We closed this position on April 21, 2021. A copy of the associated Position Update report is here.

It’s hard to find undervalued, high-quality companies in this market. Most cheap companies are cheap for a reason, and most high-quality companies have premium valuations to match.

We recently upgraded this stock to Very Attractive after the market’s overreaction to a negative forecast on its earnings call sent shares down over 10%. Investors are worried about a potential dip in earnings next year while ignoring that the long-term trends for this company are positive, and the valuation already prices in a permanent profit decline. Oshkosh Corp (OSK: $74/share) is this week’s Long Idea.

Strong Trend of Profit Growth

Oshkosh, which manufactures specialty vehicles for a wide array of governmental and industrial customers, operates in four key segments:

- Access Equipment: Includes aerial work platforms, lifts, and telehandlers, for use in construction, manufacturing, and home improvement centers

- Defense: Includes tactical wheeled vehicles for the US military, as well as a small amount of sales to foreign militaries

- Fire & Emergency: Includes fire trucks and emergency response vehicles for use in airports

- Commercial: Includes concrete mixers and trash collection vehicles

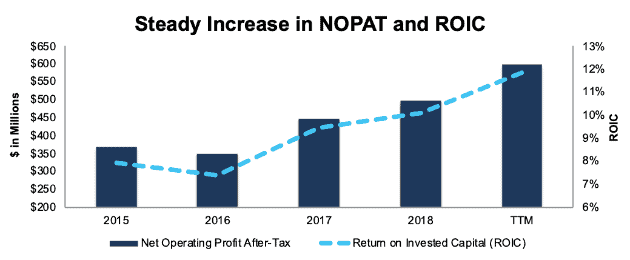

All of these segments have trended upwards in recent years due to strong economic conditions and rising military spending in the U.S. After-tax operating profit (NOPAT) increased from $368 million in 2015 to $499 million in 2018, or 11% compounded annually. Trailing twelve months (TTM) NOPAT is up to $598 million. Meanwhile, return on invested capital (ROIC) improved from 8% in 2015 to 12% TTM. See Figure 1

Figure 1: OSK’s NOPAT and ROIC Since 2015

Sources: New Constructs, LLC and company filings

As Figure 1 shows, the company’s fundamentals remain solid when including the first three quarters of 2019 (OSK’s fiscal year ends on September 30). However, the company spooked investors in its 3Q earnings call on August 1 when CEO Wilson Jones said:

“We believe the access equipment markets in North America and Europe could be down modestly in 2020, foreseeing increased replacement demand in 2021.”

These comments sent shares down over 10% despite the fact that OSK beat on the top and bottom line and raised its full-year 2019 guidance. KeyBanc downgraded the stock from Overweight to Sector Weight due to macro concerns after the earnings call.

While the potential decline in demand for 2020 is a real concern, we think the market underrates OSK’s diversified business, its excellent leadership, and its long-term growth potential. These factors should help OSK weather any cyclical downturn in 2020 and deliver long-term value to shareholders.

Diversified Business Provides Growth Opportunities

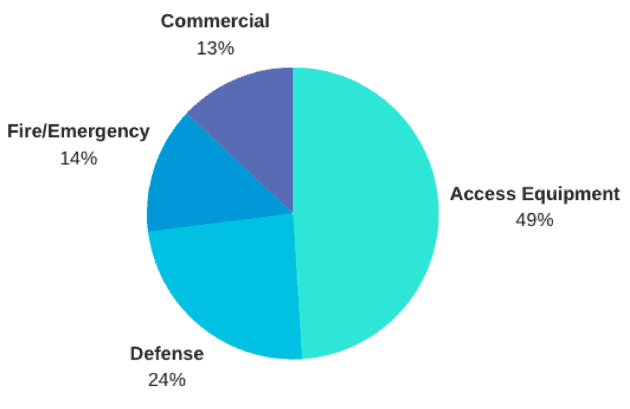

While access equipment is OSK’s largest segment, it sill accounts for less than 50% of revenue, as shown in Figure 2. Even if access equipment struggles in 2020, the other segments have significant upside potential to offset that decline.

Figure 2: OSK Revenue by Segment: 2018

Sources: New Constructs, LLC and company filings

The attention paid to cyclical headwinds for access equipment overshadowed the bullish news for other segments. For instance, Congress and President Trump recently agreed to a two-year budget deal that will boost defense spending by three percent. This deal averts a potential automatic spending cut and gives more clarity to the near-term future for the defense segment.

In addition, the fire & emergency segment has strong growth opportunities from rising demand in the U.S. and expanded opportunities internationally. International sales doubled year-over-year in the most recent quarter as the company delivered fire trucks to China and airport rescue vehicles to Egypt. The administrative challenges of dealing with foreign governments and municipalities have made it difficult for the fire & emergency segment to gain traction internationally, and even now international sales represent just 9% of segment revenue. However, the recent growth and new deliveries suggest there’s more opportunity to expand the business geographically.

These other business lines – which account for over 50% of revenue – have the potential to offset the short-term decline in access equipment and provide long-term growth for Oshkosh.

Product Diversification and Innovation Provides Competitive Advantage

Oshkosh’s diversified business also gives it a competitive advantage by allowing it to provide more comprehensive product solutions to customers than many of its competitors. For example, a city government choosing between Oshkosh and a smaller competitor to supply trucks for its fire department might take into account the fact that Oshkosh can also supply emergency vehicles for the city’s airport. A construction firm might prefer Oshkosh for its ability to provide both aerial work platforms and concrete mixers.

In addition to product diversification, the company seeks to differentiate from its competition through product innovation. In recent years, Oshkosh delivered innovative new products like natural gas-powered concrete mixers and garbage trucks, hybrid and battery powered boom lifts, and battery-powered communication systems for news vehicles.

These innovations earned Oshkosh the designation as the 4th most sustainable industrial company, and the 17th most sustainable company overall in the Barron’s 100 Most Sustainable U.S. Companies ranking.

Oshkosh’s ability to provide a wide array of products and to differentiate its products through energy efficiency and other unique features gives it a competitive advantage in its industry.

Superior Corporate Governance Leads to Value Creation

Oshkosh’s growth in recent years has not come at the expense of prudent capital stewardship, as we often see with many other rapidly growing companies. Instead, Oshkosh’s corporate governance ensures that executives are focused on creating lasting shareholder value.

ROIC has been a part of the company’s long-term incentive plan since 2000. More recently, the company has further intensified its focus on capital efficiency by adding Days Net Working Capital as a performance target for annual bonuses. The CEO and CFO’s bonuses are based on the whole company’s performance, while segment heads earn bonuses based on their specific segment performance.

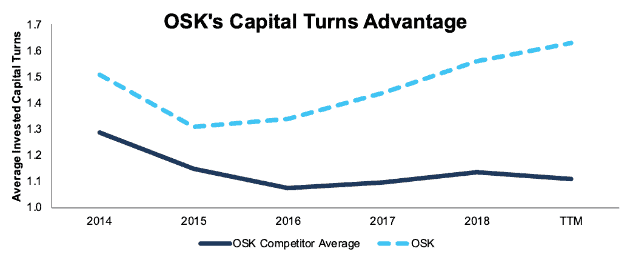

This focus on capital efficiency helps Oshkosh significantly outperform its peers in terms of invested capital turns – or revenue/average invested capital – as shown in Figure 3. The weighted average capital turns for the company’s peers listed in its proxy statement declined from 1.3 to 1.1 over the past five years. Meanwhile, Oshkosh’s capital turns increased from 1.5 to 1.6 over the same time.

Figure 3: Average Invested Capital Turns: OSK vs. Peers: 2014-TTM

Sources: New Constructs, LLC and company filings

Oshkosh’s superior capital turns indicate that the company is more intelligent about allocating capital and ensuring that its assets operate at the highest-possible level of efficiency.

Valuation Is Below the Bear-Case Scenario

Even if Oshkosh does face a cyclical downturn next year, this decline is already priced into the stock. At its current valuation of $75/share, OSK has a price to economic book value (PEBV) ratio of 0.9. This ratio means the market expects OSK’s NOPAT to permanently decline by 10%.

Notably, this expectation is far below what analysts are projecting for the stock. Consensus estimates have revenue declining by just 1% and earnings per share declining by just 3% in 2020. These estimates also project revenue and earnings to bounce back to 2019 levels by 2021.

If we assume analyst estimates for EPS growth and decline roughly line up with changes in NOPAT, we can use our reverse discounted cash flow model to see the divergence between the market’s valuation and consensus forecasts.

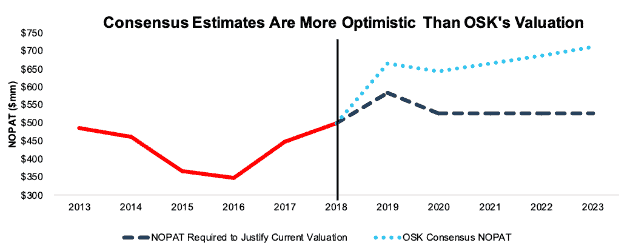

Figure 4 shows OSK’s price of $75/share implies that NOPAT will increase by 17% in 2019, decline by 10% in 2020, and never grow again after that. Meanwhile, analysts expect 2019 earnings to increase by 34%, decline by just 3% in 2020, and then increase by 3% in the years after. These estimates are well above what the current stock price implies for future growth, which gives OSK significant upside potential.

Figure 4: OSK’s Historical and Implied Future NOPAT vs. Consensus Analyst Estimates

Sources: New Constructs, LLC and company filings

Based on the current information about OSK’s cash flows and future projections, it’s hard to justify the current low valuation.

Cheap Valuation Provides Upside

OSK’s 0.9 PEBV means the stock is the cheapest it has been since 2016. The last time OSK was this cheap, the stock more than doubled over the following two years. We’re not necessarily projecting an exact repeat, but there is significant potential upside going forward.

If OSK can maintain its TTM NOPAT margin of 7% and grow NOPAT by 4% compounded annually over the next decade, the stock is worth $100/share today – a 34% upside to the current stock price. See the math behind this dynamic DCF scenario.

This scenario could prove conservative, as the 4% growth is slightly below the 5% projected growth of the construction equipment market. Even if OSK grows slower than the overall market, the stock still has potential upside.

Sustainable Competitive Advantages That Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Oshkosh’s business will enable the company to generate higher profits than the current valuation of the stock implies. This list of competitive advantages helps OSK offer better products/services at a lower price and prevents competition from taking market share.

- Diversified product lineup that offers more comprehensive solutions

- Product innovation, especially around energy efficiency and sustainability, that differentiates

- Superior capital efficiency compared to peers

What Noise Traders Miss with OSK

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus tends toward technical trading tends while high-quality fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing OSK:

- Positive trends in other segments to offset the headwinds in the access equipment business

- Superior corporate governance that leads to greater capital efficiency

- Bear case forecasts actually imply a higher valuation than the current stock price

Catalyst: Trade Deal, International Growth Could Send Shares Higher

A new trade deal, especially one that lifted tariffs on steel prices, would be a big boost to Oshkosh, which purchases a significant amount of steel for its manufacturing process. Falling steel prices help the company in the short-term because it has ~$5 billion (60% of TTM revenue) in contracted backlog where the prices are locked in based on higher steel input costs. Longer-term, falling steel prices make the company’s products more affordable and should boost overall demand.

Even without a trade deal, Oshkosh has the ability to shift attention away from the concerns in the North American access equipment market by growing its international business. If the company can continue to win new business abroad, that should reduce the concern over short-term cyclical pressures.

Dividends and Buybacks Provide 8% Yield

Oshkosh has increased its dividend for each of the past seven years. Since 2014, Oshkosh has increased its quarterly dividend from $0.15 to $0.27, or 12% compounded annually. Its current annualized dividend of $1.08 equates to a dividend yield of 1.4%.

In addition to dividends, Oshkosh returns capital to shareholders through share repurchases. Over the last twelve months, the company repurchased $374 million (7% of market cap) worth of shares. The company currently has a remaining purchase authorization of 8.8 million shares, or $660 million worth of stock at the current price. With its $397 million in TTM free cash flow, Oshkosh has the ability to maintain its buyback and dividend and return 8% of its market cap to shareholders each year.

Insider Trading and Short Interest Trends are Minimal

Insider activity has been minimal over the past 12 months, with 23 thousand shares purchased and 246 thousand shares sold for a net effect of 223 thousand shares sold. These sales represent less than 1% of shares outstanding.

There are currently 2.3 million shares sold short, which equates to 3% of the float and 4 days to cover. There doesn’t appear to be much appetite to bet against this stock.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[1] findings in Oshkosh’s 2018 10-K:

Income Statement: we made $266 million of adjustments, with a net effect of removing $27 million in non-operating expense (1% of revenue). We removed $120 million in non-operating income and $146 million in non-operating expenses. You can see all the adjustments made to OSK’s income statement here.

Balance Sheet: we made $1.6 billion of adjustments to calculate invested capital with a net increase of $1.3 billion. You can see all the adjustments made to OSK’s balance sheet here.

Valuation: we made $1.1 billion of adjustments with a net effect of decreasing shareholder value by $1 billion million. Despite this decrease in value, OSK remains undervalued. You can see all the adjustments made to OSK’s valuation here.

Attractive Funds That Hold OSK

The following funds receive our Attractive-or-better rating and allocate significantly to Oshkosh.

- WBI BullBear Rising Income 2000 ETF (WBIA) – 4.4% allocation and Very Attractive rating

- WBI BullBear Value 2000 ETF (WBIB) – 4.2% allocation and Attractive rating

This article originally published on August 7, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.