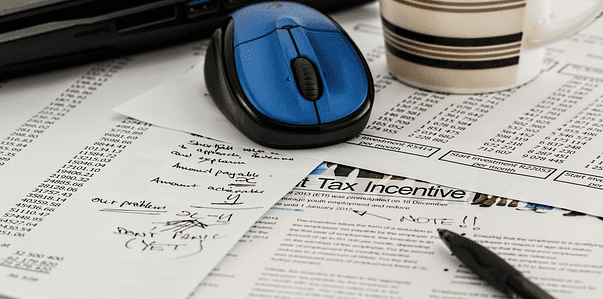

On January 11, 2018, we showed that the “earnings recovery” is an illusion. U.S. equities[1] may have rebounded from 2015 lows, but economic earnings – which reverse accounting distortions and account for the weighted average cost of capital (WACC) – remain in a persistent downturn. Figure 1 shows this trend.

Figure 1: Economic vs. GAAP Earnings

Sources: New Constructs, LLC and company filings.

This disconnect between accounting earnings and economic earnings is not just due to a handful of companies. 6 out of 11 sectors have misleading earnings (GAAP rising and economic earnings falling) in the last fiscal year. Over the last twelve months, six sectors have negative economic earnings, and just two sectors, Technology and Healthcare, have positive and rising economic earnings.

The breadth of this decline in economic earnings suggests that the majority of U.S. public companies are unable to earn a return on invested capital (ROIC) greater than their WACC on new investments. In other words, the majority of U.S. companies are struggling to find profitable ways to allocate capital.

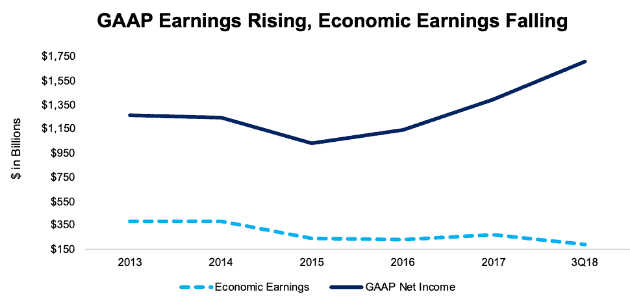

As Figure 2 shows, the Tech sector is one of only two sectors with rising and positive economic earnings. But, the economic earnings picture is not as rosy as GAAP earnings would suggest. While GAAP net income has risen 9% over the past five years, economic earnings are only up 7%. Tech companies also have the most excess cash of any sector, at $1.1 trillion, a sign that they are also struggling to find profitable growth opportunities.

Figure 2: Economic vs. GAAP Earnings: Information Technology

Sources: New Constructs, LLC and company filings.

Figure 2 explains why tech has “taken over the market.” It’s been the only option for investors that want real earnings growth.

For example, Microsoft (MSFT) has more than tripled the return on the S&P 500 over the past five years. Its economic earnings have grown by 32% compounded annually since 2016 compared to a flatlining net income.

However, many investors are quick to buy into the illusory earnings growth in the rest of the market, which we see as a result of the meteoric increase in the number of noise traders.

The disconnect between accounting and economic earnings in the market stems from two primary issues:

- Income statement manipulation: managers exploit accounting loopholes to overstate accounting profits. GAAP net income has grown 6% over the past five years for the companies in Figure 1, but net operating profit after tax (NOPAT) is up only 4% over that timeframe.

- GAAP earnings overlook balance sheets and the cost of equity capital. Over the past five years, the companies in Figure 1 have increased their balance sheets, i.e. invested capital, by 32%. Their weighted average cost of capital (WACC) is up from 5.7% to 6.9% over the same time. Economic earnings decline when the cost and amount of capital rise faster than NOPAT.

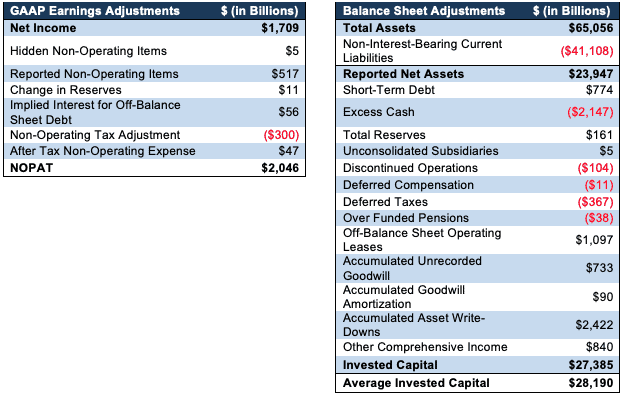

Economic earnings equal NOPAT - (WACC*Invested Capital). When NOPAT grows slower than net income while invested capital and WACC grow faster, economic earnings decline. Figure 3 details the adjustments we make to calculate the current NOPAT and invested capital values for the whole market.[2]

Figure 3: Reconciling GAAP Earnings with Economic Earnings: NOPAT and Invested Capital

Sources: New Constructs, LLC and company filings.

Our biggest adjustment on the NOPAT side is to strip out non-operating items that are reported directly in the financial statements, such as interest expense, preferred dividends, and minority interest income. Our Robo-Analyst also uncovered a net $5 billion in non-operating expenses hidden in the footnotes.

On the balance sheet side, we added back $2.4 billion in accumulated asset write-downs that companies tried to scrub off their balance sheet. Adding back accumulated write-downs holds companies accountable for all the capital invested in the business over its life.

Only by making these adjustments can you reverse accounting distortions and reveal true profitability[3].

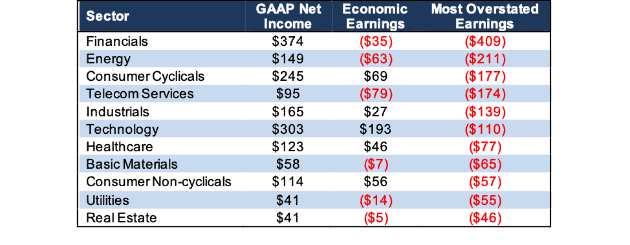

Figure 4 provides a quick summary of the sector whose accounting income is most overstated.[4] Figures 5-14 compare economic earnings to GAAP net income for each sector.

Figure 4: TTM Economic Vs. GAAP Earnings: All Sectors ($ in billions)

Sources: New Constructs, LLC and company filings.

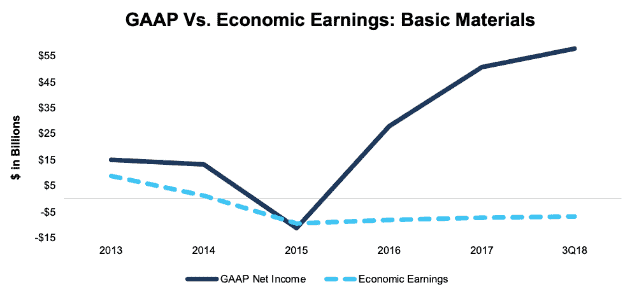

Basic Materials Sector

GAAP earnings show a large rebound after the commodities rout caused significant write-downs in 2015. Economic earnings show that this sector still has a long road ahead to recovery. Over the trailing twelve months, DowDuPont Inc. (DWDP) has the largest discrepancy between reported net income and economic earnings. GAAP net income of $2.1 billion vastly overstates the firm’s profitability while economic earnings, at -$5.4 billion reveal significant losses.

Figure 5: Economic vs. GAAP Earnings: Basic Materials

Sources: New Constructs, LLC and company filings.

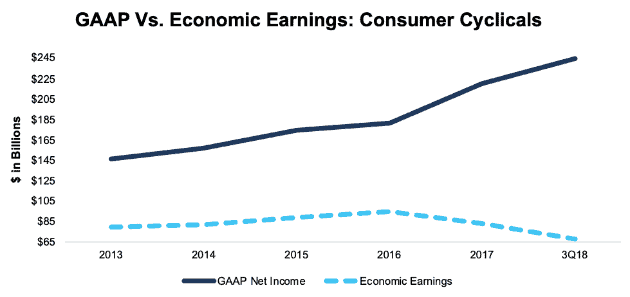

Consumer Cyclicals Sector

Part of the significant gap between GAAP net income and economic earnings for the Consumer Cyclicals sector can be explained by off-balance sheet operating leases that constitute a hidden (although not for long) form of invested capital. Operating leases account for 9% of all invested capital in the sector, compared to just 5% for the whole market.

Figure 6: Economic vs. GAAP Earnings: Consumer Cyclicals

Sources: New Constructs, LLC and company filings.

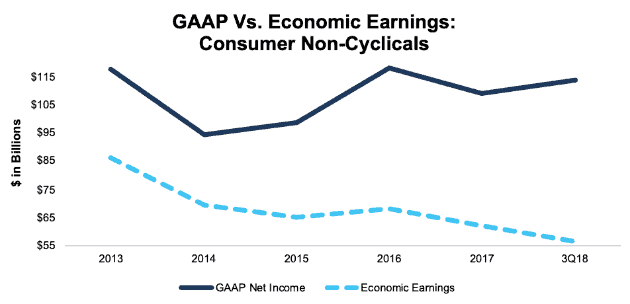

Consumer Non-Cyclicals Sector

The disconnect between net income and economic earnings has widened significantly over the past few years. Trailing twelve months net income is 20% higher than it was four years ago, while economic earnings are 19% lower. The Coca-Cola Company (KO) has actually bucked this trend in recent years. While GAAP net income has fallen 27% compounded annually since 2015, economic earnings have grown 6% compounded annually.

Figure 7: Economic vs. GAAP Earnings: Consumer Non-Cyclicals

Sources: New Constructs, LLC and company filings.

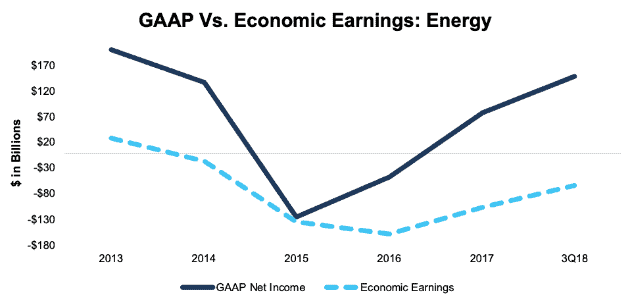

Energy Sector

While the Energy sector returned to GAAP profitability last year, and continued through the TTM period, Figure 8 shows economic earnings still remain far away from breaking even.

Figure 8: Economic vs. GAAP Earnings: Energy

Sources: New Constructs, LLC and company filings.

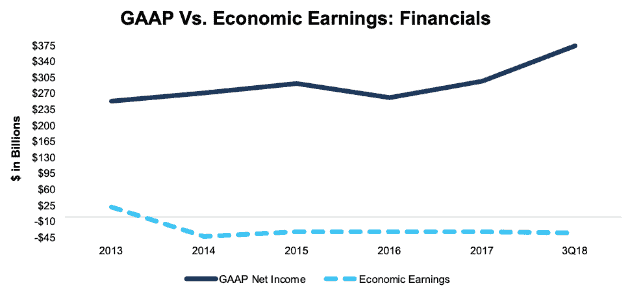

Financials Sector

The Financials sector has only earned positive economic earnings on aggregate in one of the past six years. The past twelve months have seen the divergence between GAAP and economic earnings widen even further, as GAAP earnings are up 26% from 2017 while economic earnings (which are already negative) are down 13%.

Figure 9: Economic vs. GAAP Earnings: Financials

Sources: New Constructs, LLC and company filings.

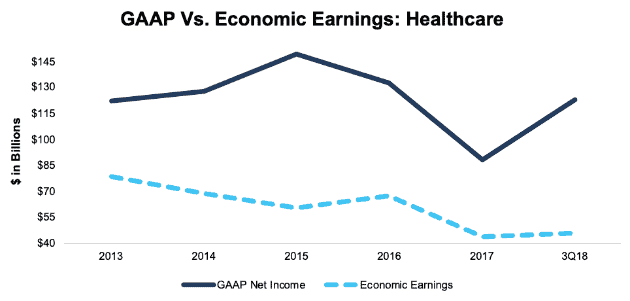

Healthcare Sector

In recent years, GAAP earnings were declining closer to the level of economic earnings in the Healthcare sector. However, the TTM period has seen a return to growth in both GAAP net income and economic earnings. TTM economic earnings are up 5% while net income is up 40% over last year.

Figure 10: Economic vs. GAAP Earnings: Healthcare

Sources: New Constructs, LLC and company filings.

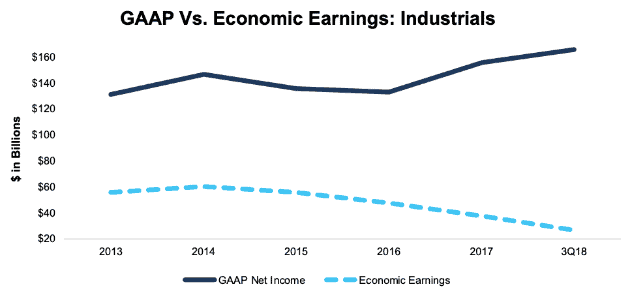

Industrials Sector

Few sectors have as wide a divergence as Industrials. GAAP earnings continue a steady increase even as economic earnings are down 29% from their 2017 levels over the past twelve months. Waste Management (WM) has one of the largest discrepancies between net income and economic earnings in the entire Industrials sector. TTM net income is up 18% over 2017 while economic earnings are down over 104%. This disconnect earns WM our Unattractive rating.

Figure 11: Economic vs. GAAP Earnings: Industrials

Sources: New Constructs, LLC and company filings.

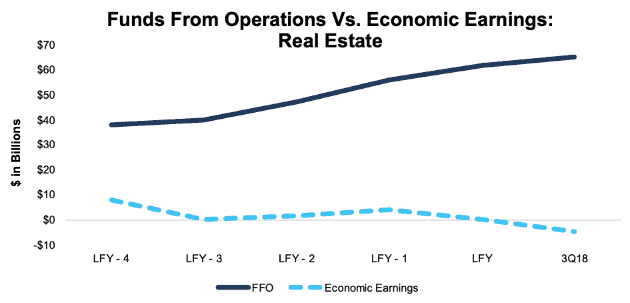

Real Estate Sector

Real Estate has seen a significant divergence over the last three years. After trending higher from 2014-2016, economic earnings have turned negative and are down 211% since 2016. Meanwhile, funds from operations (“FFO”) are up 16% over the same time.

Figure 12: Economic Earnings vs. Funds from Operations: Real Estate

Sources: New Constructs, LLC and company filings.

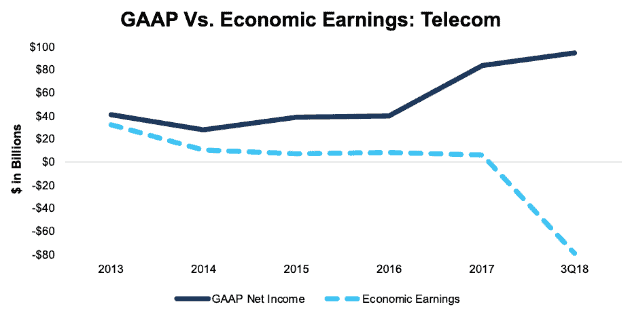

Telecom Sector

The Telecom sector earns its reputation as an oligopolistic industry. Three large companies in the industry –Verizon (VZ), BCE Inc. (BCE) and Nippon Telegraph and Telephone (NTTYY) – earned $10.5 billion in positive economic earnings over the trailing twelve months. The other 36 companies had a combined economic loss of $89 billion.

Figure 13: Economic vs. GAAP Earnings: Telecom

Sources: New Constructs, LLC and company filings.

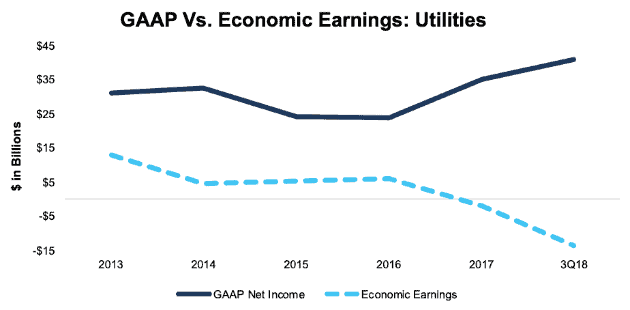

Utilities Sector

The Utilities sector is another sector with GAAP earnings growth in the double digits even as economic earnings continue lower. Almost all the reported growth comes from the fact that GAAP earnings were artificially depressed by write-downs in 2016. NOPAT is flat, while invested capital and the weighted average cost of capital are rising, leading to the decline in economic earnings.

Figure 14: Economic vs. GAAP Earnings: Utilities

Sources: New Constructs, LLC and company filings.

The Need for Diligence Has Arrived

The breadth of the decline in economic earnings should give investors pause. Almost every sector is experiencing this decline, and even for the Technology sector GAAP earnings overstate the profit growth.

Now more than ever investors need unconflicted and comprehensive fundamental research. Only by analyzing the footnotes and MD&A can one find companies that buck the trend of rising GAAP earnings and falling economic earnings. These are the stocks that will hold up when this bull market finally does come to an end.

To see our Sector ratings and reports, click here.

Not a Member Yet? You need a Professional Membership or higher to view the content on this page.Start Your Professional Membership Today | New Constructs Member Login

This article originally published on December 3, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] With a combined market cap of ~$38 trillion, 2,600+ companies for which we have quarterly data represent the vast majority of the U.S. equity market as well as a handful of international companies.

[2] Details on the adjustments for all 11 sectors can be found in the Appendix.

[3] Ernst & Young’s recent white paper “Getting ROIC Right” proves the superiority of our measure of NOPAT, invested capital and ROIC along with other financial ratios.

[4] Details on change in GAAP net income and economic earnings by sector can be found in the Appendix.