Large Cap Value Style

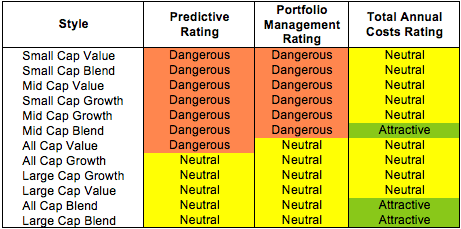

The Large Cap Value style ranks third out of the twelve fund styles as detailed in my Style Rankings for ETFs and Mutual Funds report. It gets my Neutral rating, which is based on aggregation of ratings of 49 ETFs and 807 mutual funds in the Large Cap Value style as of January 28, 2014.

David Trainer, Founder & CEO

Large Cap Growth Style

The Large Cap Growth style ranks fourth out of the twelve fund styles as detailed in my Style Rankings for ETFs and Mutual Funds report. It gets my Neutral rating, which is based on aggregation of ratings of 24 ETFs and 650 mutual funds in the Large Cap Growth style as of January 27, 2014.

David Trainer, Founder & CEO

Large Cap Blend Style

The Large Cap Blend style ranks second out of the twelve fund styles as detailed in my Style Rankings for ETFs and Mutual Funds report. It gets my Neutral rating, which is based on aggregation of ratings of 35 ETFs and 886 mutual funds in the Large Cap Blend style as of January 27, 2014.

David Trainer, Founder & CEO

All Cap Value Style

The All Cap Value style ranks sixth out of the twelve styles as detailed in my Style Rankings for ETFs and Mutual Funds report. It gets my Dangerous rating, which is based on aggregation of ratings of 2 ETFs and 239 mutual funds in the All Cap Value style as of January 27th, 2014.

David Trainer, Founder & CEO

All Cap Growth Style

The All Cap Growth style ranks fifth out of the twelve fund styles as detailed in my Style Rankings for ETFs and Mutual Funds report. It gets my Neutral rating, which is based on aggregation of ratings of 2 ETFs and 448 mutual funds in the All Cap Growth style as of January 28, 2014.

David Trainer, Founder & CEO

All Cap Blend Style

The All Cap Blend style ranks second out of the twelve fund styles as detailed in my Style Rankings for ETFs and Mutual Funds report. It gets my Neutral rating, which is based on aggregation of ratings of 38 ETFs and 738 mutual funds in the All Cap Blend style as of January 24, 2014.

David Trainer, Founder & CEO

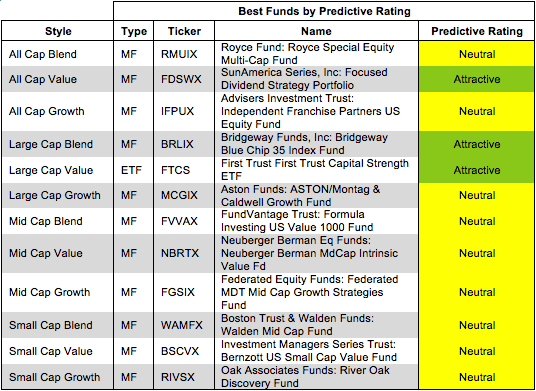

Rating Breakdown: Best & Worst ETFs & Mutual Funds by Style

This report identifies the “best” ETFs and mutual funds based on the quality of their holdings and their costs. As detailed in “Low-Cost Funds Dupe Investors”, there are few funds that have both good holdings and low costs. While there are lots of cheap funds, there are very few with high-quality holdings.

David Trainer, Founder & CEO

Our Outlook For Stocks in 2014

The bull market received a bit of a scare last week as the S&P 500 fell almost 3%, the biggest single week loss since 2012. The market seems to have

David Trainer, Founder & CEO

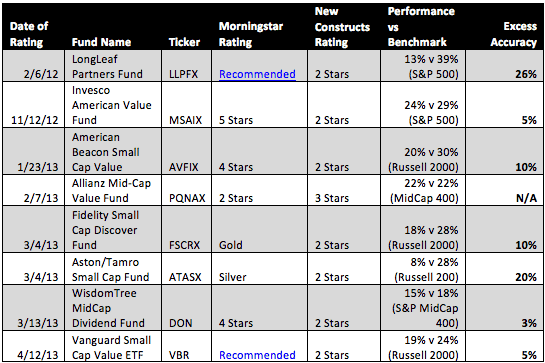

Morningstar’s Ratings Are Not The Final Word

Morningstar’s research can be helpful, but we believe our in-depth analysis of ETF and mutual fund holdings gives our ratings a superior predictive value, and results back up our claim.

David Trainer, Founder & CEO

Don’t Trust the Dead Cat Bounce in Angie’s List

Investors beware: Angie's List may be on the rise but the bounce is nothing more than a dead cat. Quantitative Analytics Analyst, David Trainer, highlights Angie's Lists flawed business model, weak growth projections and the fact that insiders keep selling shares. Analysts might see "value" in the company but research shows that growth is slowing, and such growth as there is, is misleading with Customer feedback disappearing behind advertisers' payments. As new competitors move fast into the market, Analysts warn that Patricia Arquette's portrayal of the NGO's inspiring founder shouldn't blind investors to the harsh realities of Angie's List's poor business performance.

David Trainer, Founder & CEO

Danger Zone: Ashland (ASH)

Specialty chemicals producer Ashland Inc. (ASH) is in the Danger Zone this week. Those that consider ASH a “value” stock are mistaken. The stock is cheap by traditional metrics such as price to earnings, but a closer look reveals the value to be an illusion.

David Trainer, Founder & CEO

1Q14 Investment Style Rankings For ETFs & Mutual Funds

No fund style earns better than my Neutral rating going into 1Q14. My style ratings are based on the aggregation of my fund ratings for every ETF and mutual fund in each style.

David Trainer, Founder & CEO

1Q Best & Worst ETFs & Mutual Funds—by Sector—Recap

Each quarter, we provide the most comprehensive review of equity ETFs and mutual funds available. We review the Best & Worst ETFs and Mutual Funds by sector and style.

This article

David Trainer, Founder & CEO

Utilities Sector

The Utilities sector ranks last out of the ten sectors as detailed in my Sector Rankings for ETFs and Mutual Funds report.

David Trainer, Founder & CEO

Telecom Services Sector

The Telecom Services sector ranks fourth out of the ten sectors as detailed in my Sector Rankings for ETFs and Mutual Funds report.

David Trainer, Founder & CEO

Materials Sector

The Materials sector ranks seventh out of the ten sectors as detailed in my Sector Rankings for ETFs and Mutual Funds report. It gets my Dangerous rating, which is based on aggregation of ratings of 11 ETFs and 15 mutual funds in the Materials sector as of January 22nd, 2014.

David Trainer, Founder & CEO

Information Technology Sector

The Information Technology sector ranks second out of the ten sectors as detailed in my Sector Rankings for ETFs and Mutual Funds report. It gets my Neutral rating, which is based on aggregation of ratings of 27 ETFs and 130 mutual funds in the Information Technology sector as of January 20, 2013.

David Trainer, Founder & CEO

Industrials Sector

The Industrials sector ranks fifth out of the ten sectors as detailed in my Sector Rankings for ETFs and Mutual Funds report. It gets my Dangerous rating, which is based on aggregation of ratings of 17 ETFs and 18 mutual funds in the Industrials sector as of January 16, 2014.

David Trainer, Founder & CEO

Apple’s Declining Advantage is Undeniable

Apple cannot have pricing power and market share at the same time. No one can for an extended period of time. The problem with AAPL is that it is priced for the company to achieve market share penetration and growth at high prices. The reality is that the quality of Apple products versus competitors is declining. Prices will have to come down just to maintain market share.

David Trainer, Founder & CEO