Though Core Earnings[1] for the S&P 500 reached record heights in 1Q22 (more details here), we find that this earnings power is very unevenly distributed. 40 companies, or just 8% of companies in the S&P 500, account for 50% of the Core Earnings for the entire S&P 500. Deeper analysis reveals that these 40 companies trade at lower valuations compared to the rest of the index.

Perhaps, the most telling sign that investors are not digging below the surface when allocating capital is this mismatch between earnings power and market capitalization.

Clearly, the rising tide does not always lift all boats so investors must find individual stocks that will outperform in any environment. Below, we reveal the three sectors with the most concentrated Core Earnings power[2] and the stocks in those sectors where investors are assigning valuation premiums and discounts in the wrong places.

Investors Undervalue Strong Earnings

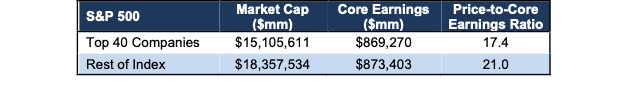

Per Figure 1, the top 40 companies, based on Core Earnings, in the S&P 500 trade at a price-to-Core Earnings (P/CE) ratio[3]’[4] of 17.4. The rest of the index trades at a P/CE ratio of 21.0. Of course, stock prices are based on future earnings so one could argue that these valuations simply reflect diminished expectations for the 40 companies with the highest Core Earnings. However, on closer inspection it becomes clear that the market is badly mispricing earnings potential among some of the largest companies.

Among the top 40 Core Earners, only one gets worse than our Neutral Stock Rating and twenty receive an Attractive-or-better rating, which indicates strong overall earnings potential. Indeed, our Long Ideas have specifically identified several of the top 40 Core Earnings companies as outperformance opportunities. These include the likes of Microsoft (MSFT), Alphabet (GOOGL), Cisco (CSCO), Johnson & Johnson (JNJ), Walmart (WMT), Oracle (ORCL), JPMorgan Chase (JPM), Intel (INTC), and others discussed below.

Figure 1: Disparity in Earnings and Valuation of the S&P 500

Sources: New Constructs, LLC and company filings.

Below we zoom into the earnings at the sector and company level to highlight examples where valuations are not properly aligned with earnings power.

Uneven Distribution in Energy Sector Earnings Power

When we look below the surface, we see that the Energy sector’s Core Earnings, at $109.8 billion in 1Q22 are driven largely by just a few companies.

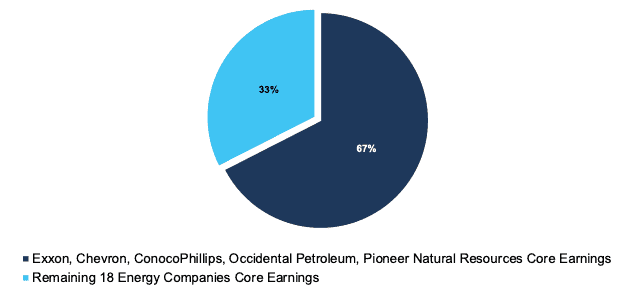

Exxon Mobil (XOM), Chevron Corporation (CVX), ConocoPhillips (COP), Occidental Petroleum Corp (OXY), and Pioneer Natural Resources Company (PXD) make up 67% of the sector’s Core Earnings and account for the largest percent of Core Earnings from a sector’s top five companies across any of the S&P 500 sectors.

Put another way, 22% of the companies in the S&P 500 Energy sector generate 67% of the sector’s Core Earnings.

Figure 2: Five Companies Generate 67% of Energy Sector’s Core Earnings Profitability

Sources: New Constructs, LLC and company filings.

Top Earners Look Cheap Compared to Rest of Energy Sector

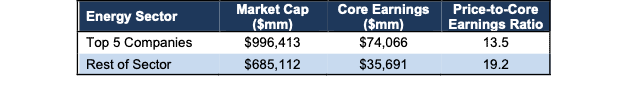

The five companies that make up 67% of the Energy sector’s Core Earnings trade at a P/CE ratio of just 13.5, while the other 18 companies in the sector trade at a P/CE ratio of 19.2.

Per Figure 3, investors are paying a premium for some of the lowest earners in the sector, while the top earning companies, which again include Exxon, Chevron, ConocoPhillips, Occidental Petroleum, and Pioneer Natural Resources, trade at a discount.

Figure 3: Disparity in Earnings and Valuation of the S&P 500 Energy Sector

Sources: New Constructs, LLC and company filings.

To quantify the expectations for future profit growth, we look at the price-to-economic book value (PEBV) ratio, which measures the difference between the market’s expectations for future profits and the no-growth value of the stock. Overall, the Energy sector’s PEBV ratio through 6/13/22 is 0.9. Three of the five top earning Energy sector stocks trade at or below the PEBV of the overall sector. Additionally, each of the five companies have grown Core Earnings at double-digit compound annual growth rates (CAGR) over the past five years, which further illustrates the disconnect between current valuation, past profits, and future profits.

Technology: Digging Deeper Reveals Few Large Winners

When we look below the surface, we see that the Technology sector’s Core Earnings, at $480.5 billion, are unevenly distributed, though slightly less top heavy as the Energy sector.

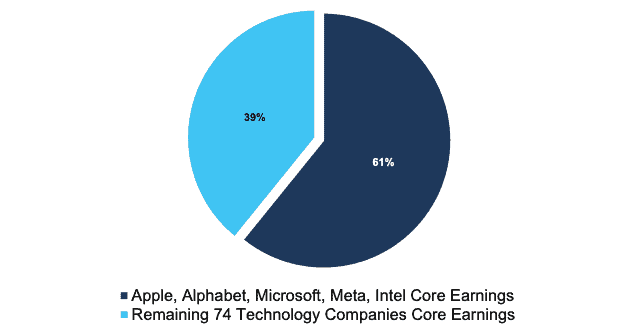

Apple Inc. (AAPL), Alphabet, Microsoft, Meta Platforms (META), and Intel Corporation, make up 61% of the sector’s Core Earnings.

Put another way, 6% of the companies in the S&P 500 Technology sector generate 61% of the sector’s Core Earnings. Expanding this analysis, we also find that the top 10 companies, or 13% of the S&P 500 Technology sector companies, make up 73% of the sectors Core Earnings.

Figure 4: Only a Few Firms Dominate Technology Sector Profitability

Sources: New Constructs, LLC and company filings.

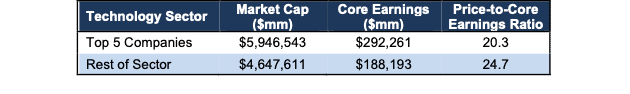

Not Paying a Premium for Top Earning Technology Sector Companies

The five companies that make up 61% of the Technology sector’s Core Earnings trade at a P/CE ratio of 20.3, while the other 74 companies in the sector trade at a P/CE ratio of 24.7.

Per Figure 5, investors can get the Technology sector’s top earning companies at a significant discount, based on P/CE ratio, compared to the rest of the Technology sector. We’ve recently featured three of the top earners, Alphabet, Microsoft, and Intel as Long Ideas and argued each deserves a premium valuation given respective large scale, strong cash generation, and diversified business operations.

Figure 5: Disparity in Earnings and Valuation of the S&P 500 Technology Sector

Sources: New Constructs, LLC and company filings.

Overall, the Technology sector’s PEBV ratio through 6/13/22 is 1.4. Four of the top five earners (Microsoft being the lone stock) trades at or below the PEBV of the overall sector. We’ve argued Microsoft deserves a premium due to its growing moat here. Additionally, four of the five companies have grown Core Earnings at a double-digit CAGR over the past five years, which further illustrates the disconnect between current valuation, past profits, and future profits.

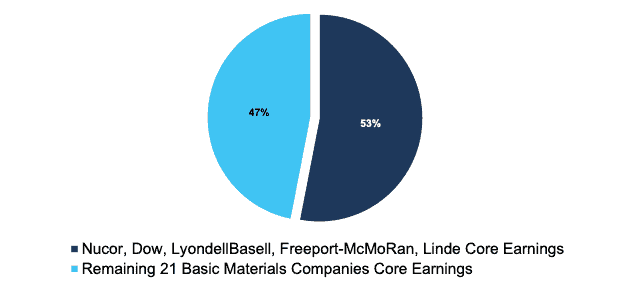

Basic Materials: Digging Deeper Reveals Top Heavy Nature of Sector

When we look below the surface, we see that the Basic Materials sector’s Core Earnings, at $60.1 billion, are also unevenly distributed, though less so than the Energy and Technology sectors.

Nucor Corporation (NUE), Dow Inc. (DOW), LyondellBasell Industries (LYB), Freeport McMoRan (FCX), and Linde, PLC (LIN), make up 53% of the sector’s Core Earnings.

Put another way, 20% of the companies in the S&P 500 Basic Materials sector generate 53% of the sector’s Core Earnings.

Figure 6: Five Firms Dominate Basic Materials Sector Profitability

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in the measurement period.

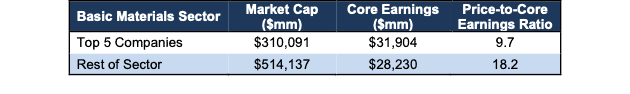

Basic Materials Sector Companies Trade at a Large Discount

The five companies that make up 53% of the Basic Materials sector’s Core Earnings trade at a P/CE ratio of 9.7, while the other 21 companies in the sector trade at a P/CE ratio of 18.2.

Per Figure 7, despite generating over half the Core Earnings in the sector, the top five companies account for just 38% of the entire sector’s market cap and trade at a P/CE ratio nearly half of the other companies in the sector. Investors are effectively putting a premium on lower earnings and under allocating capital to the companies in the sector with the highest Core Earnings through the TTM ended 1Q22.

Figure 7: Disparity in Earnings and Valuation of the S&P 500 Basic Materials Sector

Sources: New Constructs, LLC and company filings.

Overall, the Basic Material sector’s PEBV ratio through 6/13/22 is 0.9. Four of the top five (Linde being the lone stock) earners trades below the PEBV of the overall sector. Additionally, three of the five companies have grown Core Earnings at a double-digit CAGR over the past five years. One (LyondellBasell) has grown at an 8% CAGR and Dow doesn’t have history dating back five years due to its formation in 2019. These growth rates further illustrate the disconnect between current valuation, past profits, and future profits for these industry leaders.

Diligence Matters – Superior Fundamental Analysis Provides Insights

The Core Earnings dominance from just a few firms, coupled with the disconnect in valuation of those top earners, illustrates why investors need to perform proper due diligence before investing, whether it be an individual stock or even a basket of stocks through an ETF or mutual fund.

Those rushing to invest in the Energy, Technology, or Basic Materials sectors and doing so blindly through passive funds are allocating to a significant amount of firms with less earnings strength than the entire sector as a whole would indicate.

Our measure of Core Earnings leverages cutting-edge technology to provide clients with a cleaner and more comprehensive view of earnings. Investors armed with our measure of Core Earnings have a differentiated and more informed view of the fundamentals of companies and sectors, which allows them insights to find high-quality and low-quality stocks, generate alpha, and fulfill the fiduciary duty of care.

This article originally published on June 21, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] The Journal of Financial Economics features the superiority of our Core Earnings in Core Earnings: New Data & Evidence.

[2] Top three excludes the Telecom Services sector as there are only five companies in the sector.

[3] We calculate this metric based on S&P Global’s (SPGI) methodology, which sums the individual S&P 500 constituent values for market cap and Core Earnings before using them to calculate the metric.

[4] Price as of 6/13/22 and financial data through calendar 1Q22.

1 Response to "Biggest Valuation Disconnects in the S&P 500"

perceptive article thanks