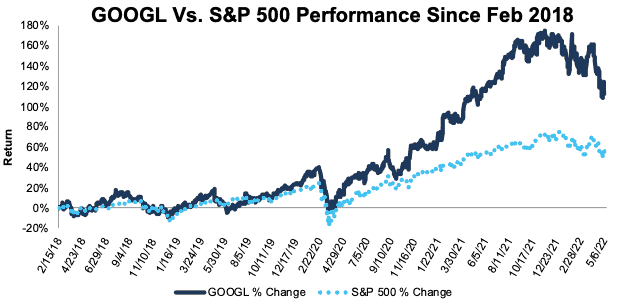

We first made Alphabet (GOOGL: ~$2,300/share) a Long Idea in February 2018. Since then, the stock is up 110% compared to a 46% gain for the S&P 500. Even after such strong outperformance, the stock has another 43%+ upside while the index looks weaker by the day. Our last report (April 2021) on Alphabet is here.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

Alphabet’s Stock Has Strong Upside Based on:

- the continuing impact of digital transformation post the COVID-19 pandemic

- its large free cash flow generating business

- substantial research and development spending

- robust growth from cloud business

- opportunities to develop additional profit-generating segments

- the current price has 47% upside with only moderate profit growth.

Figure 1: Long Idea Performance: From Date of Publication Through 5/10/2022

Sources: New Constructs, LLC

What’s Working

The Real Pandemic Winner: Unlike other companies – such as Peloton (PTON), Wayfair (W), and Shopify (SHOP) – that have seen their pandemic-driven profits fade over the trailing twelve months (TTM), Alphabet’s business continues to surpass already elevated pandemic levels. The company’s revenue rose 23% year-over-year (YoY) in 1Q22, while its Core Earnings rose 24%.

The pandemic accelerated a digital transformation worldwide in many industries and now fuels continued demand for Alphabet’s advertising services, which accounted for ~29% of digital ad revenue in the U.S. market in 2021.

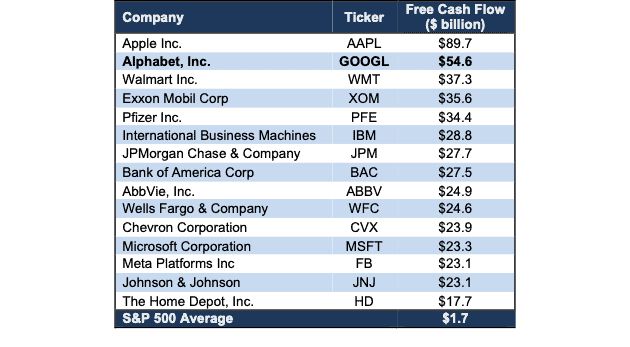

Alphabet Generates Lots of Free Cash Flow: Alphabet’s advertising business enables the company to generate strong free cash flow (FCF). Over the past five years, Alphabet generated cumulative FCF of $134.9 billion (9% of market cap), second only to Apple (AAPL) among companies in the S&P 500.

Over the TTM, Alphabet’s FCF of $54.6 billion is 1.2x the combined FCF of Microsoft (MSFT) and Meta Platforms (FB) and 32x the average TTM FCF of all S&P 500 companies. See Figure 2.

Figure 2: TTM Free Cash Flow: S&P 500 Top 15

Sources: New Constructs, LLC and company filings

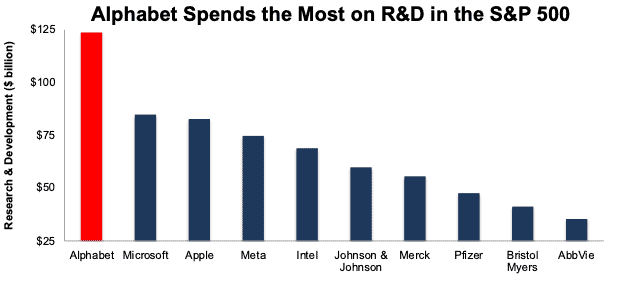

Alphabet leverages its cash-generating advertising business to fund substantial research and development (R&D) spending, which creates a significant competitive advantage for the company. Alphabet’s five-year cumulative R&D spend is the most of all companies in the S&P 500, per Figure 3. Alphabet’s R&D spending over the past five years is 1.5x Microsoft’s, 1.5x Apple’s, and 2x pharmaceutical giant Johnson & Johnson’s (JNJ) R&D spending.

Figure 3: 5-Year Cumulative Research and Development: S&P 500 Top 10

Sources: New Constructs, LLC and company filings

Profitability Continues to Improve: Alphabet’s Core Earnings have risen from $28.8 billion in 2018 to $70.5 billion over the TTM. The company’s net operating profit after tax (NOPAT) margin has risen from 20% in 2018 to 26% TTM, while its invested capital turns have risen from 1.6 to 2.1 over the same time. Rising NOPAT margins and invested capital turns have driven Alphabet’s return on invested capital (ROIC) from 33% in 2018 to 55% over the TTM.

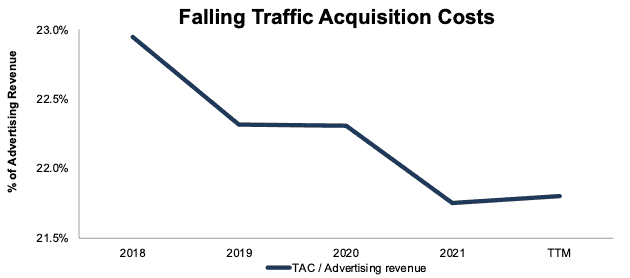

Alphabet’s ability to control its traffic acquisition costs (TAC), i.e. the amount it spends to acquire advertising revenue, is a key driver of its improved profitability. Over the TTM, advertising revenue accounted for 81% of Alphabet’s total revenue. Per Figure 4, Alphabet’s TAC have steadily fallen from 23% of revenue in 2018 to below 22% TTM.

Figure 4: Traffic Acquisition Costs as Percent of Advertising Revenue: 2018 – TTM

Sources: New Constructs, LLC and company filings

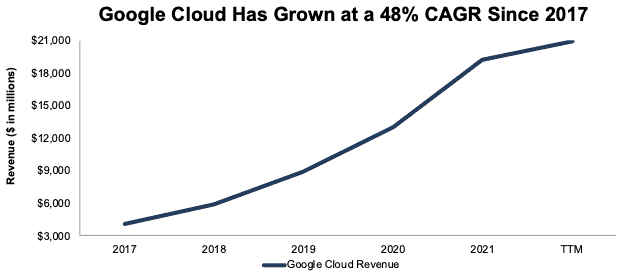

Google Cloud Drives Revenue Growth: Alphabet is more than just an advertising business and its cloud segment drives further revenue growth. Per Figure 5, cloud revenue rose from $4.1 billion in 2017 to $19.2 billion in 2021, or 48% compounded annually. Over the TTM, Google Cloud revenue is $21 billion and accounts for 8% of total revenue.

Figure 5: Google Cloud Revenue: 2017 – TTM

Sources: New Constructs, LLC and company filings

What’s Not Working

Regulatory Concerns Loom Over the Stock: “Big Tech” companies have long lobbied Washington to limit legislative and regulatory restrictions. These efforts, coupled with disagreement between political parties, have stalled major legislative action against Big Tech.

However, the real regulatory threat to Alphabet, and the rest of Big Tech, comes from the EUs Digital Markets Act (DMA), which Alphabet unsuccessfully lobbied against. The DMA will force large companies to open up their ecosystems, share data with competitors, and stop using personal data for targeted advertising without explicit consent. Repeated violations of the DMA could bring fines of up to 10% of global annual revenue.

It’s not all bad news for Big Tech, though. The DMA prohibits member states from passing their own laws, which removes the risk of even more extreme country-specific regulation or an impossible patchwork of regulations.

Over the long run, Alphabet is likely to navigate regulatory challenges and deliver profits. Indeed, its business has proven to be more resilient to privacy-related changes than Meta’s (FB). Large incumbent companies are often best equipped to navigate highly regulated industries. Alphabet is armed with the cash, political savvy, and services that deliver a social good which could help the company widen its moat as it positions its business to comply with regulatory complexities. Examples of other companies we have written on that deliver exceptionally profitable operations in highly regulated environments include JPMorgan (JPM), Shell (SHEL), Johnson & Johnson (JNJ), Verizon (VZ), and Ford (F).

Reliance on Advertising: While Alphabet’s large advertising business is very profitable, the company’s concentration in advertising means a fundamental shift in the digital advertising industry could have a very adverse effect on the company’s profitability. However, Alphabet’s 92% share of the global search market, provides the company’s advertising business with a large moat that new forms of digital advertising will have trouble replicating.

Furthermore, the company’s growing cloud and subscription-based service business help offset some of its exposure to advertising, and Alphabet invests in several initiatives that could help the company transition away from its reliance on advertising. Some of these initiatives include Deep Mind artificial intelligence, Waymo self-driving, and Verily data-driven health solutions.

Diversifying Away from Advertising Will Lower Margins: As the company grows other segments of its business, those segments are not likely to match the high margins Alphabet’s advertising segment achieves, which could lower the company’s overall ROIC. Nonetheless, as long as other segments generate an ROIC above its weighted average cost of capital (WACC), the company will create more shareholder value as it grows economic earnings through these additional segments.

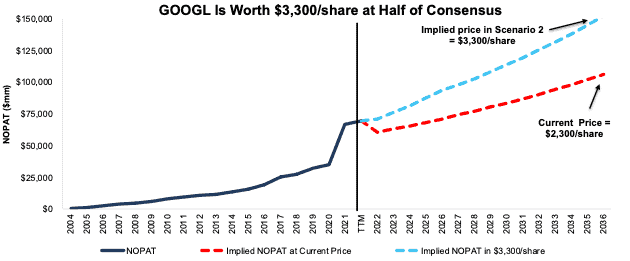

Stock Is Priced for Limited Profit Growth

Concerns over political and regulatory risks have helped drive the stock down 21% year-to-date. However, given the resiliency of Alphabet’s business model, this decline provides investors with an attractive entry point. The stock’s price-to-economic book value (PEBV) ratio is 1.1 is at its cheapest level since 2012, when the stock traded at just $354/share. A PEBV ratio of 1.1 means the market expects Alphabet’s NOPAT to grow to no more than 10% above TTM levels, which seems overly pessimistic. Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for Alphabet.

In the first scenario, we quantify the expectations baked into the current price. We assume,

- NOPAT margin falls to 23% (below TTM margin of 26%) from 2022 – 2036, and

- revenue grows 3% (vs. 2022 – 2026 consensus estimate CAGR of 14%) compounded annually from 2022 to 2036.

In this scenario, Alphabet’s grows NOPAT by just 2% compounded annually through 2036, and the stock is worth ~$2,300/share today – equal to the current price.

Shares Could Reach $3,300+

If we assume Google’s:

- NOPAT margin remains at TTM levels of 26% from 2022 – 2036,

- revenue grows at a 7% CAGR from 2022 – 2026 (half the consensus estimate CAGR from 2022 – 2026), and

- revenue grows by just 5% (vs. 21% CAGR over the past decade) compounded annually from 2027 – 2036, then

the stock is worth ~$3,300/share today – 43% above the current price. In this scenario, Alphabet’s NOPAT grows 6% compounded annually over the next 15 years. For reference, Alphabet has grown NOPAT by 28% compounded annually over the past five years and 35% compounded annually since 2004 (earliest available data). Should Alphabet grow NOPAT more in line with historical levels, the stock has even more upside.

Figure 6: Alphabet’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on May 11, 2022.

David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.