Trailing-twelve-month (TTM) return on invested capital (ROIC) for the NC 2000 fell quarter-over-quarter (QoQ) in 3Q22 for the first time in the last eight quarters. This decline comes from deterioration in net operating profit after tax (NOPAT) margins. Six out of eleven NC 2000 sectors saw a QoQ decline in ROIC in 3Q22.

This report is an abridged and free version of All Cap Index & Sectors: ROIC Falls in 3Q22, one of our quarterly reports on fundamental market and sector trends. The full report is available to our new Professional (previously known as Unlimited) and Institutional members.

The full version of this report analyzes[1],[2] the drivers of economic earnings [ROIC, NOPAT margin, invested capital turns, and weighted average cost of capital (WACC)] for the NC 2000, our All Cap Index, and each of its sectors (last quarter’s analysis available here).

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[3] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

NC 2000 ROIC Falls in 3Q22

The NC 2000’s ROIC fell from 9.4% in 2Q22 to 9.3% in 3Q22. The NC 2000’s NOPAT margin fell from 12.0% in 2Q22 to 11.7% in 3Q22, while invested capital turns rose from 0.78 to 0.80 over the same time.

Two key observations:

Last quarter, we noted the “record” return on capital was a mirage and that the bullish trend in ROIC could reverse soon. That reversal began in 3Q22. Inflation previously lifted margins as profits were calculated using current prices for revenue but historic prices for inventory. As the rise in inventory costs began to outpace the rise in prices charged, margins fell.

WACC for the S&P 500 has now increased QoQ for six consecutive quarters and could continue moving higher as the Federal Reserve is expected to raise rates further. The rising cost of capital threatens the viability of many weaker companies, several of which we’ve highlighted in our Zombie Stocks reports.

Key Details on Select NC 2000 Sectors

The Energy sector performed best in the third quarter of 2022, with ROIC rising 185 basis points. Energy companies benefited from higher energy prices and strong economic activity in the first half of 2022, which boosted profits across the sector. This trend continued into 3Q22.

The Technology sector is the biggest loser in the third quarter. ROIC for the Technology sector experienced a QoQ decline of 94 basis points in 3Q22.

Below, we highlight the Consumer Non-cyclicals sector, which saw an 8 bps rise QoQ in ROIC in 3Q22.

Sample Sector Analysis[4]: Consumer Non-cyclicals

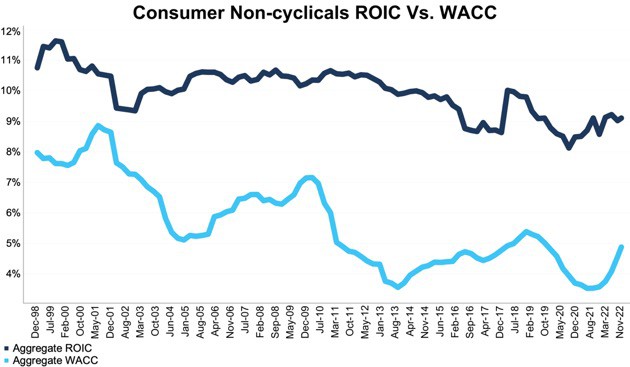

Figure 1 shows the Consumer Non-cyclicals sector ROIC rose from 9.0% in 2Q22 to 9.1% in 3Q22. The Consumer Non-cyclicals sector NOPAT margin rose from 6.8% in 2Q22 to 6.9% in 3Q22, while invested capital turns rose from 1.32 in 2Q22 to 1.33 in 3Q22.

Figure 1: Consumer Non-cyclicals ROIC vs. WACC: Dec 1998 – 11/25/22

Sources: New Constructs, LLC and company filings.

The November 25, 2022 measurement period uses price data as of that date for our WACC calculation and incorporates the financial data from 3Q22 10-Qs for ROIC, as this is the earliest date for which all of the 3Q22 10-Qs for the NC 2000 constituents were available.

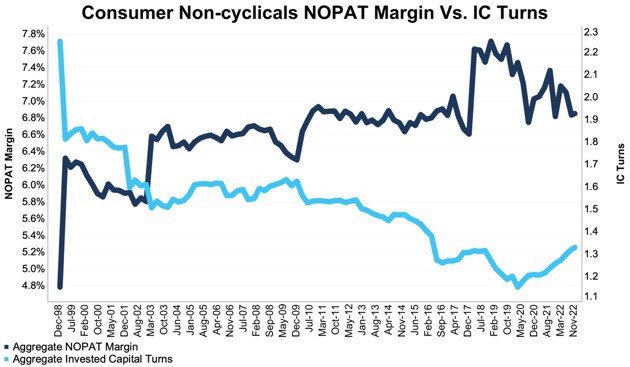

Figure 2 compares the trends in NOPAT margin and invested capital turns for the Consumer Non-cyclicals sector since December 1998. We sum up the individual NC 2000/sector constituent values for revenue, NOPAT, and invested capital to calculate these metrics. We call this approach the “Aggregate” methodology.

Figure 2: Consumer Non-cyclicals NOPAT Margin and IC Turns: Dec 1998 – 11/25/22

Sources: New Constructs, LLC and company filings.

The November 25, 2022 measurement period uses price data as of that date for our WACC calculation and incorporates the financial data from 3Q22 10-Qs for ROIC, as this is the earliest date for which all of the 3Q22 10-Qs for the NC 2000 constituents were available.

The Aggregate methodology provides a straightforward look at the entire sector, regardless of market cap or index weighting and matches how S&P Global (SPGI) calculates metrics for the S&P 500.

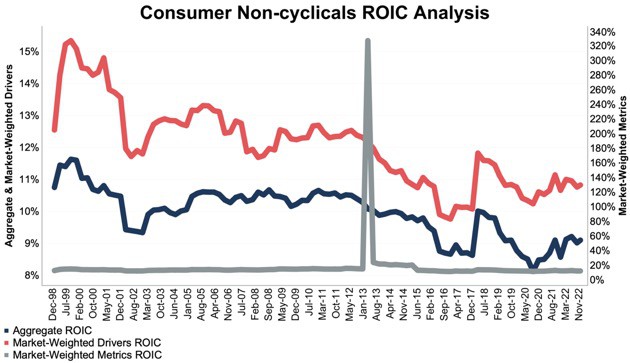

For additional perspective, we compare the Aggregate method for ROIC with two other market-weighted methodologies: market-weighted metrics and market-weighted drivers. Each method has its pros and cons, which are detailed in the Appendix.

Figure 3 compares these three methods for calculating the Consumer Non-cyclicals sector’s ROICs.

Figure 3: Consumer Non-cyclicals ROIC Methodologies Compared: Dec 1998 – 11/25/22

Sources: New Constructs, LLC and company filings.

The November 25, 2022 measurement period uses price data as of that date for our WACC calculation and incorporates the financial data from 3Q22 10-Qs for ROIC, as this is the earliest date for which all of the 3Q22 10-Qs for the NC 2000 constituents were available.

This article was originally published on December 14, 2022.

Disclosure: David Trainer, Kyle Guske II, Matt Shuler, and Italo Mendonça receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Appendix: Analyzing ROIC with Different Weighting Methodologies

We derive the metrics above by summing the individual NC 2000/sector constituent values for revenue, NOPAT, and invested capital to calculate the metrics presented. We call this approach the “Aggregate” methodology.

The Aggregate methodology provides a straightforward look at the entire sector, regardless of market cap or index weighting and matches how S&P Global (SPGI) calculates metrics for the S&P 500.

For additional perspective, we compare the Aggregate method for ROIC with two other market-weighted methodologies:

- Market-weighted metrics – calculated by market-cap-weighting the ROIC for the individual companies relative to their sector or the overall NC 2000 in each period. Details:

- Company weight equals the company’s market cap divided by the market cap of the NC 2000/its sector

- We multiply each company’s ROIC by its weight

- NC 2000/Sector ROIC equals the sum of the weighted ROICs for all the companies in the NC 2000/each sector

- Market-weighted drivers – calculated by market-cap-weighting the NOPAT and invested capital for the individual companies in the NC 2000/each sector in each period. Details:

- Company weight equals the company’s market cap divided by the market cap of the NC2000/its sector

- We multiply each company’s NOPAT and invested capital by its weight

- We sum the weighted NOPAT and invested capital for each company in the NC 2000/each sector to determine the NC 2000/sector’s weighted NOPAT and weighted invested capital

- NC 2000/Sector ROIC equals weighted NC 2000/sector NOPAT divided by weighted NC 2000/sector invested capital

Each methodology has its pros and cons, as outlined below:

Aggregate method

Pros:

- A straightforward look at the entire NC 2000/sector, regardless of company size or weighting.

- Matches how S&P Global calculates metrics for the S&P 500.

Cons:

- Vulnerable to impact of by companies entering/exiting the group of companies, which could unduly affect aggregate values despite the level of change from companies that remain in the group.

Market-weighted metrics method

Pros:

- Accounts for a firm’s size relative to the overall NC 2000/sector and weights its metrics accordingly.

Cons:

- Vulnerable to outsized impact of one or a few companies. This outsized impact tends to occur only for ratios where unusually small denominator values can create extremely high or low results.

Market-weighted drivers method

Pros:

- Accounts for a firm’s size relative to the overall NC 2000/sector and weights its NOPAT and invested capital accordingly.

- Mitigates potential outsized impact of one or a few companies by aggregating values that drive the ratio before calculating the ratio.

Cons:

- Can minimize the impact of period-over-period changes in smaller companies, as their impact on the overall sector NOPAT and invested capital is smaller.

[1] Calculated using SPGI’s methodology, which sums up individual NC 2000 constituent values for NOPAT and invested capital. See Appendix III for more details on this “Aggregate” method and Appendix I for details on how we calculate WACC for the NC 2000 and each of its sectors.

[2] This report is based on the latest audited financial data available, which is the 3Q22 10-Q in most cases. Price data as of 11/25/22.

[3] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

[4] The full version of this report provides the same analysis for all eleven sectors.