free cash flow based on financial data from 1Q21 10-Qs.

Figure 14: Free Cash Flow by Sector – Financial Data from 1Q21 10-Qs

Sources: New Constructs, LLC and company filings.

Financial data from 1Q21 10-Qs.

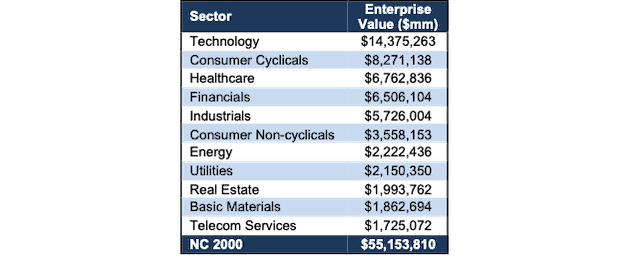

Figure 15 ranks all 11 sectors by enterprise value as of 5/19/21.

Figure 15: Enterprise Value by Sector – as of 5/19/21

Sources: New Constructs, LLC and company filings.

Prices as of 5/19/21.

These two tables show the Technology sector not only generates the most free cash flow, but it also has the highest enterprise value of all sectors.

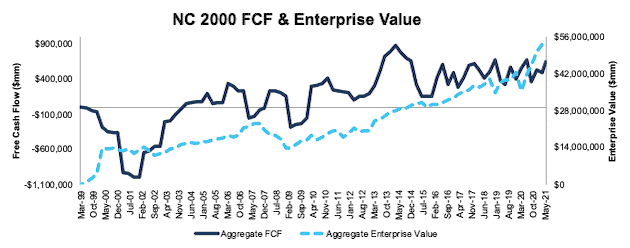

Figures 16-27 compare the FCF and enterprise value trends for the NC 2000 and every sector since 1998.

Figure 16: NC 2000 FCF & Enterprise Value: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

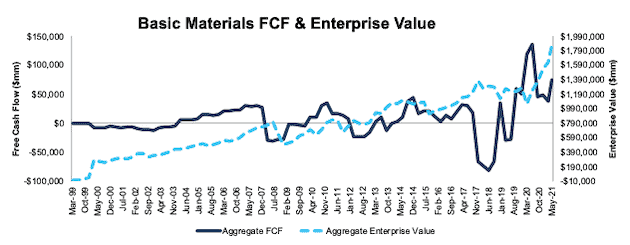

Figure 17: Basic Materials FCF & Enterprise Value: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

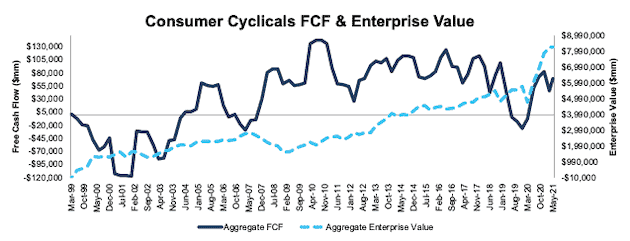

Figure 18: Consumer Cyclicals FCF & Enterprise Value: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

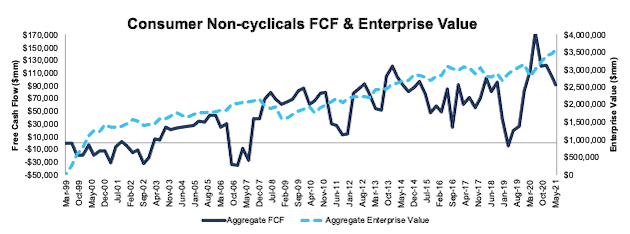

Figure 19: Consumer Non-Cyclicals FCF & Enterprise Value: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

Figure 20: Energy FCF & Enterprise Value: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

Figure 21: Financials FCF & Enterprise Value: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

Figure 22: Healthcare FCF & Enterprise Value: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

Figure 23: Industrials FCF & Enterprise Value: March 1999 – 5/19/21[5]

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

Figure 24: Real Estate FCF & Enterprise Value: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

Figure 25: Technology FCF & Enterprise Value: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

Figure 26: Telecom Services FCF & Enterprise Value: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

Figure 27: Utilities FCF & Enterprise Value: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

Appendix II: Analyzing Trailing FCF Yield with Different Weighting Methodologies

We derive the metrics above by summing the individual NC 2000/sector constituent values for free cash flow and enterprise value to calculate trailing FCF yield. We call this approach the “Aggregate” methodology.

The Aggregate methodology provides a straightforward look at the entire NC 2000/sector, regardless of market cap or index weighting, and matches how S&P Global (SPGI) calculates metrics for the S&P 500.

For additional perspective, we compare the Aggregate method for free cash flow with two other market-weighted methodologies. These market-weighted methodologies add more value for ratios that do not include market values, e.g. ROIC and its drivers, but we include them here, nonetheless, for comparison:

- Market-weighted metrics – calculated by market-cap-weighting the trailing FCF yield for the individual companies relative to their sector or the overall NC 2000in each period. Details:

- Company weight equals the company’s market cap divided by the market cap of the NC 2000/ its sector

- We multiply each company’s trailing FCF yield by its weight

- NC 2000/Sector trailing FCF yield equals the sum of the weighted trailing FCF yields for all the companies in NC 2000/sector

- Market-weighted drivers – calculated by market-cap-weighting the FCF and enterprise value for the individual companies in each sector in each period. Details:

- Company weight equals the company’s market cap divided by the market cap of the NC 2000/ its sector

- We multiply each company’s free cash flow and enterprise value by its weight

- We sum the weighted FCF and weighted enterprise value for each company in the NC 2000/each sector to determine each sector’s weighted FCF and weighted enterprise value

- NC 2000/Sector trailing FCF yield equals weighted NC 2000/sector FCF divided by weighted NC 2000/sector enterprise value

Each methodology has its pros and cons, as outlined below:

Aggregate method

Pros:

- A straightforward look at the entire NC 2000/sector, regardless of company size or weighting in any indices.

- Matches how S&P Global calculates metrics for the NC 2000.

Cons:

- Vulnerable to impact of companies entering/exiting the group of companies, which could unduly affect aggregate values. Also susceptible to outliers in any one period.

Market-weighted metrics method

Pros:

- Accounts for a firm’s market cap relative to the NC 2000/sector and weights its metrics accordingly.

Cons:

- Vulnerable to outlier results from a single company disproportionately impacting the overall trailing FCF yield.

Market-weighted drivers method

Pros:

- Accounts for a firm’s market cap relative to the NC 2000/sector and weights its free cash flow and enterprise value accordingly.

- Mitigates the disproportionate impact of outlier results from one company on the overall results.

Cons:

- More volatile as it adds emphasis to large changes in FCF and enterprise value for heavily weighted companies.

Figures 28-39 compare these three methods for calculating NC 2000 and sector trailing FCF yields.

Figure 28: NC 2000 Trailing FCF Yield Methodologies Compared: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

Figure 29: Basic Materials Trailing FCF Yield Methodologies Compared: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

Figure 30: Consumer Cyclicals Trailing FCF Yield Methodologies Compared: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

Figure 31: Consumer Non-cyclicals Trailing FCF Yield Methodologies Compared: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

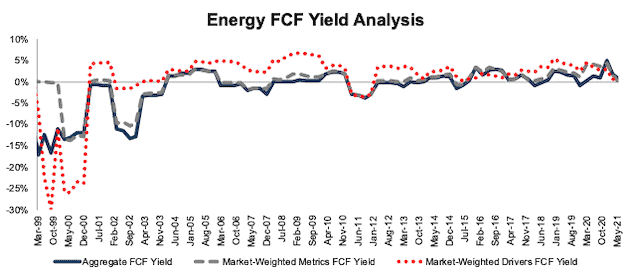

Figure 32: Energy Trailing FCF Yield Methodologies Compared: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

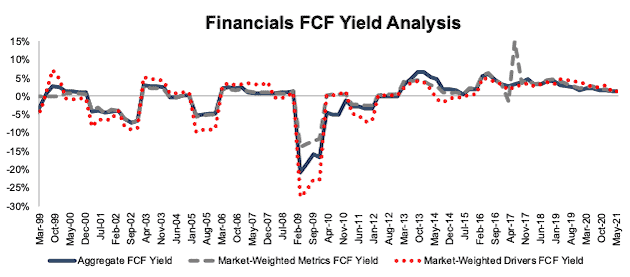

Figure 33: Financials Trailing FCF Yield Methodologies Compared: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

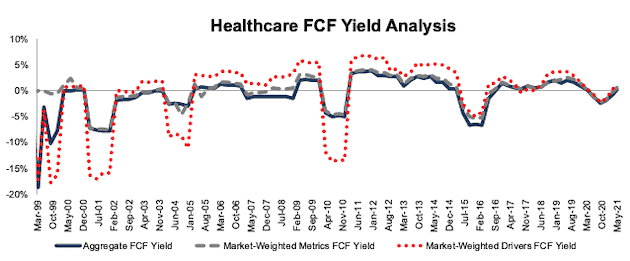

Figure 34: Healthcare Trailing FCF Yield Methodologies Compared: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

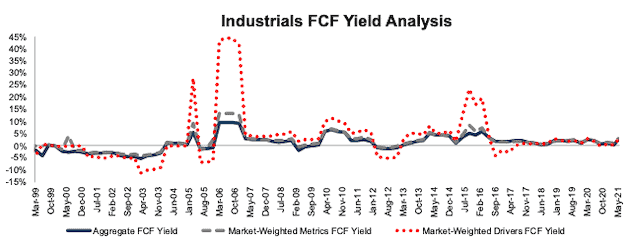

Figure 35: Industrials Trailing FCF Yield Methodologies Compared: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

Figure 36: Real Estate Trailing FCF Yield Methodologies Compared: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

Figure 37: Technology Trailing FCF Yield Methodologies Compared: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

Figure 38: Telecom Services Trailing FCF Yield Methodologies Compared: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

Figure 39: Utilities Trailing FCF Yield Methodologies Compared: March 1999 – 5/19/21

Sources: New Constructs, LLC and company filings.

The May 19, 2021 measurement period uses price data as of that date and incorporates the financial data from 1Q21 10-Qs, as this is the earliest date for which all the 1Q21 10-Qs for the NC 2000 constituents were available.

[1] We calculate these metrics based on S&P Global’s (SPGI) aggregation methodology, which sums the individual NC 2000 constituent values for free cash flow and enterprise value before using them to calculate the metrics. We call this the “Aggregate” methodology. Get more details in Appendices I and II.

[2] For 3rd-party reviews, including The Journal of Financial Economics, on our more reliable fundamental data, historically and prospectively, across all stocks, click here and here.

[3] The NC 2000 consists of the largest 2000 U.S. companies by market cap in our coverage. Constituents are updated on a quarterly basis (March 31, June 30, September 30, and December 31). We exclude companies that report under IFRS and non-U.S. ADR companies.

[4] We use stock prices from 5/19/21 because that is the date when all the 1Q21 10-Qs for the NC 2000 constituents were available.

[5] The Industrials sector free cash flow is heavily influenced by General Electric (GE) in 2005. In 2005 GE restated ~$135 billion of Investment Securities to Assets of Discontinued Operations. This reclassification caused a large year-over-year change in invested capital from 2004-2005, and therefore a large increase in FCF. However, due to poor disclosures in the filings, we’re unable to specifically track the changes beyond reclassifying an operating asset as a non-operating asset.