We closed this Long Idea on September 19, 2024. A copy of the associated Position Close report is here.

After a 29% return for the S&P 500 in 2019 and a 191% return over the past decade, it’s hard to find value in the market. Most high-quality companies are fairly valued, or worse, overvalued, at this point.

Leveraging our database of footnotes adjustments[1], we identified a company that looks like a good value after significantly underperforming the market in 2019. This company has a strong track record of profit growth, a cheap valuation, and it is the undisputed leader in a rapidly growing industry. C.H. Robinson Worldwide (CHRW: $81/share) is this week’s Long Idea.

Focus on Profits, Not Revenue

CHRW is the largest freight brokerage company in North America by revenue and one of the largest in the industry globally. CHRW manages shipping and logistics services for over 124 thousand companies worldwide.

CHRW acts as a middleman between its customers and its network of 76 thousand freight carriers – with which it contracts to fulfill its customers’ shipping needs.

CHRW’s revenues are highly sensitive to changes in freight costs, which tend to fluctuate significantly year-by-year. On the other hand, its profits are based on the spread between what it charges its customers and what it pays to the freight carriers, which tends to be much more consistent.

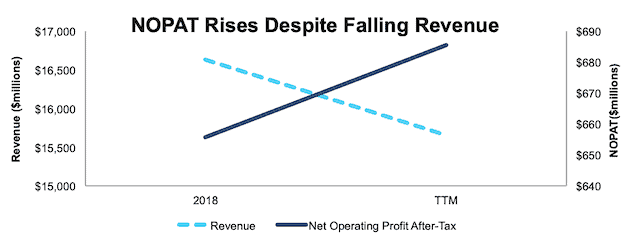

Declining freight costs in 2019 led to CHRW’s revenues falling by 8% year-over-year through the first three quarters of 2019. Meanwhile, the company’s net operating profit after tax (NOPAT) increased by 12% over the trailing twelve months (TTM) period, as shown in Figure 1.

Figure 1: CHRW’s Revenue and NOPAT: 2018-TTM

Sources: New Constructs, LLC and company filings

While the company’s revenues declined in 2019, its costs declined more. “Purchased transportation and related services”, the amount of money CHRW pays to its contracted freight carriers, declined by 9% year-over-year through the first nine months of 2019.

Based on its stock price (down 6% in 2019), investors seem to be paying too much attention to the top-line and not enough to the company’s steadily rising cash flows.

Strong Industry Trends

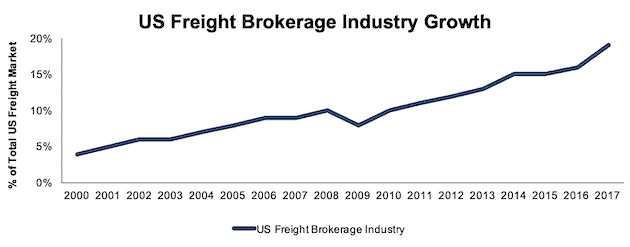

The freight brokerage industry has grown rapidly over the past two decades as more companies outsource their logistics management. Figure 2 shows that freight brokers have risen from 4% of the U.S. freight market in 2000 to 19% in 2017.

Figure 2: U.S. Freight Brokerage Penetration of Total Freight Market

Sources: CHRW Investor Presentation

The freight brokerage model offers companies many advantages over managing their logistics in-house, including:

- Flexibility: Companies that own their trucks or contract directly with individual freight carriers may struggle to adapt to fluctuating shipping needs, find themselves unable to fulfill high demand, or pay for shipping services they don’t need. Using a freight broker provides flexibility and allows companies to quickly adapt to changing shipping needs.

- Aggregating Demand: Some companies have shipping needs that aren’t large enough to fill an entire truck, plane, ship, or other carrier. A freight broker can aggregate demand from all these companies and contract with a shipper to carry all their orders together. In trucking, this service is known as “Less-than-truckload” (LTL) shipping, and it accounted for 17% of CHRW’s net revenue in 2018.

- Industry Knowledge: The freight industry is highly fragmented. There are nearly a million different trucking companies in the US, with over 95% of these companies operating fewer than 20 trucks. CHRW’s deep industry knowledge and relationships can help it find the cheapest and most efficient shipping options to meet its customers’ needs.

Freight brokers are an attractive option for almost any company with significant logistics requirements. Meanwhile, the rise of e-commerce and globalization means that shipping demand continues to rise at a rapid rate.

As a result, analysts expect the freight brokerage industry to grow at a 5% compound annual rate over the next five years.

Undisputed Industry Leader

CHRW is by far the largest freight brokerage company in North America. Its 2018 revenues were higher than the next three largest companies – Total Quality Logistics, XPO Logistics (XPO), and Echo Global Logistics (ECHO) – combined.

In an industry where size and scale play such a crucial role in driving competitive advantages, CHRW’s superior scale gives it a significant edge over its peers.

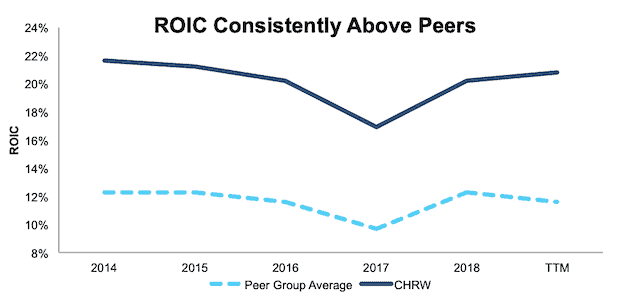

This competitive advantage shows up in its superior return on invested capital (ROIC) compared to its peers. Figure 3 compares CHRW’s ROIC to the other publicly traded companies among the top 20 largest freight brokerage firms in North America.

Figure 3: CHRW ROIC vs. Publicly Traded Peers: 2014-TTM

Sources: New Constructs, LLC and company filings

The company’s significant – and widening – ROIC advantage proves it has been able to translate its superior scale into a durable competitive advantage.

Technology Can Drive More Efficiency

CHRW’s Navisphere technology platform, should help it maintain or even increase that advantage. Navisphere serves as an automated tool to manage customer orders, track existing shipments, and use machine learning to provide insights and information to help companies optimize their supply chain. The key to any machine learning platform is the training data that teaches the machine. CHRW’s operational history and large customer base give it a large and robust training dataset.

At its Investor Day in March 2019, CHRW noted that 75% of its shipments are tendered electronically and 50% of shipments powered by Navisphere are fully automated.

The more the firm integrates this successful technology the more it can reduce headcount and increase operating efficiency/margins. When it reported 3Q19 earnings, CHRW noted that its investment in technology and automation would lead to a decline in the overall headcount in its North American Surface Transportation segment (66% of net revenue in 2018), which will lower administrative costs.

As CHRW is able to automate more processes, from back end tasks to freight optimization, we would expect operating margins to continue their upward trend.

Diversified Customer Base Minimizes Risk

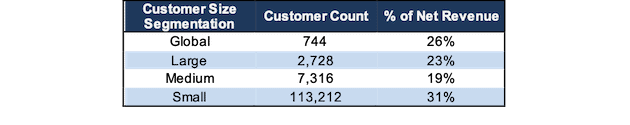

Figure 4 shows that CHRW’s customer base as a % of revenue is diversified across companies of all sizes. Importantly, its largest customer comprised only two percent of total revenues in 2018. Instead of focusing on one particular customer, or size of business, CHRW has grown by adding new customers and increasing volumes with, and providing more services to, existing customers. The lack of customer concentration minimizes the risk in owning CHRW, as a large name in the industry pulling its business would have only a limited impact on CHRW’s fundamentals.

Figure 4: CHRW’s Customer Mix

Sources: New Constructs, LLC and CHRW company presentation

CHRW also excels at maintaining strong relationships with its key customers. Its 500 largest customers – which account for 48% of revenue – had a 100% retention rate in 2018. 90% of these customers have been with CHRW for over a decade.

Scale, technological innovation, and strong customer relationships form a solid moat that should allow CHRW to continue to outperform its peers.

Short-Term Risk from Cyclical Downturn is Overstated

Despite the company’s strong fundamentals, just three out of 24 sell-side analysts have a Buy rating on the stock, while five rate it a Sell. Analysts point to excess capacity in the shipping industry hurting spreads for freight brokers.

These narrowing spreads have yet to materialize through three quarters of 2019, but even if they do show up in Q4, it will likely remain a short-term issue. Freight industry prices have fluctuated in cycles for years, but CHRW’s spread has consistently reverted to its long-term average of ~17% over the past decade.

In addition, the stock’s underperformance over the past year means that any short-term decline in margins is already priced in.

Risk of Technological Disruption is Overstated as Well

The freight brokerage industry has seen a number of splashy new entrants in recent years. Most notably, Amazon (AMZN) announced the beta of its freight brokerage platform earlier this year, and Uber (UBER) Freight launched in 2017.

While these new entrants have created a great deal of buzz in the industry, they don’t offer anything fundamentally different from CHRW and existing incumbents. As a result, Amazon’s freight brokerage hasn’t made any real news since its debut, and Uber Freight reported just $500 million in gross revenue through the first nine months of 2019, less than 5% of CHRW’s total revenue.

Additionally, CHRW, and peers, have spent years building up sales and support staffs and relationships with freight carriers that cannot be replicated overnight. CHRW’s high retention rate among existing customers is a testament to these efforts. Furthermore, the company engages its freight carriers to aid in equipment utilization, reduce empty miles, and reposition equipment in a cost effective manner. These services and relationships allow opportunities to cross-sell value-added services that would be challenging, even for Amazon, to replicate.

Amazon could also face more unique challenges in the freight brokerage industry than others. Its growing in-house shipping service competes directly with other freight carriers, and it is the dominant competitor for many retailers that use a freight broker. Freight carriers and retailers alike might be wary of locking themselves into a competitor’s ecosystem, especially one that is being investigated over possible anti-competitive actions.

CHRW Remains Undervalued Despite Fundamentals

Numerous case studies show that getting ROIC right is an important part of making smart investments. This paper compares our analytics on a mega cap company to other major providers. The Appendix details exactly how we stack up. The technology that enables this research is featured by Harvard Business School.

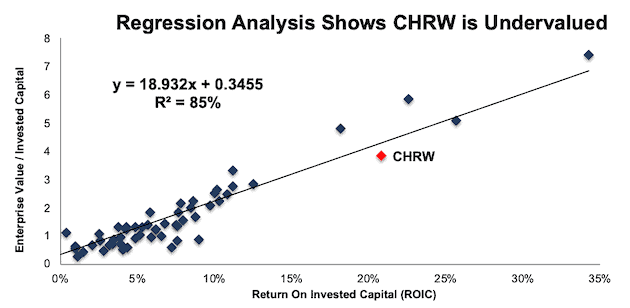

Per Figure 5, ROIC explains 85% of the difference in valuation for the 57 freight and logistic services companies we cover. CHRW trades at a discount to peers as shown by its position below the trend line.

Figure 5: ROIC Explains 85% of Valuation for Logistics Stocks

Sources: New Constructs, LLC and company filings

If the stock were to trade at parity with its peers, it would be worth $93/share – 15% above the current stock price. Given its status as the largest, and one of the most profitable, companies in the industry, CHRW deserves a premium valuation to its peers.

Cheap Valuation Provides Upside

C.H. Robinson’s cheap valuation means that the stock still has significant upside potential. At its current valuation of $81/share, the stock has a price to economic book value (PEBV) of 1.0. This ratio implies the market expects CHRW to never grow its NOPAT. Given the company’s strong track record of growth, this expectation seems overly pessimistic.

Below, we use our reverse DCF model to see what the stock could be worth given conservative assumptions about future growth in cash flows.

If CHRW can maintain NOPAT margins of 4% (current TTM margin and average over past five years) and grow NOPAT by just 5% compounded annually (in-line with analyst forecasts for industry growth) over the next decade, the stock is worth $112/share today – a 38% upside to the current stock price. See the math behind this dynamic DCF scenario.

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around CHRW’s business will enable it to continue to generate higher NOPAT than the current market valuation implies. The following competitive advantages help CHRW offer better service at lower prices and prevent competition from taking market share:

- Technological

advantage driven by CHRW’s Navisphere platform and superior dataset - Effective

sales and support staff producing high customer retention - Market

leader able to optimize economies of scale

What Noise Traders Miss with CHRW

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus is on technical trading trends while high-quality fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- Rising

NOPAT despite declining revenue - ROIC

well above its peer group - Freight

brokers gaining a larger share of the overall freight market - Valuation

implies no future growth in profits

Possible Acquisitions and Trade News Could Drive Shares Higher

Concerns over an industry down cycle have caused a recent decline in CHRW’s price. There are a few reasons why such concern could be short-lived.

First, competitor XPO Logistics just announced it is entertaining acquisition offers for four of its business units. CHRW could further cement itself as the market leader if it acquired XPO’s logistics business. More importantly, CHRW has a history of making smart acquisitions at good prices. In 2016 and 2017, it acquired APC Logistics and Milgram & Company Ltd for a total of $277 million. Given that CHRW earns the same ROIC it did in 2016 and its economic earnings have increased from $406 million in 2016 to $494 million TTM, the firm is creating value with those acquisitions. We would expect more of the same if it chose to acquire XPO’s logistics business.

Second, any further resolution in US trade talks with China could drive the stock price of CHRW, and many other global freight and shipping stocks, higher. Any positive news on this front could encourage a surge of investment into an industry that is so tied to international trade.

Dividends and Buybacks Offer Nearly 6% Yield

CHRW has increased its dividend in each of the past five years. Since 2014, CHRW has increased its annual dividend by 7% compounded annually. The current annualized dividend of $2.04/share gives the company a dividend yield of 2.5%.

In addition to dividends, CHRW returns capital to shareholders through share repurchases. In 2018, CHRW repurchased $301 million worth of shares. Over the TTM period, CHRW has repurchased $340 million (3% of market cap) worth of shares. CHRW is authorized to purchase up to 10.8 million more shares, which is currently valued at $896 million.

If CHRW repurchases shares in line with 2018, we would expect it to repurchase up to 2.9% of the current market cap, which, when combined with the 2.5% dividend yield, give CHRW a total shareholder yield of nearly 6%.

Executive Compensation Could be Improved

CHRW executives receive annual bonuses based on adjusted pre-tax income (APTI) goals. Unfortunately, ATPI excludes executive bonuses in its calculation. Wouldn’t we all want to exclude our pay when measuring profitability? In addition, executives receive performance based equity awards that are tied to growth in earnings and stock price appreciation. Unfortunately, neither of these are tied to creating shareholder value.

CHRW should tie performance compensation to improvement in ROIC, as there is a strong correlation between improving ROIC and increasing shareholder value. Tying executive compensation to ROIC also ensures that executives’ interests are properly aligned with shareholders’ interests.

Despite using different metrics, CHRW’s plan has not compensated executives while destroying shareholder value. CHRW has grown economic earnings from $399 million in 2015 to $494 million TTM.

Insider Trading and Short Interest

Over the past twelve months, insiders bought 198 thousand shares and sold 93 thousand for a net effect of 106 thousand shares purchased. These purchases represent less than 1% of shares outstanding.

There are currently 17.6 million shares sold short, which equates to 13% of shares outstanding and 11 days to cover. The high short interest increases the chances of a short squeeze should CHRW report good guidance and/or an earnings beat.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings as shown in the Harvard Business School and MIT Sloan paper, "Core Earnings: New Data and Evidence”.

Below are specifics on the adjustments we make based on Robo-Analyst findings in C.H. Robinson Worldwide’s 2018 10-K:

Income Statement: we made $95 million of adjustments with a net effect of adding $9 million in non-operating income (<1% of revenue). See all adjustments made to CHRW’s income statement here.

Balance Sheet: we made $359 million of adjustments to calculate invested capital with a net increase of $264 million. The most notable adjustment was $219 million (7% of reported net assets) related to operating leases. See all adjustments to CHRW’s balance sheet here.

Valuation: we made $1.6 billion of adjustments with a net effect of decreasing shareholder value by $1.6 billion. There were no adjustments that increased shareholder value. Besides $1.5 billion of debt (which includes the operating leases noted above), the most notable adjustment to shareholder value was $119 million in outstanding employee stock options. This option adjustment represents 1% of CHRW’s market cap. See all adjustments to CHRW’s valuation here.

Attractive Funds That Hold CHRW

The following funds receive our Attractive-or-better rating and allocate significantly to C.H. Robinson Worldwide.

- iShares

Trust: iShares Transportation Average ETF (IYT) – 4.3% allocation and

Attractive rating. - American

Beacon Alpha Quant Value Fund (AQVYX) – 3.4% allocation and Very Attractive

rating. - First

Trust NASDAQ Transportation ETF (FTXR) – 3.3% allocation and Very Attractive

rating. - Bright

Rock Quality Large Cap Fund (BQLCX) – 2.6% allocation and Attractive rating. - Ivy

Funds: Ivy Mid Cap Income Opportunities Fund (IVOYX) – 2.6% allocation and

Attractive rating.

This article originally published on January 22, 2020.

Disclosure: David Trainer, Kyle Guske II, Sam McBride, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] In Core Earnings: New Data & Evidence, professors at Harvard Business School (HBS) & MIT Sloan empirically show that our “novel dataset” is superior to “Street Earnings” from Refinitiv’s IBES, owned by Blackstone (BX) and Thomson Reuters (TRI), and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).