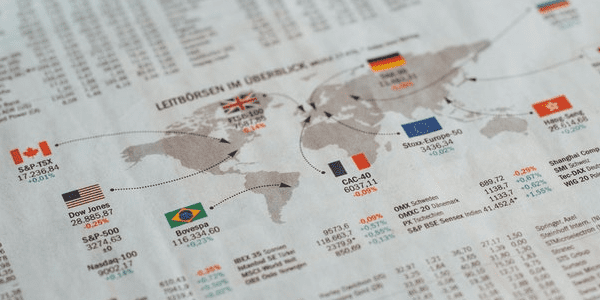

Unscrubbed Data Creates Misleading Credit Ratings

Highlighting the five ratios that drive our Credit Ratings and how our data drives materially different results compared to ratios and ratings based on unscrubbed data.

Matt Shuler, Investment Analyst II