We published an update on Freshpet on September 28, 2022. A copy of the associated report is here.

Time is running out for cash-burning companies kept afloat with easy/cheap access to capital. These “zombie” companies are at risk of going bankrupt if they cannot raise more debt or equity, which is not as easy as it used to be.

As the Fed raises interest rates and ends quantitative easing, access to cheap capital is drying up quickly. At the same time, many companies face declining margins and may be forced to default on interest payments without the possibility of refinancing. As these zombie companies run out of the cash needed to stay afloat, risk premiums will rise across the market, which could further squeeze liquidity and create an escalating series of corporate defaults.

This report features Freshpet (FRPT: $55/share), a zombie company with a high risk of seeing its stock go to $0/share. We also feature Carvana (CVNA: $25/share) here and Peloton (PTON: $11/share) here.

Zombie Companies with Little Cash Are Risky

Companies with heavy cash burn and little cash on hand are risky in today’s market. Being forced to raise capital in this environment, even if the company is ultimately successful, is not good for existing shareholders.

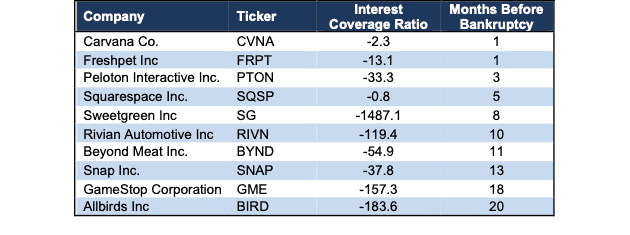

Figure 1 shows the zombie companies most likely to run out of cash first, based on free cash flow (FCF) burn and cash on the balance sheet over the trailing-twelve-months (TTM). Each company in Figure 1 has:

- Negative interest coverage ratio (EBIT/Interest expense)

- Negative FCF over the TTM

- Less than 24 months before it needs more capital to subsidize the TTM FCF burn rate

- Been a Danger Zone pick

Not surprisingly, the companies that are most at risk of seeing their stock price go to $0 are the ones with a poor underlying business model, which was overlooked by investors during the 2020-2021 meme stock-driven market frenzy. Companies such as Carvana, Freshpet, Peloton, and Squarespace (SQSP) have less than six months of cash on their balance sheets based on their FCF burn over the past twelve months. These stocks have a real risk of going to zero.

Figure 1: Danger Zone Stocks with Less than Two Year’s Worth of Cash on Hand: as of 1Q22

Sources: New Constructs, LLC and company filings.

To calculate “Months Before Bankruptcy” we divided the TTM FCF burn by 12, which equals monthly cash burn. We then divide Cash and Equivalents on the balance sheet through 1Q22 by monthly cash burn.

And Overvalued Zombie Stocks Are the Riskiest

Stock valuations that embed high expectations for future profit growth add more risk to owning shares of zombie companies with just a few months’ worth of cash left. For the riskiest zombie companies, not only does the stock price not reflect the short-term distress facing the company, but it also reflects unrealistically optimistic assumptions about the long-term profitability of the company. With these stocks, overvaluation risk is stacked on top of short-term cash flow risk.

Below, we’ll take a closer look at Freshpet and detail the company’s cash burn and how much further its stock price could fall.

Freshpet (FRPT: $55/share)

We put Freshpet (FRPT) in the Danger Zone in February 2022, and the stock has outperformed the S&P 500 as a short by 24% since then. Even after falling 69% from its 52-week high and 44% YTD, we think the stock has much more downside.

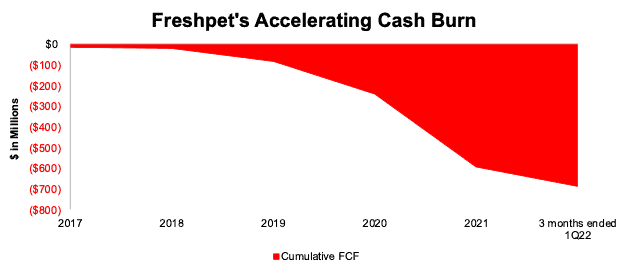

Freshpet has grown the top line at the expense of the bottom-line, and sales growth has driven more cash burn, which puts the stock in danger of declining to $0 per share. The firm’s free cash flow (FCF) has been negative every year since 2017, and its FCF burn has worsened in recent years.

Since 2017, Freshpet has burned through $691 million in FCF, per Figure 2.

Over the TTM ended 1Q22, Freshpet burned $386 million. With just $30 million in cash and cash equivalents on the balance sheet at the end of 1Q22, Freshpet’s cash balance could only sustain its FCF burn for less than one month after 1Q22. Freshpet issued shares that provided a net $338 million to the company in May 2022. Freshpet management notes that the cash would be used for “general corporate purposes”, which can include capex, development of its kitchens, investments, or repayments of debt.

Based on TTM cash burn rates, this fresh cash can keep the company afloat for 9 more months from today.

If Freshpet continues to expand its manufacturing and distribution capacity and incur heavy advertising expenses to support its revenue growth, it could run out of cash in less than 9 months.

Figure 2: Freshpet’s Cumulative Free Cash Flow Through 1Q22

Sources: New Constructs, LLC and company filings

Priced to Be Bigger Than J.M. Smucker and General Mills Pet Food Segments

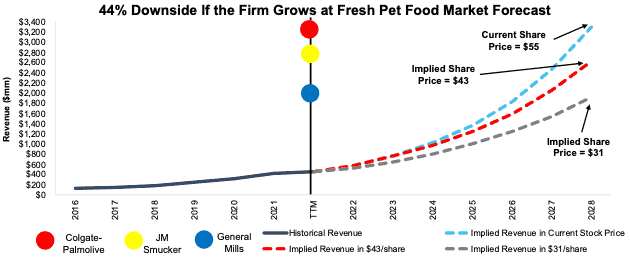

Below we use our reverse discounted cash flow (DCF) model to analyze the future cash flow expectations baked into Freshpet’s stock price. We also provide two additional scenarios to highlight the downside potential in shares if Freshpet’s revenue grows at more reasonable rates.

If we assume Freshpet’s:

- NOPAT margin immediately improves to 6% (compared to Freshpet’s -6% margin in 2021, -7% margin over the TTM, and equal to the peer group market-cap weighted average TTM margin[1]) and

- revenue grows 34% compounded annually through 2028, then

the stock would be worth $55/share today – equal to the current stock price.

In this scenario, Freshpet generates $3.3 billion in revenue in 2028 or equal to Colgate-Palmolive’s TTM pet food sales, 1.2x J.M. Smucker’s TTM pet food sales, and 1.6x General Mills’ TTM pet food sales.

Keep in mind, the number of companies that grow revenue by 20%+ compounded annually for such a long period are unbelievably rare, making the expectations in Freshpet’s share price outright unrealistic.

DCF Scenario 2: Shares are Worth $43 at Consensus Growth

We perform a second DCF scenario to highlight the downside risk to owning Freshpet should it grow at consensus revenue estimates. If we assume Freshpet’s:

- NOPAT margin improves to 6% in 2021,

- revenue grows at consensus rates in 2022 and 2023, and

- revenue grows 28% each year from 2024-2028, then

the stock would be worth $43/share today – or 22% below the current stock price. In this scenario, Freshpet generates $2.6 billion in revenue in 2028 which is still 80% of Colgate-Palmolive’s TTM pet food sales, equal to J.M. Smucker’s TTM pet food sales, and 1.3x General Mills’ TTM pet food sales.

DCF Scenario 3: FRPT Has 44%+ Downside

We review a final DCF scenario to evaluate the downside risk should Freshpet grow revenue at the consensus expectations for market growth. If we assume Freshpet’s:

- NOPAT margin immediately improves to 6% and

- revenue grows at a 24% CAGR (equal to fresh pet food market forecast) through 2028, then

the stock would be worth just $31/share today – a 44% downside to the current stock price.

Figure 3 compares Freshpet’s historical revenue to its implied revenue in each of the above DCF scenarios. We also include the TTM pet food sales from peers JM Smucker, Colgate-Palmolive, and General Mills.

Figure 3: Freshpet’s Historical and Implied Revenue: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Each of the above scenarios also assumes Freshpet grows revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is highly unlikely but allows us to create best-case scenarios that demonstrate the expectations embedded in the current valuation. For reference, Freshpet’s TTM invested capital is six times its 2016 level. If we assume Freshpet’s invested capital increases at a similar historical rate in DCF scenarios 2-3 above, the downside risk is even larger.

This article originally published on June 23, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Peer group includes Amazon.com (AMZN), Chewy Inc. (CHWY), Colgate-Palmolive (CL), Costco Wholesale (COST), General Mills (GIS), Nestle (NSRGY), J.M. Smucker (SJM), and Tyson Foods (TSN).

2 replies to "Zombie Stock #2 – Could Go to $0 As Fed Raises Rates"

Hi, How is the team’s thesis looking after Jana’s involvement and the spike up in price last week? Thanks

Rahul,

Great question! We address Jana’s involvement in our latest update to FRPT here: https://www.newconstructs.com/no-longer-a-zombie-but-still-a-dangerous-stock/.