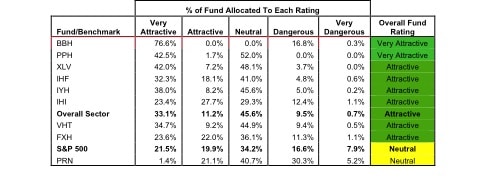

PowerShares Leads The “Most Attractive” ETFs

PowerShares Buyback Achievers (PKW) is the #1 “most attractive” ETF out of the 375+ ETFs we ranked according to our predictive rating system.

David Trainer, Founder & CEO