I hope you’ve enjoyed the free stock picks we’ve been sharing in recent weeks. Today, we’re bringing you two picks, one each from our Most Attractive Stocks and Most Dangerous Stocks Model Portfolio.

The featured stock in the Most Attractive Stocks Model Portfolio has been in the Model Portfolio for five consecutive months and earns our Very Attractive rating. As we’ll show below, the business has strong fundamentals, yet the stock is priced as profits will permanently decline by 20%. That’s a pretty cheap valuation.

The featured stock in the Most Dangerous Stocks Model Portfolio has been in the Model Portfolio for even longer, at six consecutive months, and it was the best performing short in July’s Model Portfolio. Even after falling 34% from July 3, 2024 to August 2, 2024, the stock remains significantly overvalued.

Before you get to the picks, I want to reiterate why I’m giving away a stock from each of these Model Portfolios, which are only available to Pro and Institutional members. The reason comes in three parts:

- We genuinely believe in improving the integrity of the stock market.

- We hope to get your business one day.

- We want to earn your trust and show you the extreme value we deliver.

Our write-up is below. It is much shorter than a full Long Idea or Danger Zone report, but provides insights into the kind of analysis we do and helps you set the bar for the value you deserve and should expect from any research firm.

We hope you enjoy these picks. We hope you find value. Please share with family and friends if you think it would be of interest.

We update this Model Portfolio monthly and August’s Most Attractive and Most Dangerous stocks was updated and published for clients on August 6, 2024.

July Performance Recap

The best performing large cap stock gained 21% and the best performing small cap stock was up 39%. Overall, 32 out of the 40 Most Attractive stocks outperformed the S&P 500.

The best performing large cap short stock fell by 34% and the best performing small cap short stock fell by 22%. Overall, 13 out of the 39 Most Dangerous stocks outperformed the S&P 500 as shorts.

The Most Attractive/Most Dangerous Model Portfolios outperformed as an equal-weighted long/short portfolio by 5.4%.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

All of our Most Attractive stocks have high (and rising) return on invested capital (ROIC) and low price to economic book value ratio. Most Dangerous stocks have misleading earnings and long growth appreciation periods implied by their market valuations.

Most Attractive Stocks Feature for August: Rex American Resources Corp (REX)

Rex American Resources (REX: $45/share) is the featured stock from August’s Most Attractive Stocks Model Portfolio.

Rex American Resources has grown revenue and net operating profit after tax (NOPAT) by 9% and 43% compounded annually since fiscal 2019, respectively. Rex American Resources’ NOPAT margin increased from 2% in fiscal 2019 to 9% in the TTM and invested capital turns rose from 1.5 to 2.6 over the same time. Rising NOPAT margins and invested capital turns drive Rex American Resources’ return on invested capital (ROIC) from 3% in fiscal 2019 to 22% in the TTM.

Figure 1: Rex American Resources’ Revenue and NOPAT Since Fiscal 2019

Sources: New Constructs, LLC and company filings

Rex American Resources Is Undervalued

At its current price of $45/share, REX has a price-to-economic book value (PEBV) ratio of 0.8. This ratio means the market expects Rex American Resources’ NOPAT to permanently decline by 20%. This expectation seems overly pessimistic for a company that has grown NOPAT by 5% compounded annually since fiscal 2014 and 43% compounded annually since fiscal 2019.

Even if Rex American Resources’ NOPAT margin falls to 6% (below TTM NOPAT margin of 9%) and the company’s revenue grows just 3% (below 5-year compound annual growth rate of 9%) compounded annually through fiscal 2034, the stock would be worth $54/share today – a 20% upside. In this scenario, Rex American Resources’ NOPAT grows <1% compounded annually through fiscal 2034. Should Rex American Resources grow profits more in line with historical levels, the stock has even more upside.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we made based on Robo-Analyst findings in Rex American Resources’ 10-Qs and 10-Ks:

Income Statement: we nearly $40 million in adjustments, with a net effect of removing under $5 million in non-operating expense. Professional members can see all adjustments made to Rex American Resources’ income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made over $375 million in adjustments to calculate invested capital with a net decrease of over $300 million. One of the most notable adjustments was several million in asset write downs. Professional members can see all adjustments made to Rex American Resources’ balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made nearly $400 million in adjustments to shareholder value with a net increase of over $220 million. Apart from excess cash, the most notable adjustment was for minority interests. Professional members can see all adjustments to Rex American Resources’ valuation on the GAAP Reconciliation tab on the Ratings page on our website.

Most Dangerous Stocks Feature: FormFactor Inc. (FORM)

FormFactor Inc. (FORM: $49/share) is the featured stock from August’s Most Dangerous Stocks Model Portfolio.

FormFactor’s NOPAT margin fell from 7.7% in 2018 to 5.7% in the TTM while the company’s invested capital turns remained the same at 0.8 over the same time. Falling NOPAT margins drive down FormFactor’s ROIC from 6.2% in 2018 to 4.6% in the TTM.

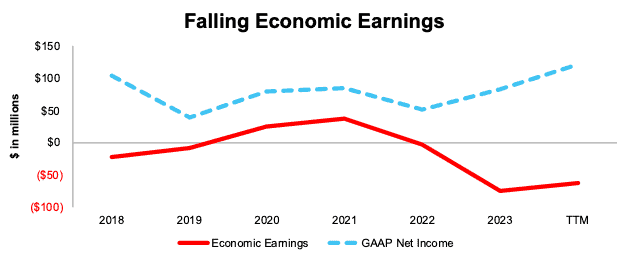

FormFactor’s economic earnings, the true cash flows of the business, which take into account changes to the balance sheet, have fallen from -$22 million in 2018 to -$63 million in the TTM. Meanwhile, the company’s GAAP net income has risen from $104 million to $121 million over the same time. Whenever GAAP earnings rise while economic earnings decline, investors should take note.

Figure 2: FormFactor’s Economic vs GAAP Earnings Since 2018

Sources: New Constructs, LLC and company filings

FORM Provides Poor Risk/Reward

Despite its poor and declining fundamentals, FormFactor’s stock is priced for significant profit growth, and we believe the stock is overvalued.

To justify its current price of $49/share, FormFactor must improve its NOPAT margin to 20% (above best-ever NOPAT margin of 17% and TTM margin of 6%) and grow revenue by 16% compounded annually through 2033. In this scenario, FormFactor grows NOPAT 38% compounded annually to $600 million in 2033. We think these expectations are overly optimistic, especially considering the company’s NOPAT has fallen <1% compounded annually over the past five years.

Even if FormFactor improves its NOPAT margin to 13% (highest NOPAT margin in the last five years) and grows revenue 11% compounded annually through 2033, the stock would be worth no more than $24/share today – a 51% downside to the current stock price.

Each of these scenarios also assumes FormFactor can grow revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best case scenarios that demonstrate the high expectations embedded in the current valuation.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we made based on Robo-Analyst findings in FormFactor’s 10-Qs and 10-Ks:

Income Statement: we made $87 million in adjustments, with a net effect of removing over $70 million in non-operating income. Professional members can see all adjustments made to FormFactor’s income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made over $650 million in adjustments to calculate invested capital with a net decrease of over $120 million. One of the most notable adjustments was hundreds of millions in asset write downs. Professional members can see all adjustments made to FormFactor’s balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made over $380 million in adjustments to shareholder value with a net increase of over $260 million. The most notable adjustment to shareholder value was for excess cash. Professional members can see all adjustments to FormFactor’s valuation on the GAAP Reconciliation tab on the Ratings page on our website.

This article was originally published on August 16, 2024.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.