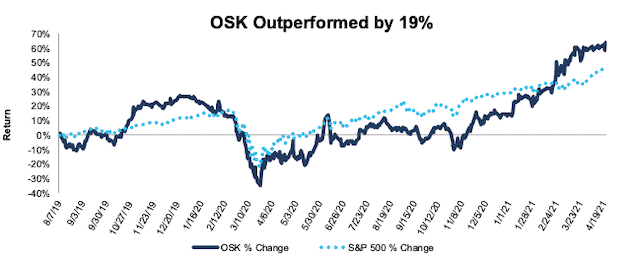

Oshkosh Corporation (OSK) – Closing Long Position – up 64% vs. S&P up 45%

We made Oshkosh Corporation (OSK: $123/share) a Long Idea on August 7, 2019. At the time of the report, OSK received a Very Attractive rating. Our long thesis focused on the firm’s diversified product lineup, history of profit growth, quality corporate governance, and low expectations for future profit growth baked into the stock price.

This report, along with all of our research[1], leverages our more reliable fundamental data[2] to get the truth about earnings, as shown in the Journal of Financial Economics paper, “Core Earnings: New Data and Evidence.”

During the nearly two-year holding period, OSK outperformed by 19% as a long position, rising 64% compared to a 45% gain for the S&P 500.

The stock’s recent strong increase means shares look fully priced and no longer provide the same risk/reward. To justify its current stock price, Oshkosh must improve profit margins to its 5-year and 10-year average while growing revenue at consensus estimates over the next two years and in-line with industry expectations from 2023-2030. Anything lower and the stock is worth less than its current price.

Given the risk/reward profile skewing more towards risk, we’re taking the gains and closing this long position.

Figure 1: OSK vs. S&P 500 – Price Return – Successful Long Idea

Sources: New Constructs, LLC and company filings

Note: Gain/Decline performance analysis excludes transaction costs and dividends.

This article originally published on April 21, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features our Robo-Analyst research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Three independent studies from respected institutions prove the superiority of our data, models, and ratings. Learn more here.