Deep customer relationships and strong cash flows will keep this tech company’s moat intact for years. After strong fiscal 1Q22 earnings, Microsoft Corporation (MSFT: $333/share) remains a Long Idea.

We leverage more reliable fundamental data, as proven in The Journal of Financial Economics[1], and shown to provide a new source of alpha, with qualitative research to highlight this firm whose stock presents excellent risk/reward.

Microsoft Has More Upside Potential

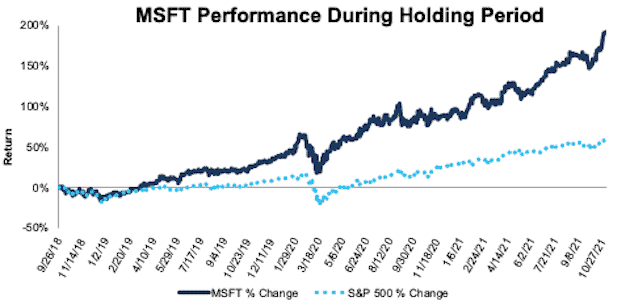

We made Microsoft a Long Idea in September 2018, and the stock has outperformed the market by 133% since then, per Figure 1. Though it has outperformed by a large margin, we believe the stock still presents favorable risk/reward given Microsoft’s extensive competitive advantages.

Figure 1: Long Idea Performance: From Date of Publication Through 11/2/2021

Sources: New Constructs, LLC and company filings

What’s Working for the Firm

An Outstanding Fiscal 1Q22. Microsoft delivered an impressive quarter in fiscal 1Q22, which saw double digit year-over-year (YoY) growth in 12 of its 14 product and service segments. Microsoft’s cloud sales (46% of total revenue) rose 36% YoY in fiscal 1Q22 and drove the company’s overall revenue 22% higher YoY.

Expansive and Integrated User Base Creates Large Moat. Microsoft has a large user base across multiple platforms which, when combined, give the company a large moat. Microsoft 365 had 54 million subscriptions in fiscal 1Q22, Microsoft Teams had 250 million monthly active users as of July 2021, LinkedIn currently has nearly 800 million members, and as of fiscal 3Q21, Windows 10 had 1.3 billion monthly active devices.

Microsoft leverages its products and services, combined with an existing large user base, to generate significant free cash flow (FCF), which, in turn, equips the company with the capital to invest in even more cash generating ventures. Over the past three years, Microsoft generated $98.3 billion in FCF, second only to Apple (AAPL) in the Technology sector. Over the trailing twelve months (TTM), Microsoft generated $34.3 billion in FCF, or 18% of the combined FCF from the 467 companies in the Technology sector.

Microsoft’s scale continues to drive more efficiencies over time as well. The company’s operating expenses (sales and marketing, general and administrative, and research and development) as a percent of revenue have steadily fallen from 34% in fiscal 2017 to 27% TTM. Microsoft’s return on invested capital (ROIC) rose from 27% to 46% over the same time.

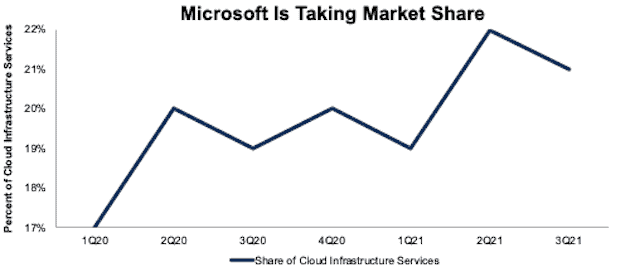

And the Moat Is Getting Bigger. The COVID-19 pandemic drove many businesses to Microsoft’s cloud-based services in search of more technological solutions for their operations. Per Figure 2, Microsoft’s share of the cloud infrastructure market improved from 17% in calendar 1Q20 to 21% in calendar 3Q21. Microsoft should see more growth in this business as Market and Markets expects the cloud computing market to grow 16% compounded annually from calendar 2021-2026.

Figure 2: Microsoft’s Share of Cloud Infrastructure Market: Calendar 1Q20 – 3Q21

Sources: New Constructs, LLC and Statista

A Difficult Business Climate Benefits Solutions Providers. Rising inflation and a challenging labor market drive businesses to seek solutions from Microsoft’s services and products, which help organizations reduce costs and improve productivity. As Satya Nadella stated in the company’s fiscal 1Q22 earnings call, “digital technology is a deflationary force in an inflationary economy.” Businesses seeking to stave off the effects of inflation will continue to drive demand for Microsoft’s products and services.

Microsoft is also seeing the effects of the tight labor market, which has driven more revenue from its LinkedIn business. LinkedIn’s fiscal 1Q22 revenue rose 42% YoY and accounted for 7% of the company’s total revenue in the quarter.

A Long-Term Pandemic Winner. Microsoft was clearly a pandemic winner, but the increased business it gained since fiscal 2020 is not a short-lived aberration. Microsoft is positioned to benefit from long-term hybrid and work from home changes.

Before the pandemic, ResearchAndMarkets forecasted the global PC market to fall 2.8% compounded annually from calendar 2019-2025. However, as hybrid work solutions drive greater demand for PCs, it now expects the global PC market to grow 8.5% compounded annually from calendar 2021-2025.

Employees working from home also expose companies to more cyber-attacks, which have increased exponentially since February 2020. The number of customers using Microsoft’s security solutions rose 50% YoY in fiscal 1Q22. Microsoft’s cybersecurity business should continue to add customers, and the cybersecurity market is projected to grow 14.5% compounded annually from calendar 2021-2026.

Microsoft Teams’ integration with Office 365 made it a natural choice for businesses looking for more collaborative solutions during the pandemic, and Microsoft Teams added 95 million users in calendar 2020. While this level of growth is certain to slow, Grand View Research expects the team collaboration software market to grow 13% compounded annually from calendar 2021-2028.

What’s Not Working for the Firm

Despite the impressive results, there are still a few weak spots in Microsoft’s business.

The company’s Surface revenue fell 17% YoY in fiscal 1Q22 as it faced difficult prior year comps, and Microsoft expects another quarter of YoY decline for the segment in fiscal 2Q22. However, Surface revenue is still up 13% from fiscal 1Q20 levels.

Supply chain constraints impact PC manufacturers (OEMs) and, therefore, Microsoft’s OEM Windows licensing business. Microsoft’s Xbox business could also experience headwinds from the supply chain crunch. At least for now, the company still expects OEM Windows licensing and Xbox revenue to grow YoY in 2Q22.

Amazon’s (AMZN) AWS is the clear market share leader of cloud infrastructure market, with 32% market share in calendar 3Q21. However, Microsoft is closing the gap with Amazon. Amazon’s 3Q21 market share is unchanged from 1Q20, while Microsoft’s market share considerably improved (see Figure 2).

Microsoft’s share of the operating systems for desktop PCs market has been in steady decline for years. In January 2013, 91% of all PCs used Windows. That number has since fallen to just 73% in June 2021. However, as shown above, the company has leveraged its customer relationships from its Windows segment to successfully grow its cloud services.

MSFT Is Priced for Historically Low Profit Growth

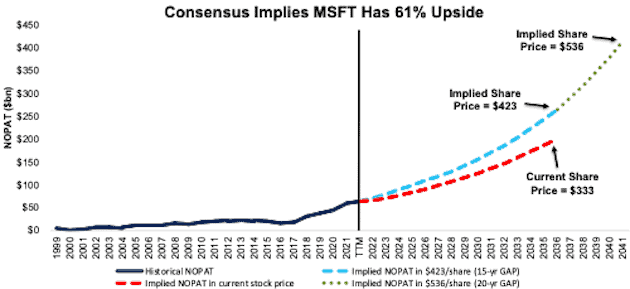

With a price-to-earnings (P/E) ratio of 37, MSFT may look expensive compared to other companies. However, unlike traditional metrics, our reverse discounted cash flow (DCF) model allows us to account for Microsoft’s considerable moat, which is central to our thesis, by evaluating its growth appreciation period (GAP). The GAP represents the number of years Microsoft can grow while earning an ROIC greater than its weighted average cost of capital (WACC). Warren Buffett refers to GAP as the moat around a business’ castle.

The following valuation scenarios assume a GAP of 15 years, which could prove to be a conservative assumption due to the strength of Microsoft’s moat. Below, we use our reverse DCF model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for Microsoft.

In the first scenario, we assume Microsoft’s:

- NOPAT margin remains at TTM levels of 36% over the next 15 years, and

- revenue grows by 8% compounded annually from fiscal 2022-2036 (vs. consensus CAGR of 14% for fiscal 2022-2024)

In this scenario, Microsoft’s NOPAT grows by 8% compounded annually over the next 15 years and the stock is worth $333/share today – equal to the current price. See the math behind this reverse DCF scenario. For reference, Microsoft grew NOPAT by 11% compounded annually over the prior 15 years, from fiscal 2006-2021.

Shares Could Reach $536 or Higher

If we assume Microsoft’s:

- NOPAT margin remains at TTM levels of 36% over the next 15 years, and

- revenue grows at a 14% CAGR through fiscal 2024 (equal to fiscal 2022-2024 consensus CAGR), and

- revenue grows 9% a year in each year thereafter through fiscal 2036, then

the stock is worth $423/share today – 27% above the current price. See the math behind this reverse DCF scenario. In this scenario, Microsoft grows NOPAT by 10% compounded annually over the next 15 years.

However, a GAP of 15 years could prove conservative, given Microsoft’s ever-expanding moat. If we assume Microsoft’s GAP extends to 20 years, and the company continues to grow revenue by 9% a year through fiscal 2041, then the stock is worth $536/share today – 61% above the current price. See the math behind this reverse DCF scenario.

Should Microsoft’s moat extend beyond 20 years, or its NOPAT margin improve beyond TTM levels, as it has in each of the past five years, the stock has even more upside.

Figure 3: Microsoft’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on November 3, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.